In this post, you will learn about the Uber business model. I’ll cover how Uber works, how Uber makes money, Uber’s strategy, and how Uber harnesses its platform technology to expand into new markets.

Table of Contents

What Is Uber?

Uber is an on-demand ride service that connects passengers with car drivers through an app. The Uber platform also connects drivers with people looking for a ride.

Anyone with a driver’s license, a new car and that has no traffic tickets can become an Uber driver. People simply hail an ‘Uber’ via an app on their phone. Uber finds a driver, ‘hails them’ and takes care of the whole process including payment.

The whole system works with simplicity, convenience, and ease of use for both parties – the driver and passenger. However, underlying this simplicity is a sophisticated set of technologies. I’ll take you through the technologies, Uber business model, and its strategy.

First, let’s look at what made Uber successful: its ride-hailing service.

How Does Uber Work?

Uber works as a car-for-hire service; in other words, people use their vehicles to offer rides through Uber to people looking for transport.

First of all, Uber is not a taxi service. Uber drivers cannot simply pick up riders off the street. Uber works as a car-for-hire service; in other words, people use their vehicles to offer rides through the Uber service.

Uber benefits from smartphone technology. Both the person who wants Uber and the driver use the app. Both use smartphones, and this is critical to their business model.

The app (the Uber platform), takes care of everything, from the initial ride-hailing to the payment process. When people need a ride, they use the app to tell Uber their pickup location.

The Uber app hooks into smartphone technologies such as geo-location and integrations with payment gateways to process payments (in other words it’s cashless). The system, called “RideCheck,” also uses the GPS, accelerometer, gyroscope, and other sensors on the driver’s smartphone to check for irregular activity, like an unexpected long stop, or a car crash.

The Uber business model relies on ease of use for the value proposition. But, there is much more under the hood of their platform that makes Uber so much more interesting.

Before moving onto the business model let’s take a look at some of the big numbers and key facts about Uber.

Quick Facts On Uber

Uber Technologies, Inc.

Garrett Camp and Travis Kalanick

March 2009

2009

Dara Khosrowshahi

San Francisco, California, USA

30,400

UBER (NYSE)

$40.06 billion (last twelve months) 2024

$2.01 billion (last twelve months) 2024

Approximately $146 billion 2024

Uber’s History

The Uber Story

Uber’s story began in Paris in 2008. Two friends, Travis Kalanick and Garrett Camp, were attending the LeWeb, an annual tech conference the Economist describes as “where revolutionaries gather to plot the future”.

In 2007, both men had sold startups they co-founded for large sums. Kalanick sold Red Swoosh to Akamai Technologies for $19 million while Camp sold StumbleUpon to eBay (EBAY) for $75 million.

Rumor has it that the concept for Uber was born one winter night during the conference when the pair was unable to get a cab. Initially, the idea was for a timeshare limo service that could be ordered via an app. After the conference, the entrepreneurs went their separate ways, but when Camp returned to San Francisco, he continued to be fixated on the idea and bought the domain name UberCab.com.

Ryan Graves, who was Uber’s General Manager and an important figure in the early stages of the company, became CEO of Uber in August 2010. In December 2010, Kalanick took over again as CEO, while Graves assumed the role of COO and board member.

The Cease-and-Desist Order

In October 2010, the company received a cease-and-desist order from the San Francisco Municipal Transportation Agency. One of the main issues cited was using the word “cab” in UberCab’s name. The startup promptly responded by changing UberCab to Uber and bought the Uber.com domain name from Universal Music Group.

A Timeline of How Uber Has Expanded

March 2009: Travis Kalanick and Garrett Camp, along with friends Oscar Salazar and Conrad Whelan, create a “black car” ride service model, eventually evolving into UberCab.

June 2010: UberCab launches in San Francisco, quickly resonating with the city’s tech-savvy and car-ownership-averse urban professionals.

