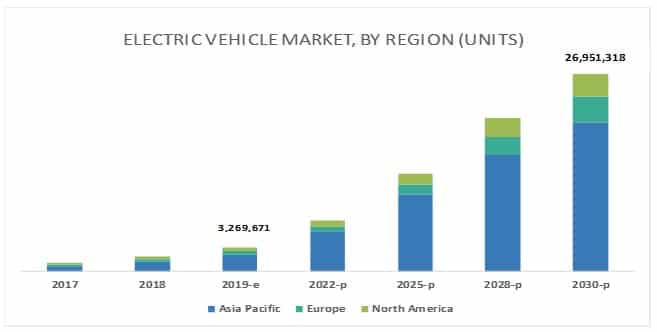

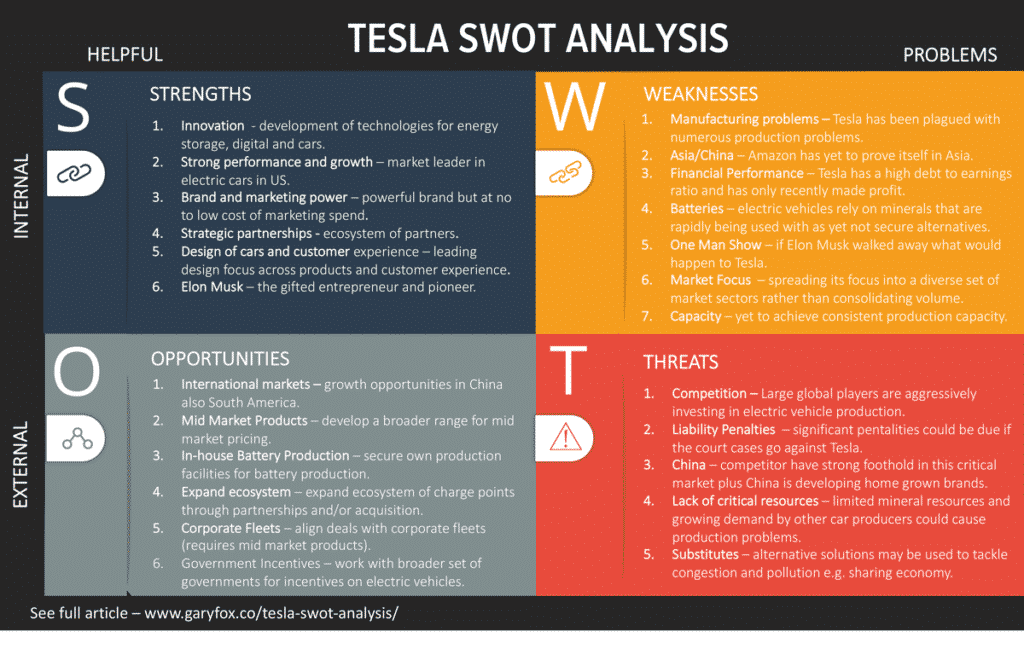

The Tesla SWOT analysis reveals that the biggest challenges come from competitive threats within the automotive industry.

While Tesla got a head start and still leads in terms of its digital and electric innovation, other manufacturers are catching up.

More car manufacturers are introducing electric cars and expanding their range. Many of these like Audi, BMW and Mercedes have strong brands and established operations that they can use for electric car production.

Can Tesla maintain its lead as its competitors aggressively ramp up production of electric cars?

In the SWOT analysis of Tesla, I take a look at these questions by analysing the strengths and weaknesses of Tesla as well some of the threats and opportunities it faces.

Table of Contents

What Is Tesla?

