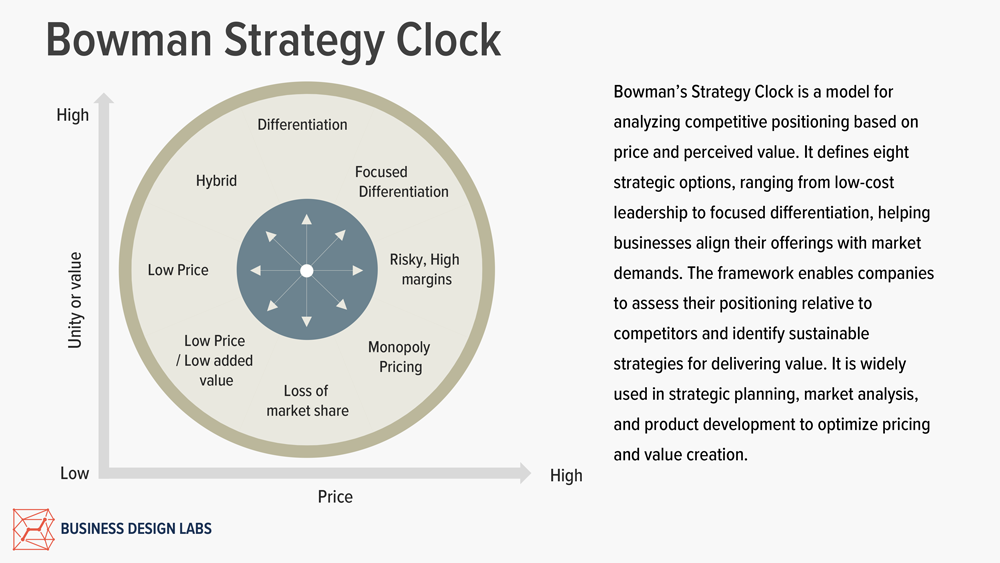

The Bowman Strategy Clock is a framework that focuses on competitive positioning strategies in relation to price and perceived value.

It builds on Porter’s generic strategies but instead offers eight distinct options to analyze how firms can deliver value to their target markets.

The framework is often used to assess competitive advantages, pricing approaches, and market positioning.

Key aspects include:

- Price: Low to high.

- Perceived value: Customer’s perception of product/service quality.

- Strategies: Eight positions, including differentiation, low-price, hybrid, and non-competitive (e.g., low value/high price).

Table of Contents

1. Background, Creator, and Context

The Bowman Strategy Clock was introduced by Cliff Bowman in the 1990s as an extension of Michael Porter’s generic strategies.

Bowman, a renowned strategist and academic, aimed to provide a more granular approach to competitive positioning, addressing limitations in Porter’s model.

Unlike Porter’s broad categories of cost leadership, differentiation, and focus, Bowman’s model incorporates eight specific strategies, offering a nuanced framework to explore price-value dynamics.

This model is especially relevant in competitive markets where understanding trade-offs between cost efficiency and perceived value is critical.

It was first published in academic discussions and later featured in management literature.

Notably, Bowman expanded on these ideas in “Competitive and Corporate Strategy: Irwin Series in Management and the Behavioral Sciences“ (1996), co-authored with David Faulkner.

2. Components, Principles, and Concepts of Bowman Strategy Clock

- Position 1: Low Price/Low Value: Competing primarily on price but offering minimal differentiation.

- Position 2: Low Price: Aimed at cost leadership while maintaining acceptable quality.

- Position 3: Hybrid: Balancing cost efficiency and differentiation.

- Position 4: Differentiation: Focus on high value with premium pricing, targeting quality-conscious consumers.

- Position 5: Focused Differentiation: Highly niche with superior value, commanding premium prices.

- Positions 6-8: Strategies with diminishing viability, such as high price/low value or unsustainable competition.

3. Strategic Responses

Based on the Bowman Strategy Clock analysis there are recommended strategic actions:

1. Low Price/Low Value

- Avoid this position unless competing in commodity markets with high price sensitivity.

- Focus on cost control to achieve economies of scale.

- Transition to a more value-driven approach if aiming for long-term sustainability.

2. Low Price (Cost Leadership)

- Maintain cost advantages through operational efficiency, supply chain optimization, and economies of scale.

- Compete on volume to offset low margins.

- Monitor competitors closely to avoid a price war.