October 2010: UberCab rebrands as Uber, securing $1.25 million in capital funding for expansion. Napster co-founder Shawn Fanning becomes an early investor. In December, Travis Kalanick takes over as CEO.

May 2011: Uber expands to New York City, facing strong resistance from the city’s established taxi industry. By December, Uber ventures into international markets, launching in Paris.

December 2013: Uber drivers file a lawsuit seeking employee status rather than being classified as independent contractors, sparking ongoing legal battles between the company and its drivers.

August 2014: Uber introduces UberPool, allowing passengers to share rides and split fares with other riders, further revolutionising urban mobility.

April 2015: Uber Eats launched in Los Angeles, Chicago, and New York, offering a food delivery service that quickly gained popularity, especially among busy millennials. This addition broadens Uber’s revenue streams.

February 2017: A blog post by a former engineer exposes a culture of sexual harassment at Uber. Amid the backlash, Uber hires former U.S. Attorney General Eric Holder to investigate, ultimately leading to significant management changes. In June, under pressure from the board, Kalanick steps down as CEO and is replaced by Dara Khosrowshahi, former CEO of Expedia.

May 2019: Uber goes public on the New York Stock Exchange with an initial share price of $45, reaching a market capitalization of $75.5 billion.

2020-2021: Uber’s business faces significant disruption due to the COVID-19 pandemic, but the company pivots successfully by expanding its UberEats delivery service, which sees massive growth as food delivery becomes more essential.

March 2022: Uber introduces a fuel surcharge to help drivers offset rising gas prices amid global economic shifts, marking a temporary but necessary adjustment to its pricing model.

October 2023: Uber celebrates its 15th anniversary with over 130 million monthly active users across its platforms, including UberEats, Uber Freight, and the core ride-sharing service, reaffirming its position as a global leader in mobility.

The Ride-Hailing Market

Ridesharing services are online platforms where drivers offer available space in their vehicles to passengers within the network for a fee.

These services function similarly to traditional taxis, but the critical distinction is using technology and private cars.

This difference often allows ridesharing platforms to bypass the regulatory requirements that apply to taxis in many regions, enabling them to offer lower prices in some cases.

The global ride-hailing market is projected to expand by over 40 per cent between 2023 and 2028 and reach approximately $216 billion by 2028. Major companies in this sector include DiDi, Uber, and Lyft (Source: Statista).

The Online Food Delivery Market

In 2023, the global online food delivery market was valued at over one trillion U.S. dollars, with 630 billion dollars coming from grocery deliveries and 390 billion dollars from meal deliveries. By 2029, the market is projected to generate revenues of up to 1.85 trillion U.S. dollars.

What Is Uber’s Business Model?

Since its conception, Uber has grown to be a significant force in the transportation industry and has now started harnessing the power of its platform to disrupt other markets. Let’s examine the Uber business model to understand how it can quickly move into other markets.