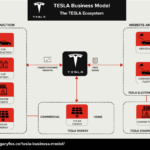

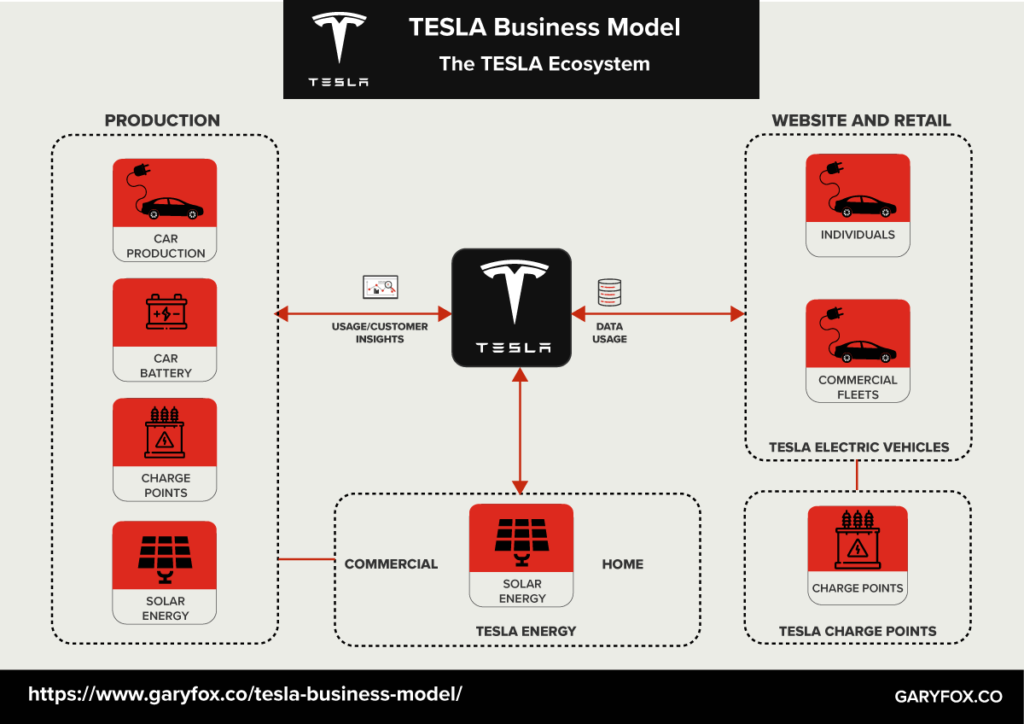

Tesla designs, develops, manufactures, leases, and sells electric vehicles, and energy generation and storage systems internationally.

Quick Facts About Tesla

| Company name: | TESLA, Inc. |

| Founders: | Elon Musk, Martin Eberhard, JB Straubel, Marc Tarpenning, Ian Wright |

| Annual revenue: | (FY 2019): $24.5 Billion |

| Profit | Net Income: | (FY 2019): $775 Billion |

| Market Cap: | (May, 2020): $148 Billion |

| Year founded: | 2003 |

| Company CEO: | Elon Musk |

| Headquarters: | Palo Alto, California |

| Link: | Tesla |

| Number of employees: | (FY 2019): 48,016 |

| Type of business: | Public |

| Ticker symbol: | TSLA |

| Company Competitors: | Audi eTron, Mercedes EQC, BMW i8, Porsche Taygan, Jaguar iPace, BYD Company iPro |

| Mission Statement: | Tesla’s mission statement was “to accelerate the world’s transition to sustainable transport.” However, in mid-2016, under Elon Musk’s leadership, the company changed the corporate mission to “to accelerate the world’s transition to sustainable energy.” |

| Vision Statement: | To create the most compelling car company of the 21st century by driving the world’s transition to electric vehicles. |

Introduction

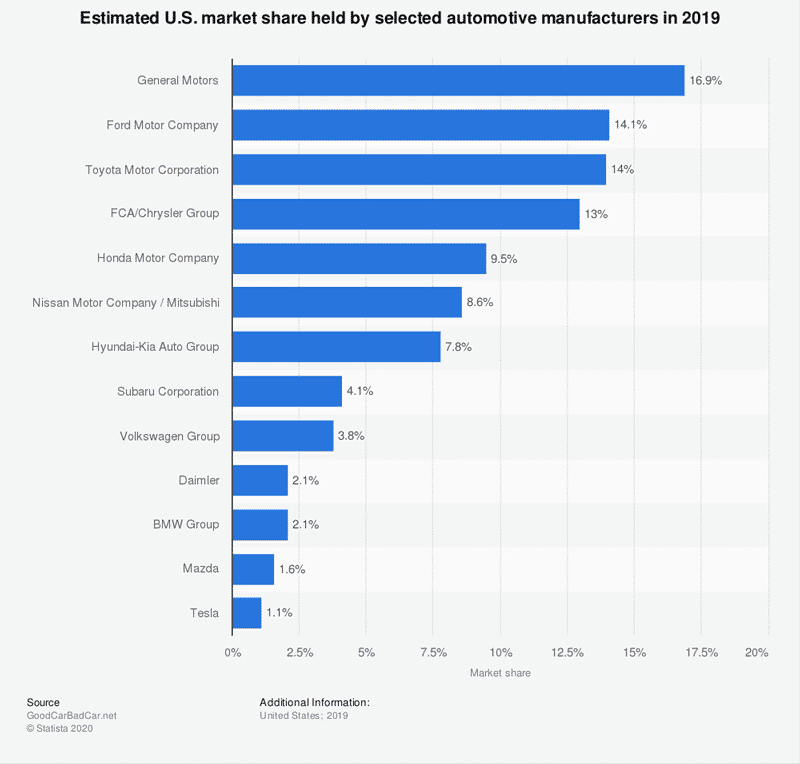

Many initially thought it was lunacy when ElonMusk launched Tesla and declared he was going to take on giants like Ford, General Motors, BMW and others.

