Amazon’s business model is an eCommerce model, but over the years, it has made acquisitions and diversified, creating a portfolio of business models and revenue streams.

Take a look at the breakdown further below.

Table of Contents

What Is Amazon’s Business Model?

The Amazon business model was initially based on eCommerce but has changed and now incorporates entertainment, music, cloud computing, meal deliveries, and much more.

Evolution of the Amazon Business Model

On July 5, 1994, Jeff Bezos incorporated the Amazon company. He must have seemed crazy at the time; only a small percentage of the population had the internet, and it was a far cry from the speed and design we have become accustomed to today.

At the time, only 0.447 percent of the world had access to the Internet; however, adoption accelerated, and by 1995, it reached 0.777 percent.

As of 2024, there are approximately 5.44 billion internet users worldwide, which equates to around 66% of the global population.

Amazon has grown into a complex digital ecosystem from a simple single-sided eCommerce platform. The Amazon business model is not a single entity but a portfolio of business models.

Amazon has rapidly changed, adapted and established itself as one of the biggest companies in history. Along with AWS, Amazon has a global reach and distribution capability, offering both digital and physical products.

For example, Amazon has harnessed its technology to transform the retail experience with Amazon Go stores. Even traditional retailers like Walmart are no longer safe from Amazon’s threat.

Key Milesones in the Evolution of the Amazon Business Model

- 1994: Jeff Bezos founds Amazon, initially as an online bookstore, and launches the website.

- 1995: Amazon sells its first book, “Fluid Concepts and Creative Analogies” by Douglas Hofstadter.

- 1997: Amazon goes public with an initial public offering (IPO) at $18 per share.

- 1998: Amazon expands its product offerings beyond books, selling CDs and DVDs.

- 1999: Amazon introduces 1-Click ordering, making the checkout process more convenient for customers.

- 2002: Amazon launches Amazon Web Services (AWS), providing cloud computing services to businesses.

- 2005: Amazon Prime is introduced, offering free two-day shipping for an annual fee.

- 2006: Amazon Elastic Compute Cloud (EC2) is launched, allowing businesses to rent virtual computers to run their applications.

- 2007: Amazon introduces the Kindle, its first e-reader device, revolutionizing the way people read books.

- 2009: Amazon acquires Zappos, an online shoe and clothing retailer, for $1.2 billion.

- 2011: Amazon introduces the Kindle Fire, a low-cost tablet computer, expanding its hardware offerings.

- 2012: Amazon acquires Kiva Systems, a robotics company, to improve efficiency in its warehouses.

- 2014: Amazon launches Amazon Echo, a smart speaker with virtual assistant Alexa, entering the smart home market.

- 2015: Amazon surpasses Walmart as the most valuable retailer in the United States by market capitalization.

- 2017: Amazon acquires Whole Foods Market for $13.7 billion, expanding its presence in the grocery industry.

- 2018: Amazon becomes the second U.S. company to reach a trillion-dollar market valuation.

- 2019: Amazon announces plans to invest $700 million to retrain 100,000 employees for higher-skilled jobs.

- 2020: Amazon experiences significant growth due to the COVID-19 pandemic, as more people turn to online shopping.

- 2021: Jeff Bezos steps down as CEO, and Andy Jassy, head of Amazon Web Services, takes over the role.

- 2022: Amazon expands its healthcare initiatives, including the acquisition of primary care organization One Medical for $3.9 billion.

- 2023: Amazon continues to invest in renewable energy, pledging to power its operations with 100% renewable energy by 2025.

Evolution of Amazons Services and Products

- 1999: Amazon introduces its Marketplace feature, allowing third-party sellers to sell their products alongside Amazon’s offerings.

- 2001: Amazon launches “Look Inside the Book” feature, allowing customers to preview book contents before purchasing.

- 2002: Amazon Web Services (AWS) is launched, offering cloud computing services to businesses.

- 2003: Amazon introduces “Search Inside the Book” feature, enabling full-text searches of book contents.

- 2005: Amazon Prime is introduced, providing free two-day shipping for an annual fee.

- 2006: Amazon Elastic Compute Cloud (EC2) is launched, allowing businesses to rent virtual computers to run their applications.

- 2007: Amazon Fresh, a grocery delivery service, is introduced in Seattle. Amazon also launches the Kindle, its first e-reader device.