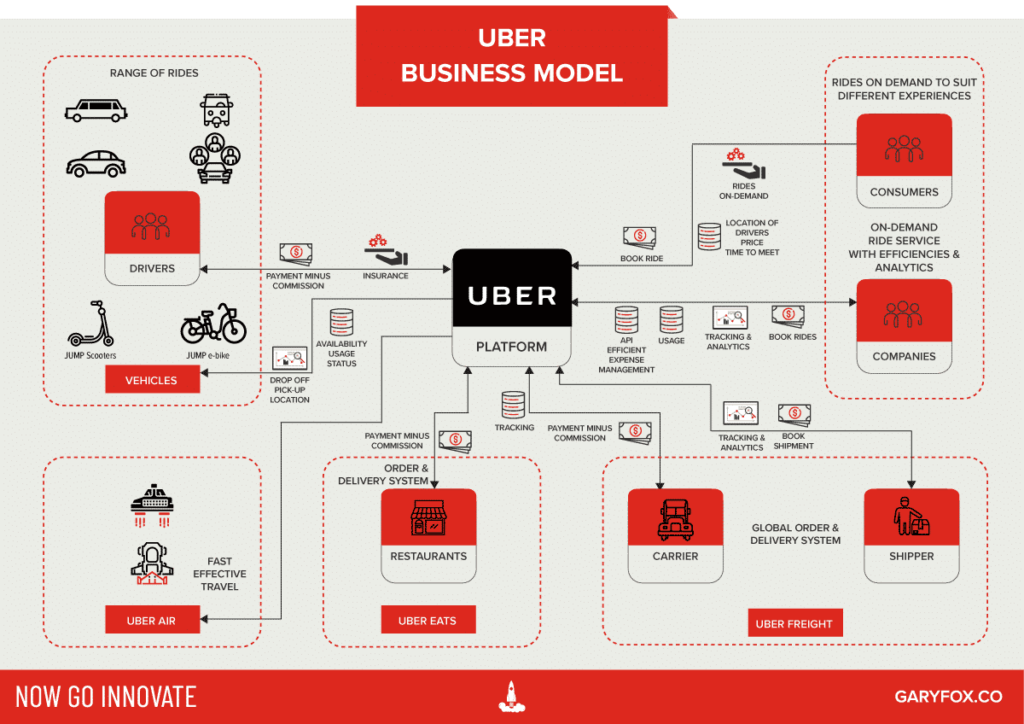

The Uber Business Model is a two-sided platform that connects drivers with customers looking for a ride using their mobile app. The app makes it easy for drivers to find the person who wants the ride.

The Uber BusinessModel Canvas

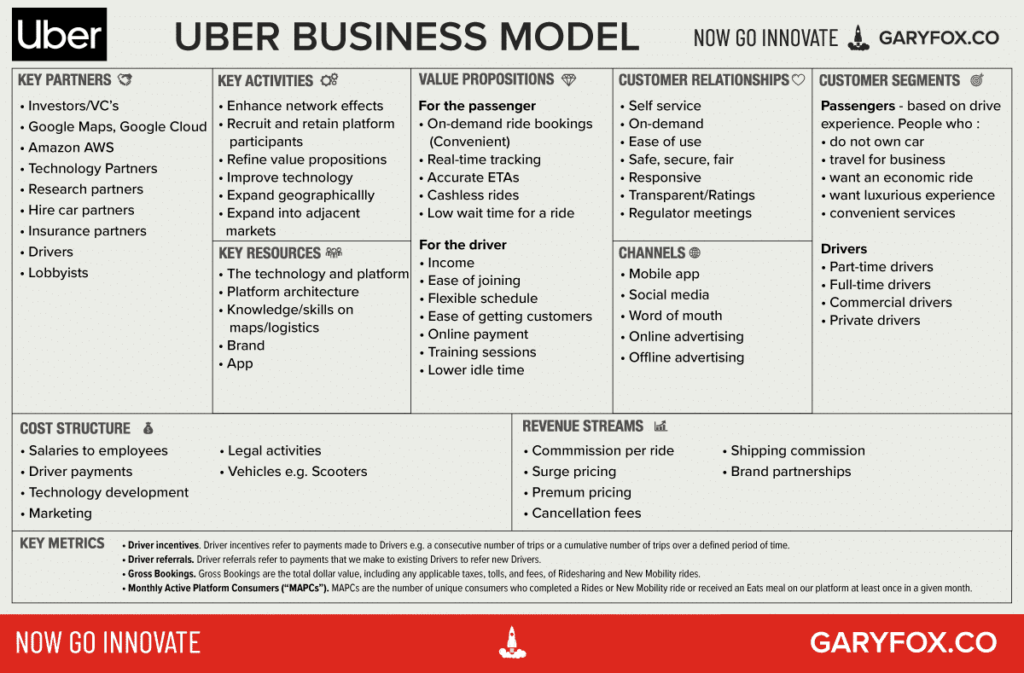

The Uber Business Model is built upon its digital platform. Like other platform business models e.g. Airbnb, Apple App Store or Amazon they rely on creating demand on both sides of the platform – the supply-side and the buy-side.