3. Hybrid (Moderate Price/Moderate Value)

- Combine efficiency with value-added features to differentiate offerings.

- Appeal to price-conscious customers who also expect acceptable quality.

- Maintain flexibility to adjust either price or value based on market shifts.

4. Differentiation (High Value)

- Invest in branding, innovation, and quality to justify premium pricing.

- Target customer segments willing to pay for perceived superior value.

- Protect competitive advantage through intellectual property or continuous innovation.

5. Focused Differentiation (High Value/Niche Market)

- Dominate niche markets by offering highly specialized or exclusive products.

- Emphasize superior quality, service, or unique features that cannot be easily replicated.

- Build strong customer loyalty and justify premium prices.

6. Risky High Margins (High Price/Low Value)

- Avoid this position, as it is unsustainable in competitive markets.

- If in this position, either increase perceived value or reduce pricing to align with customer expectations.

- Address customer dissatisfaction proactively to rebuild trust.

7. Monopoly Pricing (High Price/Low Competition)

- Leverage market power to maintain high prices, but ensure compliance with regulatory standards.

- Reinvest profits into innovation or diversification to maintain long-term competitiveness.

- Monitor market conditions for emerging competition or shifts in demand.

8. Loss of Market Share (Low Value/High Price)

- Urgently re-evaluate the strategy to improve value perception or adjust pricing.

- Innovate or rebrand to regain customer trust and competitiveness.

- Avoid prolonged reliance on this position as it leads to rapid market decline.

4. Who Should Use The Bowman Strategy Clock?

Th Bowman Strategy Clock is ideal for:

- Top Management Teams: For setting competitive strategies during planning.

- Marketing Teams: To analyze and refine product-market fit.

- Innovation/R&D Teams: To align product development with value and pricing strategies.

It’s particularly useful for firms seeking clarity on market positioning relative to competitors.

5. Why Use The Bowman Strategy Clock?

The Bowman Clock enables organizations to understand competitive strengths, optimize pricing strategies, and identify risks of unsustainable positions.

It provides a structured way to connect pricing with value creation, aligning with models like Porter’s Five Forces or the Value Chain framework. The analysis guides businesses in crafting defensible and profitable market positions.

Best applied during:

6. When to Use It?

- Strategic planning cycles (annual or semi-annual).

- Market-entry evaluations or product-launch assessments.

- Periodic competitive analyses in response to shifting consumer demands.

7. How to Use The Bowman Strategy Clock?

- Map Your Current Position: Evaluate the current strategy in terms of price and value.

- Assess Competitors: Plot competitor strategies on the clock to identify gaps or threats.

- Select a Strategy: Choose a position that aligns with target customer needs and organizational strengths.

- Monitor and Adjust: Continuously track performance metrics and adapt to market changes.

Insight: McKinsey highlights the importance of competitive benchmarking, while BCG stresses customer-focused differentiation as a sustainable advantage.

8. Pros and Cons of Bowman Strategy Clock

Pros of the Bowman Strategy Clock

- Comprehensive Analysis: Offers eight distinct strategies, providing a detailed understanding of competitive positioning compared to simpler models like Porter’s Generic Strategies.

- Flexibility: Applicable across industries, allowing businesses to tailor strategies to specific markets and consumer needs.

- Clear Focus on Price and Value: Helps organizations balance cost efficiency with customer value perception for sustainable differentiation.

- Practical Tool for Benchmarking: Simplifies comparison between a company’s strategy and competitors, highlighting gaps or opportunities.

Cons of the Bowman Strategy Clock

- Static Framework: Assumes market conditions are relatively stable, which may limit its application in highly dynamic or rapidly evolving industries.

- Limited Digital Focus: Lacks specific consideration for digital platforms, ecosystems, or network effects, making it less suited for contemporary digital markets.

- Risk of Oversimplification: May oversimplify complex strategies by forcing them into predefined categories, potentially overlooking hybrid or unconventional approaches.

- Viability of Certain Positions: Some strategies, like high price/low value, are rarely sustainable, limiting the framework’s practical utility in those cases.

9. Alternatives – Modern alternatives include:

- Blue Ocean Strategy: Emphasizing uncontested market spaces.

- Osterwalder’s Value Proposition Canvas: Linking customer pains and gains directly to value creation.

- Digital Ecosystem Models: Addressing value and price in networked environments, such as platform ecosystems.

For digital and innovation ecosystems, these approaches may offer better alignment with technological trends and platform-based competition.