- 2009: Amazon introduces AmazonBasics, a private-label product line offering affordable, high-quality everyday items.

- 2010: Amazon Studios is launched to develop original television shows and movies.

- 2011: Amazon introduces the Kindle Fire, a low-cost tablet computer. Amazon Prime Video, a streaming video service, is also launched.

- 2014: Amazon introduces the Fire Phone, a smartphone designed to compete with Apple and Android devices. The product is considered a failure and is discontinued the following year.

- 2015: Amazon launches Amazon Echo, a smart speaker with virtual assistant Alexa, entering the smart home market.

- 2016: Amazon Go, a cashierless convenience store, is announced. The first store opens to the public in Seattle in 2018.

- 2017: Amazon introduces Amazon Key, a smart lock and camera system that allows for in-home delivery of packages.

- 2018: Amazon acquires Ring, a smart doorbell and home security company, for $1 billion.

- 2019: Amazon launches Amazon Care, a healthcare service offering virtual and in-home care to employees.

- 2020: Amazon Pharmacy is introduced, allowing customers to order prescription medications online and have them delivered to their homes.

- 2021: Amazon launches Amazon Salon, its first hair salon, in London, featuring augmented reality and point-and-learn technology.

- 2022: Amazon expands its Amazon One palm-scanning payment technology to more stores and locations.

- 2023: Amazon continues to invest in its autonomous delivery robot, Scout, and drone delivery service, Prime Air, to improve last-mile delivery efficiency.

Amazon Acquisitions

- Whole Foods Market (2017): Acquired for $13.7 billion, this purchase marked Amazon’s biggest acquisition, signifying its serious intent to capture a share of the grocery market.

- Metro-Goldwyn-Mayer (MGM) (2021): Bought for $8.5 billion, this acquisition aimed to bolster Amazon Studios’ content library with a vast collection of films and TV shows.

- Zoox (2020): Acquired for $1.2 billion, Zoox is a self-driving car startup that underscores Amazon’s interest in autonomous technology.

- Zappos (2009): Purchased for $1.2 billion, Zappos, an online shoe and clothing retailer, underscored Amazon’s commitment to expanding its e-commerce empire.

- Ring (2018): Acquired for $970 million, Ring’s smart home security products aligned with Amazon’s smart home strategy.

- PillPack (2018): Bought for $839 million, PillPack allowed Amazon to enter the pharmaceutical delivery sector.

- Twitch (2014): Purchased for $775 million, Twitch, a live-streaming platform for gamers, expanded Amazon’s presence in the gaming and entertainment sectors.

- Kiva Systems (2012): Acquired for $775 million, Kiva Systems (now Amazon Robotics) underscored Amazon’s focus on automating its warehouses and improving logistics.

- Souq (2017): Bought for $580 million, Souq.com helped Amazon gain a significant foothold in the Middle East’s e-commerce market.

- Quidsi (2010): Acquired for $545 million, Quidsi was the parent company of several e-commerce websites, further expanding Amazon’s online retail operations.

Amazon has set its eye on Payments, Logistics, Pharmacy, Media & Consumer Brands (among other sectors) over the last few years. Underlying this is, of course, its continued investment in technology either through R&D or acquisitions.

Jeff Bezos once famously said, “Your margin is my opportunity.”

Today, Amazon is finding opportunities in industries that would have been unthinkable for the company to attack even a few years ago. Further on this article, we’ll take a look at what the future holds for Amazon. But first, let’s take a look at the sheer scale of the business.

Amazon Quick Facts

Here are some quick facts about Amazon that will help you to understand its scale and to put the core Amazon business model into perspective.

Amazon

Jeff Bezos

1994

1994

Jeff Bezos

Seattle, USA

(FY 2023): 1.54 million full-time and part-time employees

AMZN

2023: $574.8 billion

2023: $30.4 billion

(March, 2024): $1.81 trillion

How Does Amazon Make Money?