There are four main types of platform models:

- Collaboration

- Orchestration

- Creation

- Matching

The Uber platform provides a matching service. As an example, it helps complete match driver with someone wanting a ride. Or in the case of Uber eats, a three-sided market, it matches someone who wants to order food with a restaurant and a delivery method.

What underpins the Uber business model is the technology they employ to identify where people are using Google maps API (on the app) and match this to a driver who is nearby. Additionally, they have a dynamic pricing system that adjusts pricing according to demand in an area.

What is Uber’s Value Proposition

Uber’s value proposition is based on convenience for the rider, and for the drivers and easy way to make money at times that are convenient to them.

One of the most important outcomes of developing a business model is the value proposition. In other words, how you create, deliver and capture value.

The Uber business model for Uber rides offers the following value propositions:

- On-demand cab bookings (Convenient)

- Real-time tracking

- Accurate ETAs

- Cashless rides

- Low wait time for a ride

- Upfront pricing

- Multiple ride options

The Uber Business Model Map

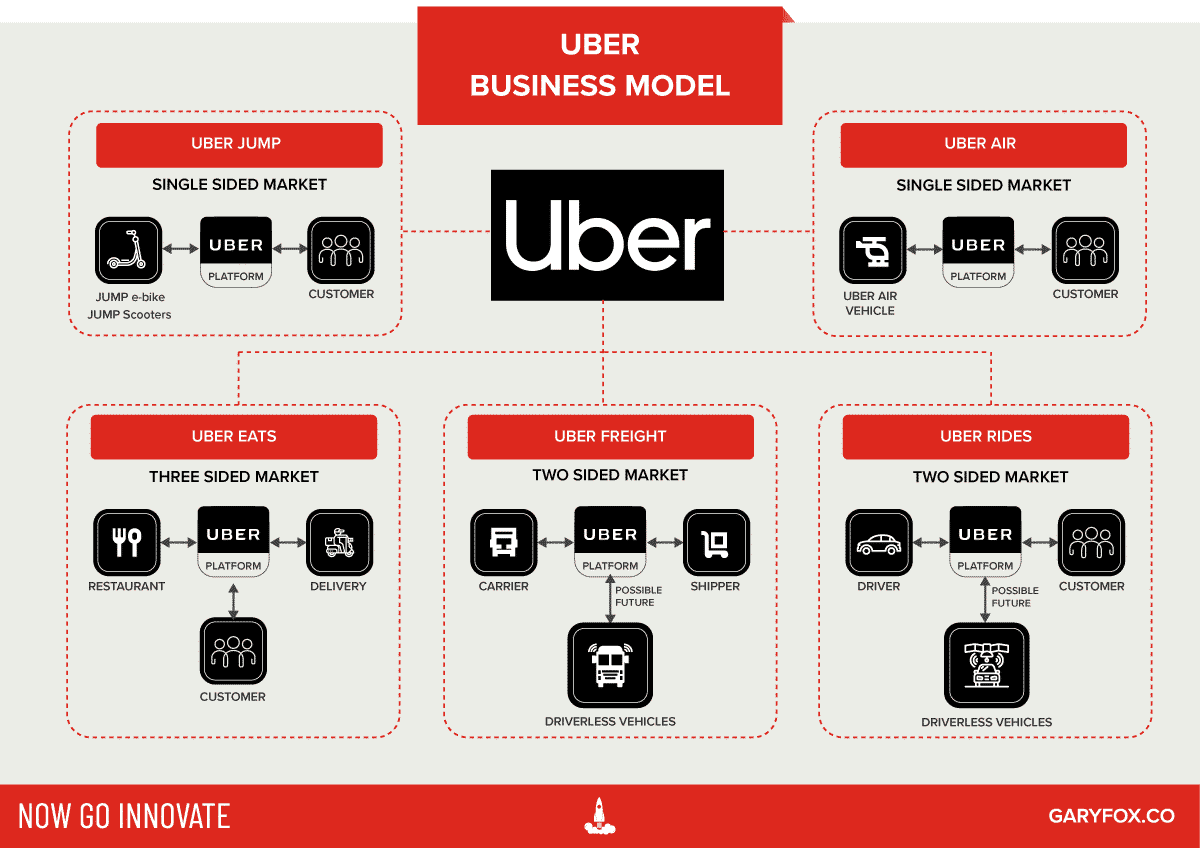

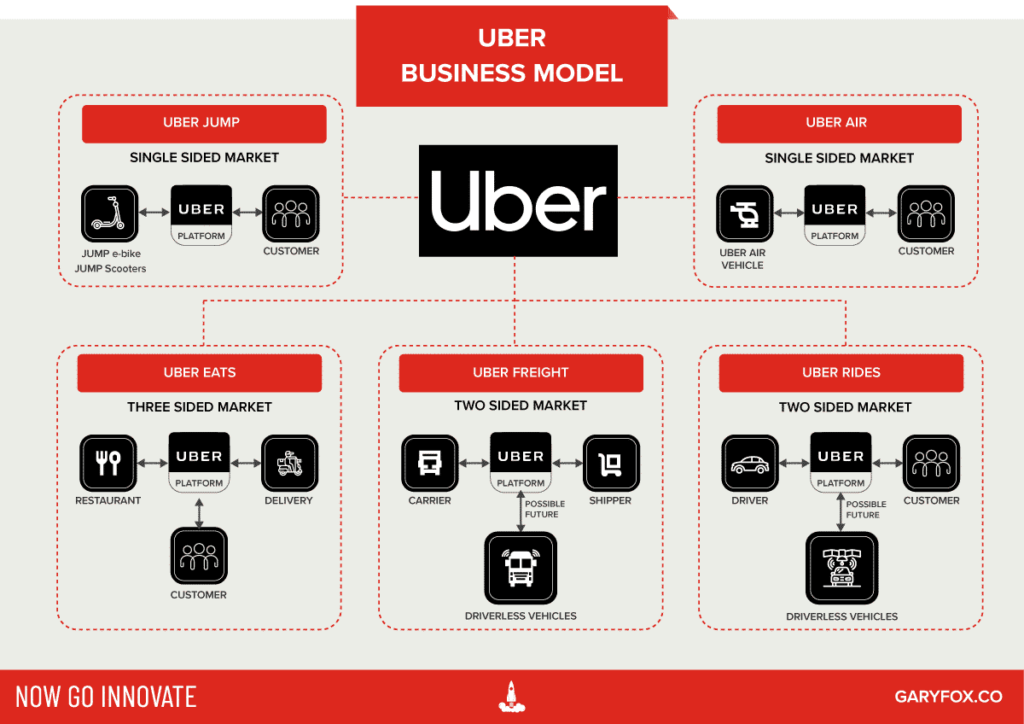

Although most people associate Uber with rides, they have since expanded into other transportation and are expected to enter into the driverless vehicle market.

The core of their capabilities is the ability to match and track objects – a vehicle for most cases. But more recently shipments.

Uber business model analysis

The Uber Business Model is shifting as they harness the power of its platform, AI and new driverless technologies towards a future where hailing a ride might not involve a driver (a human) at all. Uber business model and the platform:

- Single-sided market – Uber is the supplier to the market (Jump).

- Two-sided market – matching suppliers to buyers (Ride hailing).

- Three-sided market – matching suppliers, buyers and deliverers (UberEats).

Uber Technologies

Uber mentions artificial intelligence six times in its IPO filing, highlighting machine learning 11 times and the word algorithm 16 times. Those mentions aren’t by accident. Uber clarifies that its data science and algorithms are critical to its marketplace technologies.

