The peer-to-peer business model involves creating value by facilitating interactions, transactions, or collaborations between individuals within a defined group.

Table of Contents

The Peer-to-Peer Business Model

What is the Peer-to-Peer Business Model?

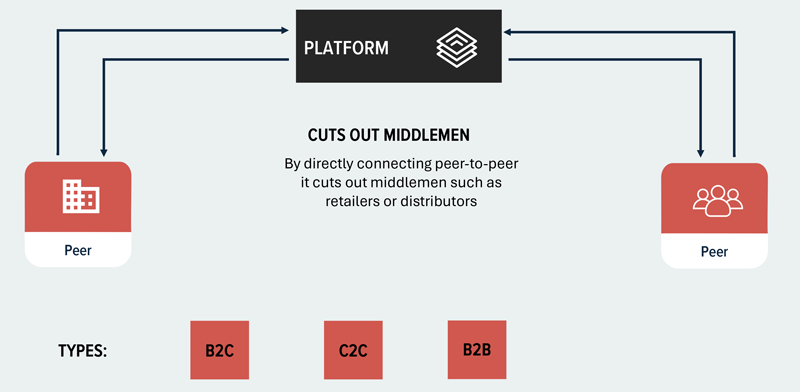

The peer-to-peer business model is a strategy where a company creates value by facilitating interactions, transactions, or collaborations between individuals within a homogeneous group.

In this P2P model, the company acts as an intermediary, providing a platform or marketplace that connects individuals who have similar needs, interests, or resources.

The platform enables these individuals to share, trade, or collaborate directly with one another, without the need for traditional intermediaries or centralized authorities.

Why is the Peer-to-Peer Business Model Important?

The peer-to-peer business model is important because it offers several key benefits for both the platform provider and the individual participants:

- Optimised Resource Use: P2P platforms optimise the use of resources by matching those with surplus or underutilised assets to those in need, minimising waste and enhancing overall efficiency.

- Reduced Costs for Transactions: By removing the need for traditional intermediaries, P2P platforms lower the costs associated with transactions. This makes accessing necessary goods, services, or resources more economical for users.

- Enhanced Options and Flexibility: Compared to conventional models, P2P platforms provide users with more choices and flexibility. Users benefit from a broad selection of providers or partners.

- Community and Trust: These platforms nurture a community feeling and trust among users. They encourage direct exchanges and collaboration among individuals with shared interests or requirements.

- Scalable Model: The P2P model exhibits significant scalability. The platform’s value tends to grow with each new participant, fostering strong network effects that can accelerate its growth and widen its reach.

How to Implement the Peer-to-Peer Business Model

To successfully implement the peer-to-peer business model, companies should follow these steps:

- Identify a Suitable Market: Identify a market or niche where there is a strong need or opportunity for peer-to-peer interactions, and where the benefits of direct collaboration or resource sharing are clear and compelling.

- Develop a User-Friendly Platform: Build a platform that is easy to use, reliable, and secure, with intuitive interfaces and robust features that enable seamless peer-to-peer interactions and transactions.

- Establish Trust and Safety Mechanisms: Implement strong trust and safety mechanisms, such as user verification, rating systems, and dispute resolution processes, to ensure that participants can interact with confidence and minimize the risk of fraud or abuse.

- Foster Community Engagement: Actively promote community engagement and collaboration among participants, through features such as forums, events, or rewards programs that encourage individuals to connect, share, and contribute to the platform.

- Ensure Scalability and Reliability: Design the platform architecture and infrastructure to be highly scalable and reliable, able to handle a growing user base and increasing transaction volumes without compromising performance or security.

- Continuously Improve and Innovate: Regularly gather feedback from participants, monitor platform performance and usage patterns, and invest in ongoing improvements and innovations to enhance the user experience and maintain a competitive edge.

Case Study: MicroLoan Connect – Transforming Access to Finance in East Africa

Peer-to-peer (P2P) lending platforms are changing the game for financial access in developing countries, offering a vivid example of technology’s power to drive social good.

“MicroLoan Connect” stands out as a pioneering initiative, demonstrating how the P2P model can bridge the gap between capital and communities in need, particularly in East Africa’s rural regions.

Situation Overview: For a long time, rural populations in developing countries have been largely ignored by traditional banks.

The reasons are many: high operational costs, perceived risks, and the challenge of profitability in these areas. As a result, millions are left without access to basic financial services, stifling economic growth and opportunity.

MicroLoan Connect’s Approach: Enter MicroLoan Connect, a platform that leverages the P2P model to offer a lifeline. It connects individuals who wish to lend money with those in need of small loans in East Africa. The platform’s innovation lies not just in its technology but in its approach to understanding the unique needs of its users.

Implementation and Impact:

- Technology as an Enabler: By utilizing mobile technology, MicroLoan Connect reaches users in remote areas, where traditional banking infrastructure is scarce or non-existent. This accessibility is crucial in regions where mobile phone penetration surpasses that of banking services.

- Lowering Barriers: The platform reduces the cost and complexity of obtaining a loan. Borrowers can apply directly from their mobile phones, and lenders worldwide can contribute, regardless of the amount.

- Building Communities: Beyond financial transactions, MicroLoan Connect fosters a sense of community and mutual support. It encourages financial literacy among its users and provides a framework for borrowers to share their success stories, inspiring others.

Examples of the Peer-to-Peer Business Model

- Airbnb: Airbnb is a P2P platform that connects individuals who have spare rooms or properties with travelers seeking short-term accommodations, enabling hosts to earn income from their underutilized space and guests to access unique, affordable lodging options.

- Uber: Uber is a P2P ride-sharing platform that connects individuals who need transportation with drivers who are willing to provide rides using their personal vehicles, offering a convenient, flexible, and often more affordable alternative to traditional taxi services. Seee

- Etsy: Etsy is a P2P e-commerce platform that connects individual artists, crafters, and vintage sellers with buyers seeking unique, handmade, or one-of-a-kind items, enabling creators to reach a global audience and buyers to access a diverse range of niche products.

- Lending Club: Lending Club is a P2P lending platform that connects individual borrowers with investors who are willing to fund their loans, enabling borrowers to access credit at competitive rates and investors to earn attractive returns on their capital.

Summary of the Peer-to-Peer Business Model

The peer-to-peer business model has already begun to change many industries by enabling direct and decentralized interactions between people.

This approach avoids traditional middlemen, creating new ways for value and efficiency. As digital technology keeps advancing and more people look for flexible, personalized, and collaborative options, the P2P model is set to stay a strong and disruptive presence in the business world.

Related Posts and Business Model Patterns

- Platform as a Service business model

- Digital business models

- Virtualization business model

- Microfinance Business Model

- Orchestrator Business Model