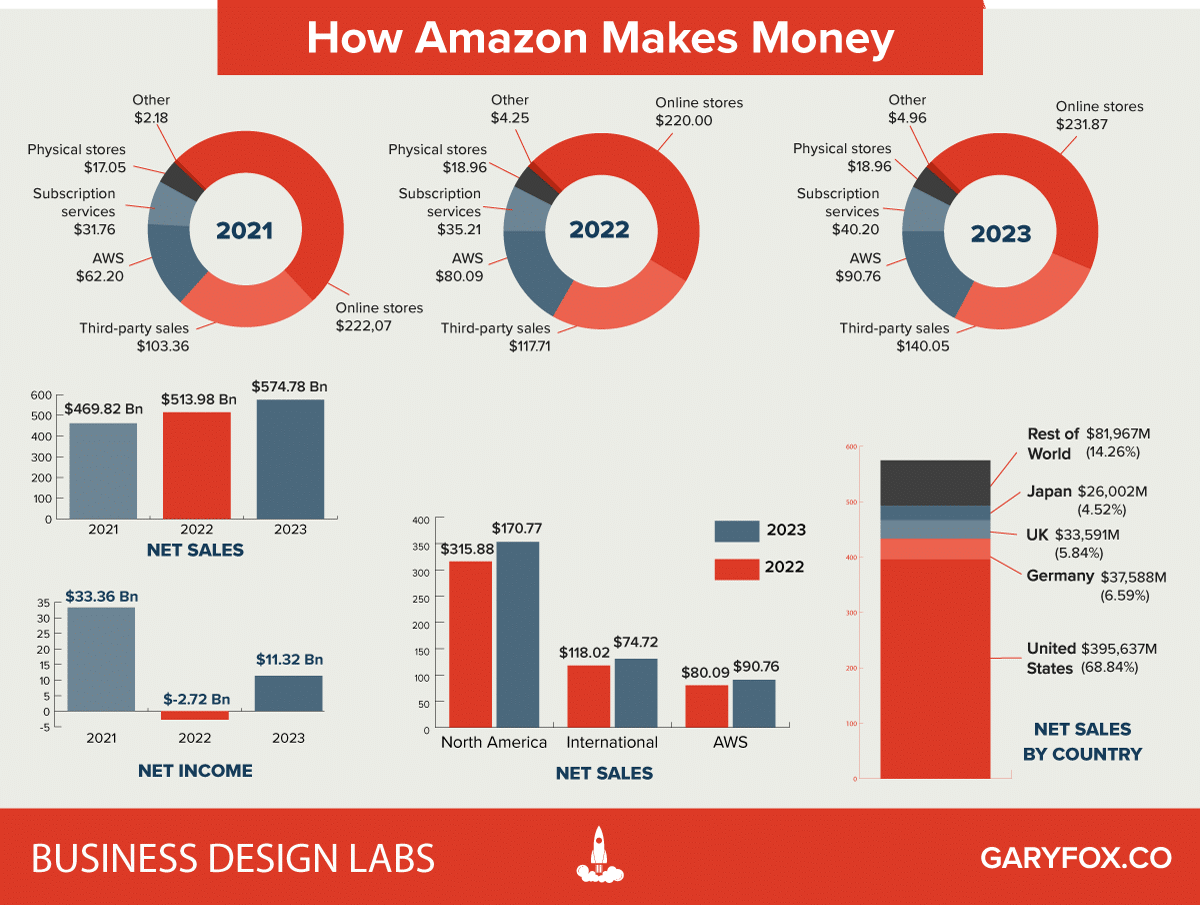

Amazon Financial Performance

Below is a breakdown of Amazon’s revenue and profit by product/service for 2023, including percentage changes from the previous year:

| Segment | 2023 Revenue ($ billion) | % Change from 2022 | 2023 Profit ($ billion) | % Change from 2022 |

|---|---|---|---|---|

| North America | 352.8 | +12% | 14.9 | From -2.8 billion (Loss in 2022) to Profit |

| International | 131.2 | +11% | -2.7 | Improvement from -7.7 billion (Loss reduced) |

| AWS (Amazon Web Services) | 90.8 | +13% | 24.6 | +7.9% |

| Total | 574.8 | +12% | 36.9 | Significant Turnaround from 2022 Loss |

Amazon has seen notable growth and encountered challenges over the past three years, reflected in its revenue, net income, and regional performance. The company’s financial performance highlights its diverse business model and expansion efforts. Below is a breakdown of how Amazon generates revenue, the challenges faced, and the strategies for future growth.