Back in 2003, that was a bold decision to make at a time when there much of the technology to create a viable electric car was still in its infancy. As an example, in 2003 there were no batteries in terms of capacity and storage that would be able to create a prototype.

Fast forward to today and Elon Musk, Tesla Inc, has transformed the motor industry leaving other established players still playing catch up.

In fact, if you look back at Elon Musk’s self-declared masterplan you can see he has achieved his overall vision.

Tesla Products and Services

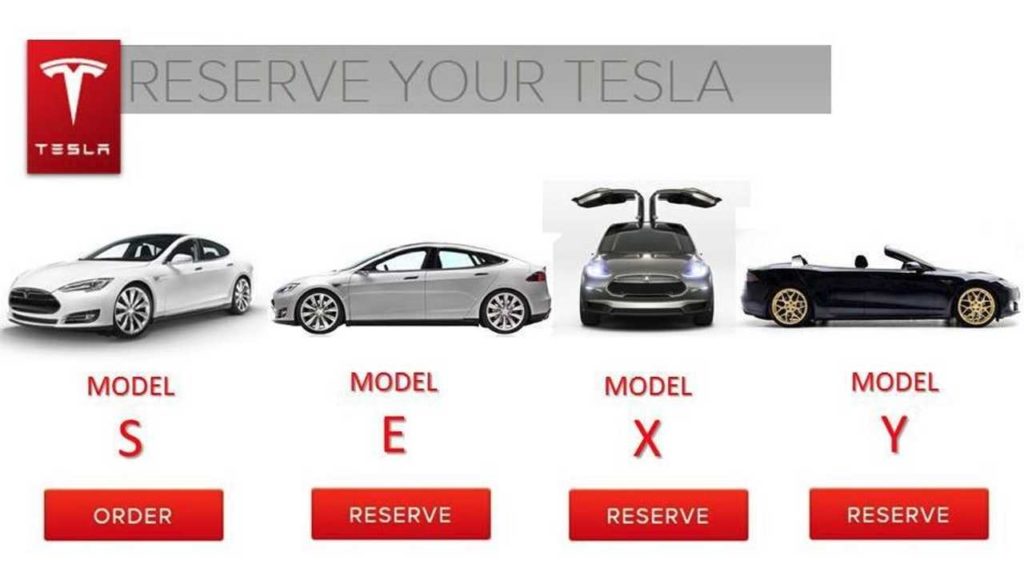

Tesla currently is expanding has a range of consumer and commercial vehicle markets, including Model 3, Model Y, Model S, Model X, Cybertruck, Tesla Semi and a new Tesla Roadster.

Model S

Model S is a four-door full-size sedan that we began delivering in June 2012. Model S introduced Tesla vehicle mainstays such as a large touchscreen driver interface, Autopilot hardware, over-the-air software updates, and fast charging through our Supercharger network.

Along with the Model X, the Model S features the highest performance characteristics and longest ranges. Both these vehicles are equipped with a standard dual-motor all-wheel-drive powertrain and are also available in Performance versions with enhanced acceleration and/or top speed and styling.

Model 3

Model 3 was launched in July 2017. It is a four-door mid-size sedan that is designed for mass-market appeal. The Model 3 is produced in the US and in China at the Gigafactory Shanghai.

Model X

Model X is a mid-size SUV with seating for up to seven adults, which was launched in September 2015. Model X has unique features including falcon wing doors for easy access to passenger seating and an all-glass panoramic windshield.

Model Y

Model Y is a compact sport utility vehicle (“SUV”) built on the Model 3 platform with the capability for seating for up to seven adults.

Future Consumer and Commercial Electric Vehicles

Tesla delivered to the market the first high-performance electric luxury sports car, the Tesla Roadster. The company sold approximately 2,500 Roadsters before ending production in January 2012. However, now it is decided to resurrect the concept car and has built a new Roadster which launched in 2020.

In addition, Tesla has unveiled a number of planned electric vehicles to address a broader cross-section of the vehicle market, including specialized consumer electric vehicles in Cybertruck and a commercial electric vehicle in Tesla Semi.

The Tesla Business Model draws its strength from the unique ecosystem it is building, but others are now catching up.

