The Amazon SWOT analysis shows that this global eCommerce player aims to fuel its growth through acquisitions and by transforming the retail experience.

Amazon was launched in 1994 by president and CEO Jeff Bezos in Seattle, Washington. It is now a global eCommerce giant with a market capitlization of over $1 Trillion.

Through a keen strategic vision of the future and seizing opportunities to innovate with emerging technologies, this global power brand is set to dominate where and how we buy products and services.

Despite this, there are several competitors investing heavily to compete against Amazon in its different market. The Amazon business model might be secure but many of its new initiatives might be under threat.

Table of Contents

Amazon Quick Facts

Amazon Products and Services

Key Competitors of Amazon

Analysis of Amazon

In this Amazon SWOT analysis, I’ll take a look into the external challenges Apple faces – the Opportunities and Threats, as well as its internal capabilities to realize the opportunities and deal with the threats – Strengths and Weaknesses.

As the New York Times reports,

“[Amazon] isn’t just secretive, the way Apple is, but in a deeper sense, Jeff Bezos’ e-commerce and cloud-storage giant is opaque. Amazon rarely explains either its near-term tactical aims or its long-term strategic vision. It values surprise.”

New York Times

What is the SWOT Analysis For Amazon?

The SWOT analysis of Amazon shows that this global eCommerce giant is set to move into new markets but its weakness in Asia could pose a major threat.

The SWOT Analysis of Amazon

amazon financial analysis

Here’s a breakdown of Amazon’s revenue and profit by product/service for 2023, including percentage changes from the previous year:

| Segment | 2023 Revenue ($ billion) | % Change from 2022 | 2023 Profit ($ billion) | % Change from 2022 |

|---|---|---|---|---|

| North America | 352.8 | +12% | 14.9 | From -2.8 billion (Loss in 2022) to Profit |

| International | 131.2 | +11% | -2.7 | Improvement from -7.7 billion (Loss reduced) |

| AWS (Amazon Web Services) | 90.8 | +13% | 24.6 | +7.9% |

| Total | 574.8 | +12% | 36.9 | Significant Turnaround from 2022 Loss |

This table illustrates Amazon’s the critical role of AWS in

Amazon has continued to demonstrate growth but the retail segment (physical stores) is struggling to grow and make a profit. However, its AWS cloud services show strong and profitable growth.

- Product Sales: Revenue from the sale of products on its online platform, including both direct sales and third-party seller transactions.

- Subscription Services: Fees from Amazon Prime memberships, along with subscriptions for services like Amazon Music and Kindle Unlimited.

- AWS: Revenue from Amazon Web Services, offering cloud computing and storage solutions to businesses and individuals.

- Advertising: Income from on-site advertising services provided to third-party sellers and other advertisers.

- Physical Stores: Sales from Amazon’s physical retail locations, including Whole Foods Market and Amazon Go stores.

Amazon SWOT Analysis – Strengths

Amazon SWOT Analysis – Weaknesses

Amazon SWOt Analysis – Opportunities

Amazon SWOT Analysis – Threats

Summary of Amazon SWOT Analysis

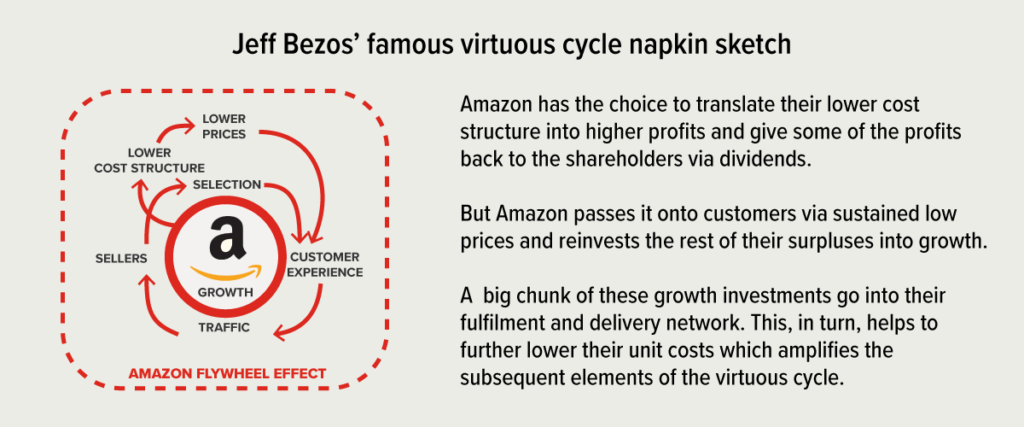

Amazon’s ecosystem has also given it more cash to deploy, which is why it can afford to pursue low-profit initiatives. As Amazon enters new markets and exapnds, it follows a strategic playbook:

- Attract and retain customers to the platform by providing a better customer experience.

- Invest in operations e.g. warehouses, distribution and data centres.

- Optimize operations using intelligent systems that reduce duplication, waste and improve efficiencies.

- Monetize operations by allowing others to use the platform(s).

Other Amazon Posts

The Amazon Business Model and Amazon Mission Statement

If you’re interested in creating your own SWOT analysis then download these free SWOT analysis templates now.