Revenue and Profit Overview

From 2021 to 2023, Amazon’s total revenue demonstrated a steady increase. In 2021, revenue stood at approximately $469.8 billion, grew to $514 billion in 2022, and reached $575 billion in 2023. While this indicates a strong growth trajectory, the net income presented significant variation. A net income of $33.4 billion in 2021 declined sharply to a loss of $2.7 billion in 2022, then partially recovered to $11.3 billion in 2023.

The 2022 loss was due to several factors, including macroeconomic challenges, increased operational costs, and valuation losses, notably from investments like Rivian Automotive. Despite cost pressures and a slowdown in revenue growth, Amazon worked on cost efficiencies and streamlined logistics, which helped stabilize its net income in 2023.

Revenue Breakdown by Segment

Amazon’s diversified business model includes multiple revenue streams:

- Online Stores and Third-Party Sales: These segments accounted for a substantial portion of revenue in 2023, with online stores contributing 43.93% and third-party sales 26.53%. Amazon’s robust e-commerce presence is driven by a broad product range, competitive pricing, and improved delivery capabilities.

- Amazon Web Services (AWS): AWS continues to be a growth engine, contributing 17.19% of total revenue in 2023. Investments in new features and cloud services have sustained AWS’s leadership position in cloud computing, despite experiencing slightly slower growth than in earlier years.

- Subscription Services and Other Segments: Subscription services, including Prime, represented 7.62% of revenue in 2023. The growth in Prime memberships and increased engagement with content offerings such as Prime Video have supported revenue generation in this segment.

Regional Performance

In 2023, Amazon’s regional performance highlighted its dominance in the U.S. market and growth across international markets:

- United States: The U.S. remains Amazon’s largest market, generating 68.84% of total revenue. This is primarily due to Amazon’s extensive e-commerce operations and the continued growth of AWS.

- International Markets: Key regions include Germany (6.54%), the United Kingdom (5.84%), Japan (4.52%), and the “rest of the world” combined (14.26%). These markets present growth potential as Amazon adapts to local market conditions, builds regional infrastructure, and navigates competition and regulations.

Key Growth Areas and Strategies

Amazon’s growth is fuelled by several strategic focuses:

- AWS Expansion: AWS remains a core growth area. The company is adding new cloud features, expanding AI and machine learning capabilities, and building infrastructure to attract a diverse client base. These efforts significantly bolster Amazon’s overall revenue.

- Fulfillment and Logistics Improvements: Amazon continues to enhance its fulfillment network by improving delivery speed and reducing costs. Regional inventory placement and streamlining of operations have optimized delivery efficiency and contributed to cost savings.

- New Business Investments: Amazon is diversifying its revenue streams by investing in new business areas like satellite broadband (Project Kuiper) and healthcare (including acquisitions like Amazon Clinic and One Medical). These ventures aim to provide additional growth opportunities and increase Amazon’s global presence.

Challenges and Forward Strategy

International Expansion and Regulation: Growing in diverse international markets requires dealing with unique regulatory environments and strong local competition. Amazon’s strategy involves adapting offerings to local preferences, expanding AWS services globally, and fostering relationships with third-party sellers to drive growth.

Cost Management: Rising operational costs—especially in transportation, wages, and supply chains—challenge Amazon’s profitability. The company has concentrated on operational efficiencies, reducing fulfillment costs, and lowering the cost-to-serve.

Sustaining Growth in Core Segments: With a stabilized e-commerce market post-pandemic, Amazon is facing challenges in maintaining rapid growth. The company is tackling this by enhancing customer experiences, expanding its product range, and boosting subscription-based models to drive repeat purchases.