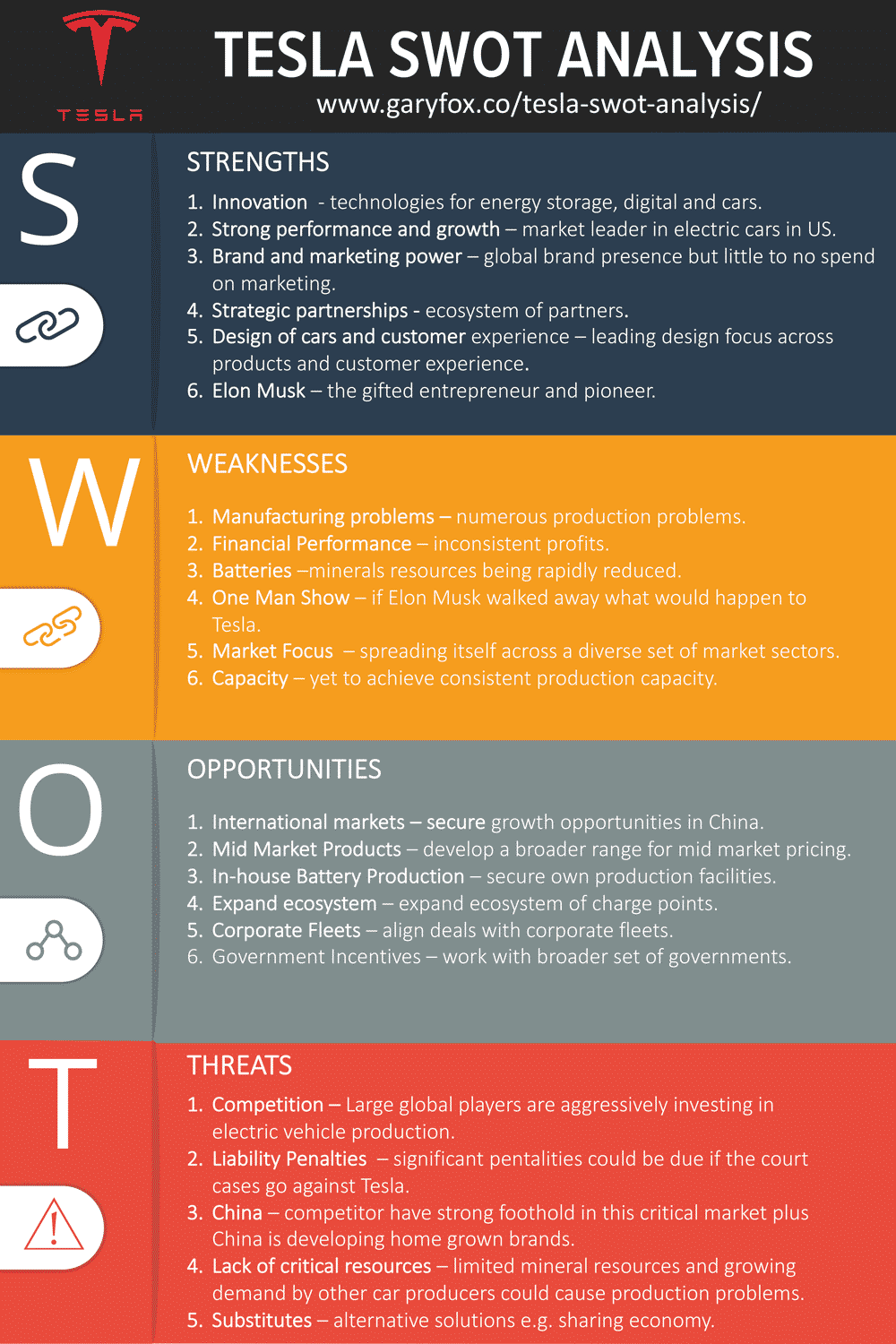

Tesla Strengths – Internal Factors

The Tesla SWOT analysis begins with a look at the internal strengths and capabilities of Tesla.

Tesla Weaknesses – Internal Factors

The Tesla SWOT analysis weaknesses section identifies the aspects of Tesla that could expose it to threats and present problems in the future.

Tesla Opportunities – External Factors

|

Tesla Threats – External Factors

|

Tesla SWOT Analysis Summary

The Tesla SWOT analysis shows that the biggest threat comes from competitors. Tesla’s competitors ready have strong infrastructure, distribution and models that they can transform to electric. This would secure sales and limit Tesla’s growth.

Tesla has built a strong brand and continues to innovate and that could result in a future where Tesla becomes a household name for a long time to come.

Free SWOT Analysis Templates

If you’re interested in creating your own SWOT analysis then download these free SWOT analysis templates now.