Uber has built its own proprietary marketing, routing, and payment technologies. Its marketplace technologies are the bridge between Uber’s various ventures.

Uber’s technologies comprise the real-time algorithmic decision engine that matches supply and demand for our Personal Mobility, Uber Eats, and Uber Freight offerings.

- A demand prediction engine is used to predict volume, supply and demand, and location dynamics with current and historical trends. Data visualizations are available for zones with unique pricing characteristics.

- Matching and dispatching algorithms that review and consider variables such as distance, time, traffic, weather and even meal preparation times for Uber Eats.

- Pricing tools that set real-time prices at the local level based on demand.

The Uber business model relies on Uber continually investing in their new technologies and harnessing new AI to reshape the future of transportation.

Ubers Key Metrics

Uber’s business model is based on core metrics that guide how well it performs. First, the average per customer over a month indicates loyalty, plus the number of services a customer uses.

Driver incentives. Driver incentives refer to payments made to Drivers e.g. a consecutive number of trips or a cumulative number of trips over a defined period of time.

Driver referrals. Driver referrals refer to payments that we make to existing Drivers to refer new Drivers.

Excess Driver incentives. Excess Driver incentives refer to cumulative payments, including incentives.

Gross Bookings. Gross Bookings are the total dollar value, including any applicable taxes, tolls, and fees, of Ridesharing and New Mobility rides.

Monthly Active Platform Consumers (“MAPCs”). MAPCs are the number of unique consumers who completed a Rides or New Mobility ride or received an Eats meal on their platform at least once in a given month.

Uber Acquisitions

The Uber business model has transformed Uber’s capabilities and presented further opportunities for expansion. Moreover, with the focus on AI it points to smarter segmentation of customers based on use and other data.

| Company | Description | Purchase Value | Date |

|---|---|---|---|

| Cornershop | Online grocery delivery in Chile and Mexico, and more recently in Peru and Toronto | Undisclosed | 2020 |

| Careem | Careem is the internet platform for the greater Middle East region. A pioneer of the region’s ride-hailing economy, Careem is expanding services across its platform to include mass transportation, delivery and payments to become the region’s everyday super app. | $3.1Bn | 2019 |

| Swipe Labs | Swipe Labs built a social app that was a competitor to Snapchat. They have been doubts about the benefits of this acquisition. | Undisclosed | 2017 |

| Geometric Intelligence | Geometric Intelligence, a startup co-founded by academic researchers with AI experience, and its team provide the core for Uber’s central AI lab at Uber’s SF HQ. | Undisclosed | 2016 |

| Otto | The company focused on retrofitting semi-trucks with radars, cameras and laser sensors to make them capable of driving themselves. However, since the acquisition Uber has focused on autonomous cars. | $680M | 2016 |

| deCarta | DeCarta was a company that provided a range of location and map services, including in-map search, location APIs, turn-by-turn navigation and more. | Undisclosed | 2015 |

The Uber business model is changing and adapting and these acquisitions point the direction for how Uber will expand and address problems that its technology can solve in different markets.

What is Uber’s Business Strategy

The ride-hailing market has become more competitive as others have entered the market, received funding and taken on Uber head to head. The largest of these is Lyft.

Any company that has invested heavily in its resources and built unique capabilities needs to exploit them whilst maintaining a focus on its core market. The long-term play is in autonomous vehicles but it is many years before they will be a day to day reality.