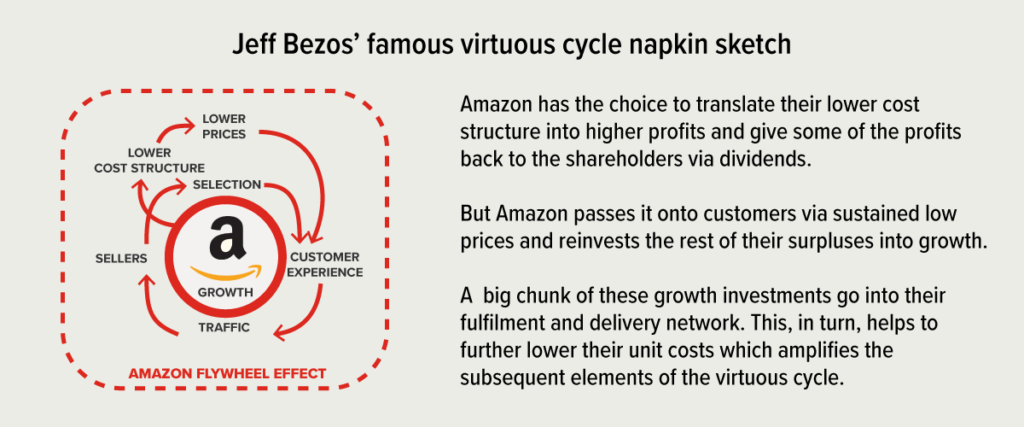

Amazon Business Model: Jeff Bezos’s Flywheel

Because of our model we are able to turn our inventory quickly and have a cash-generating operating cycle. On average, our high inventory velocity means we generally collect from consumers before our payments to suppliers come due.

Amazon report January 2020

Amazon’s Cash Machine

Amazon benefits from its cash conversion cycle. In simple terms, Amazon receives payments from its customers before paying for the product.

By using days payable for suppliers, Amazon is able to fund their growth using suppliers’ balance. Why is this important? It allows Amazon to have the cash to invest in other things and make use of the money rather than being tied up in inventory.

There are three aspects to take into account the cash conversion cycle:

- Days payable outstanding (DPO)

- Days inventory outstanding (DIO)

- Days sales outstanding (DSO)

Amazon’s DPO

Days payable outstanding (DPO) is a standard accounting measure that shows a company’s average period for settling its payables. It indicates the time taken to pay invoices. The DPO formula is: ending accounts payable / (cost of sales/number of days).

For Amazon, DPO was last reported in Q4 2023 as 82.15, showing an increase of 2% from 80.45 year-over-year.

Amazon’s DIO

- For the three months ended in December 2023, inventory was $22,431 million.

- Amazon’s cost of goods sold for the same period was $72,853 million.

- Therefore, Amazon’s DIO for the three months ended in December 2023 was 30.15 days.

Amazon’s DSO

Days Sales Outstanding (DSO) is a standard accounting metric, defined as a measure of the average number of days that a company takes to collect revenue after a sale has been made. A low DSO value means that it takes a company fewer days to collect its accounts receivable.

Amazon Business Model: Value Propositions

How does Amazon Business work?

The Amazon business model has been built up over two decades and for years was not considered profitable. During that time it made huge investments in its infrastructure.

As a strategy, it has created an economic moat (competitive advantage) and made it hard for any competitor to match its logistics and fulfilment capabilities. The Amazon business model has several economic moats including patents, technology and partnerships.

The Amazon Business Model Canvas

Customer Segments

Understanding customer segments is core to understanding the Amazon business model. The company has crafted its services and offerings to cater to a broad spectrum of customer needs and preferences which is demonstrated in the range of products it stocks.

Value Propositions

Amazon’s value proposition is focused on offering distinct advantages to its diverse customer segments through innovation, efficiency, and scalability.

Channels

The Amazon business model leverages a variety of channels to reach and engage with its customers. The main channels used by Amazon include:

Customer Relationships

Building and maintaining robust customer relationships are central to the Amazon business model and ensure repeat business and customer loyalty.

Key Activities

Amazon’s business model – the key activities encompass a broad spectrum of operations and strategic initiatives. These activities are central to maintaining its competitive edge and fostering growth across its diverse service offerings:

Key Resources

The Amazon business model relies on several key resources that enable the company to operate effectively and maintain its competitive advantage. These resources are critical to its success and help support its various business operations. The key resources for Amazon include:

Key Partners

The Amazon business model relies on a diverse network of key partners that play a crucial role in supporting the company’s operations, growth, and success. These partnerships span across various industries and sectors, enabling Amazon to leverage specialized expertise, resources, and capabilities to enhance its value proposition and deliver a seamless experience to its customers.

Revenue Streams

Amazon’s revenue streams are diversified, which shows its robust business model and ensuring financial sustainability.

Cost Structure

The cost structure of the Amazon business model is complex and reflects the scale of its operations across various sectors. Key components of Amazon’s cost structure include:

Amazon’s Supply Side

Given such a staggering amount of categories, let alone individual items, the question arises where do all these products come from? It’s not just the storage and logistics but also inventory costs, especially for low-frequency items. Here are the most common sourcing models:

Amazon uses three approaches for the fulfilment of books but also a number of other categories. The following three approaches are typical of Amazon’s (though it is more complex than illustrated):

- Standard inventory: hold only the most popular stock in their own fulfilment centres.

- Just-in-time inventory: arrangements with the producers (rather than wholesaler) to ship the stock to either Amazon or (depending on a number of factors) directly to the customer when an order comes in.

- Third-party sellers: this is another case of inventory not owned by Amazon and sold through Amazon Marketplace. These can be other professional sellers or other users who want to sell their used items. In most cases, the inventory would be held and shipped by the 3rd party unless they use Fulfilment by Amazon and/or Shipping with Amazon services.

Marketplace strategies

Like many other platforms (e.g. Uber) the Amazon business model increasingly relies on Artificial Intelligence.

It is used to maximize profits through dynamic pricing, bundling products and offer personalized promotions and recommendations.

These are some of the classical marketing levers to drive volume and growth.

The Amazon business model depends on not just offering the lowest pricing but offering pricing that rapidly reflects market changes and pricing changes. Amazon tracks pricing across the web to identify its price point and that of its competition.

In practice, as is the practice for many online retailers, the lowest prices are for the most popular products, with less popular products commanding higher prices and a greater margin for Amazon.

- Price dynamism: Amazon makes millions of price changes every day. Some estimate, they change the pricing of 15-20% of their products per day. Dynamic pricing also called surge pricing, demand pricing, real-time pricing or algorithmic pricing is where the price is flexible based on demand, supply, competition price, subsidiary product prices.

- Price perception strategy: One e-commerce service company points out that Amazon’s “[…] consistently low prices on the highest-viewed and best-selling items drive a perception among consumers that Amazon has the best prices overall”.

- Demand/supply pricing: It is presumed that inventory levels (supply) and demand influence the dynamic pricing. For example, when demand for a product spikes within a short period, say, due to a promotional campaign, this may lead to surging prices. Some accounts state that Amazon keeps surplus profits on a Marketplace product for themselves rather than passing it onto the merchant.

- Competition monitoring: Here is an example of how prices change for popular items change within one day as each retailer constantly checks their competitor’s prices and reacts algorithmically.

- Seasonal prices: up to 30% of annual sales are concentrated in the period between Black Friday and Christmas, with some categories being particularly popular in this time frame.

- Bundling/recommendations: Another tactic is bundling (sometimes with discounts) whereby Amazon suggest similar products for you to buy, e.g. under “customers who bought this item also bought”.

Demand Side

The Amazon business is built on delivering exceptional customer experience. Despite its size, any complaints are dealt with quickly and its response times but many other industries e.g. banks to shame.

How Amazon Optimizes The Customer Experience

There are many ways to center a business. You can be competitor focused, you can be product focused, you can be technology focused, you can be business model focused, and there are more. But in my view, obsessive customer focus is by far the most important. Even when they don’t yet know it, customers want something better, and your desire to delight customers will drive you to invent on their behalf.

Jeff Bezos

The Amazon business model puts the customer experience at the centre of everything it does. Some key points:

- Amazon’s services are so tailored and streamlined that it’s difficult to consider shopping elsewhere! From 1-click checkout to prompt delivery, everything about Amazon’s services is designed to make shopping completely streamlined, efficient and convenient.

An insight into Amazon’s UX strategy can be viewed below:

Amazon’s Acquisitions

Amazon has traditionally been a conservative buyer. Despite the historic Whole Foods acquisition ($13.7Bn), as well as a few other purchases like Zappos ($1.2Bn, 2009) and smart doorbell system Ring ($1.2Bn, 2018).

Overall, Amazon has historically been far less focused on acquisitions than its tech giant rivals. However, that seems to have changed. There are now multiple business models besides the core Amazon business model that started and remains within the marketplace.

Amazon’s Business Strategy

Jeff Bezos The Vision

The latest report includes a great vision for Digital Agility.

We will continue to focus relentlessly on our customers.

We will continue to make investment decisions in light of long-term market leadership considerations rather than short-term profitability considerations or short-term Wall Street reactions.

“Relentlessly focus on customer experience by offering our customers low prices, convenience, and a wide selection of merchandise.”