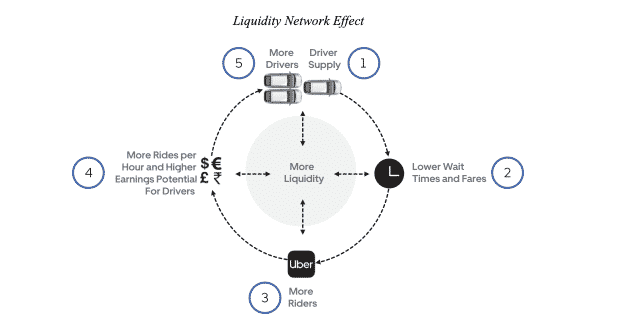

The core focus is to use an existing core base of users who want convenience and a variety of ride experiences and scaling the network effect which results in more liquidity. As I have mentioned before in my talks, it is the customer experience that will underpin how they achieve this.

In many developing countries that do not have a strong logistics infrastructure, there is a need to connect suppliers with customers. As an example, most retailers are still supplied from a host of different suppliers rather than a wholesaler. The Uber business model provides new opportunities for trade and efficiencies.

We can see from Uber’s acquisitions that they have identified opportunities to improve the transparency and access between supplier and buyers.

The Uber business model is rapidly evolving as they expand into new geographies and new markets.

How does Uber make money

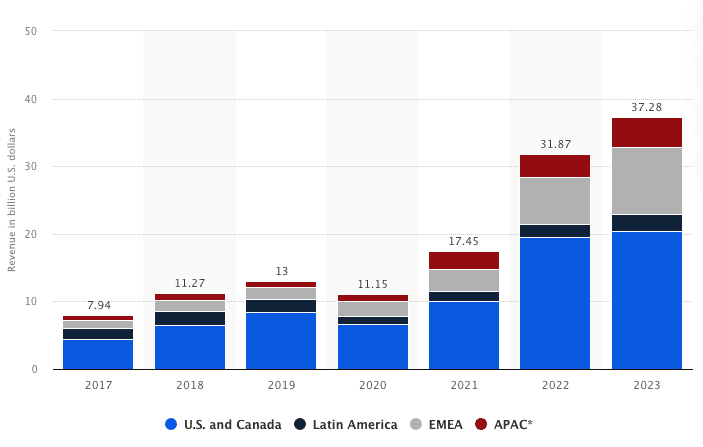

In 2023, Uber Technologies generated over 27 billion U.S. dollars in revenue from its United States and Canada operations. While revenue grew across all regions, the Europe, Middle East, and Africa (EMEA) region saw robust year-on-year growth. By the end of the year, Uber’s global user base exceeded 150 million monthly active users.

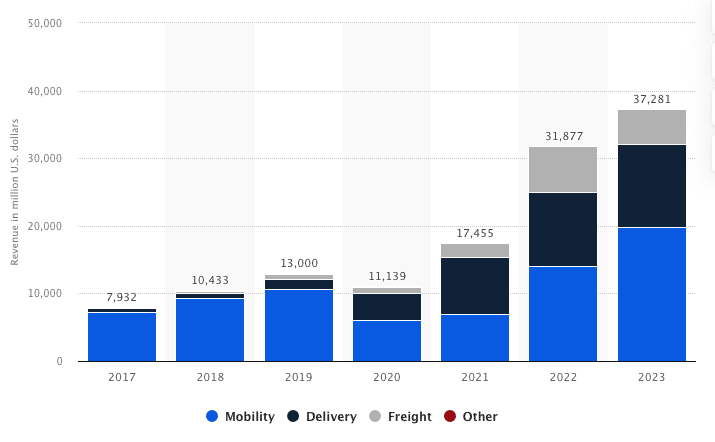

In 2023, Uber Technologies generated nearly 20 billion U.S. dollars in revenue from its mobility segment, which includes ride-sharing services. While the delivery and freight segments contribute a smaller portion to the company’s overall revenue, the delivery segment has seen consistent growth in recent years. In contrast, the freight segment experienced a 24 per cent decline.