“We work to earn repeat purchases by providing easy-to-use functionality, fast and reliable fulfillment, timely customer service, feature-rich content, and a trusted transaction environment.

Who Amazon Sees As Competition

Amazon describes the competitive environment for its products and services as intense. It views its main competitors as:

- Physical, e-commerce, and omnichannel retailers, publishers, vendors, distributors, manufacturers, and producers of the products we offer and sell to consumers and businesses.

- Publishers, producers, and distributors of physical, digital, and interactive media of all types and all distribution channels.

- Web search engines, comparison shopping websites, social networks, web portals, and other online and app-based means of discovering, using, or acquiring goods and services, either directly or in collaboration with other retailers.

- Companies that provide e-commerce services, including website development and hosting, omnichannel sales, inventory, and supply chain management, advertising, fulfilment, customer service, and payment processing.

- Companies that provide fulfilment and logistics services for themselves or for third parties, whether online or offline.

- Companies that provide information technology services or products, including on-premises or cloud-based infrastructure and other services.

- Companies that design, manufacture, market, or sell consumer electronics, telecommunication, and electronic devices.

- Companies that sell grocery products online and in physical stores.

Based on this we can pull out the main themes:

- Amazon has its sights on Grocery – household purchases.

- Amazon is focused on expanding AWS and its offer e.g. AI as a service.

- Amazon will expand its range of consumer electronics for the home and smart devices to compliment Amazon Echo.

- Amazon will continue to invest in entertainment and media e.g. Amazon Music and Prime Video.

Amazon’s Strategy

Amazon’s generic corporate strategy can be described as concentric diversification.

This strategy is based on harnessing technological capabilities and following a cost leadership strategy aimed at offering the maximum value for its customers at the lowest price. The strategy involves a customer-centric focus where Amazon becomes the go-to portal for their online shopping needs.

Apart from this, Amazon’s strategy is driven by its sources of competitive advantage:

- technology.

- economies of scale.

- leveraging efficiencies between external drivers and internal resources.

- use AI to drive supply-side efficiencies and demand-side insights and growth.

Experimentation and testing at Amazon

Amazon writes in the blog that it’s a safe space to fail. It’s about more than the typical test, fail, repeat cycle that many companies can claim. It’s understood at Amazon that it’s OK to unwind a decision that was the wrong one, and to try again with a different decision.

One area where I think we are especially distinctive is failure. I believe we are the best place in the world to fail (we have plenty of practice!), and failure and invention are inseparable twins. To invent you have to experiment, and if you know in advance that it’s going to work, it’s not an experiment. Most large organizations embrace the idea of invention, but are not willing to suffer the string of failed experiments necessary to get there.

Amazon annual report 2018

Business models are all about experimentation. The Amazon business model approach is no different. The brand isn’t afraid to experiment with potential flops, like the Fire Phone, Amazon Auctions and WebPay. It is only through failure that Amazon ultimately succeeded with the super-successful Amazon Kindle, Amazon Prime and Echo.

What is omnichannel retailing? The goal for Amazon, in fact, most retailers/etailers is to be able to sell to customers at the time of need through any device and through any channel.

Omnichannel retailing is a fully-integrated approach to commerce, providing shoppers with a unified experience across all channels or touchpoints.

You can see from the CBInsights diagram how the Amazon business model is providing a raft of services that would otherwise be performed by a bank.

Expansion Into New Markets

Country Expansion

Amazon expanded geographically with its acquisition of Souq.com, a Middle Eastern e-commerce site. Expect more acquisitions which consolidate its presence in developing economies.

AWS GROWTH CONTINUES

Seattle-based Amazon is doubling down on AI for AWS and the ecosystem around its AI assistant, Alexa. It’s seeking to become the central provider for AI-as-a-service. But it’s not leaving retail behind either, running grocery, book, and convenience stores across the US.

AI Everywhere

Amazon is funnelling huge amounts of money into the AI tech and talent. The Amazon business model already has seen acquisitions across a wide range of AI companies:

The Amazon business model of the future will be underpinned by AI everywhere – from backend supply logistics through to optimising product suggestions and the overall customer experience.

Amazon Business Model The Future

The trends highlighted earlier will make it interesting to watch as the pace of change and technology rapidly evolves. In turn, this will create exciting opportunities for Amazon to break into new markets with new business models and disrupt incumbent players.