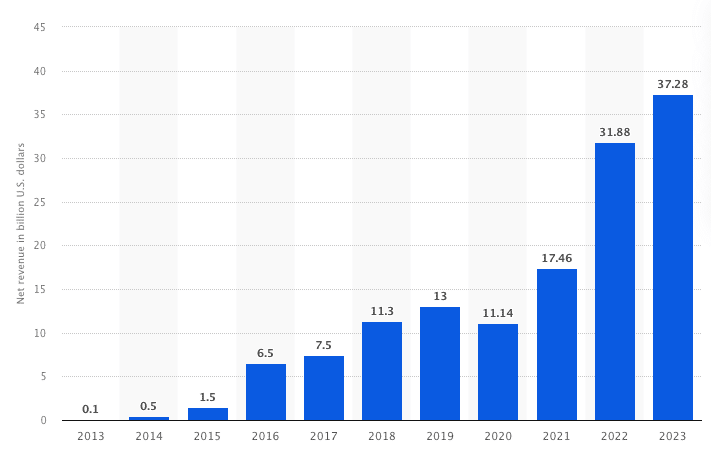

In 2023, Uber Technologies reported approximately 37.28 billion U.S. dollars in net revenue. The ride-hailing service serves around 150 million monthly users globally.

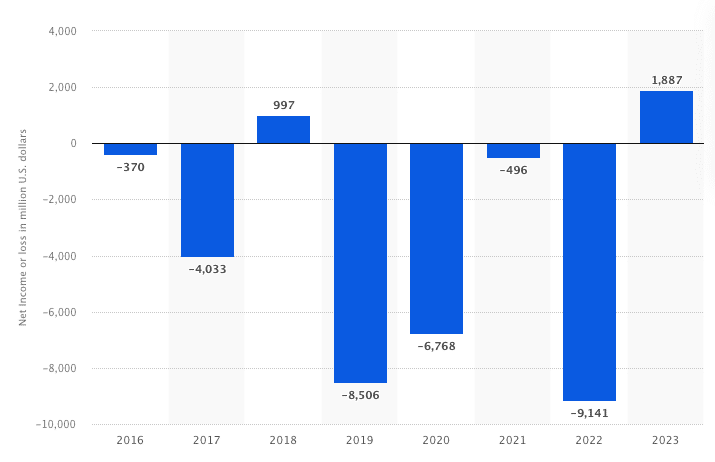

In 2023, Uber posted a net profit of nearly 1.9 billion U.S. dollars, marking its first profitable year since 2018. From 2016 to 2022, the company consistently reported losses, except 2018, when it achieved a profit of just under one billion U.S. dollars. Uber’s financial challenges during this period were exacerbated by the COVID-19 pandemic, which severely impacted its core ride-hailing business in 2020 and 2021.

Who Owns Uber?

In 2024, Uber has significant backing from major institutional and individual shareholders. SB Cayman 2 Ltd, affiliated with SoftBank, remains the largest individual shareholder, holding approximately 19.35% of the company’s stock.

Other key institutional investors include Vanguard Group (8.39%), BlackRock Inc. (7.02%), and Morgan Stanley (4.66%). The Public Investment Fund of Saudi Arabia, a major investor since 2016, holds 3.47% of Uber’s shares. Additionally, Garrett Camp, Uber’s co-founder, retains a 3.20% stake in the company.

Here’s a table reflecting the current major shareholders:

Here’s an updated table reflecting the current major shareholders:

| Shareholder | Ownership (%) | Shares Held | Type |

|---|---|---|---|

| SB Cayman 2 Ltd (SoftBank) | 19.35% | 406.46 million | Insider |

| Vanguard Group | 8.39% | 176.19 million | Institution |

| BlackRock Inc. | 7.02% | 147.47 million | Institution |

| FMR LLC (Fidelity) | 4.96% | 104.30 million | Institution |

| Morgan Stanley | 4.66% | 97.83 million | Institution |

| State Street Corp | 3.87% | 81.38 million | Institution |

| Public Investment Fund (Saudi) | 3.47% | 72.84 million | Insider |

| Garrett Camp | 3.20% | 67.27 million | Insider |