Amazon business model is an eCommerce model, but over the years it has made acquisitions and diversified creating a portfolio of business models and revenue streams.

In Q4 2019, Bezos said the number of items delivered via free one-day and same-day delivery more than quadrupled in the holiday quarter, without providing specific numbers.

As a result, Amazon rejoined the $1tn club (temporarily) on the back of blockbuster earnings in 2019!

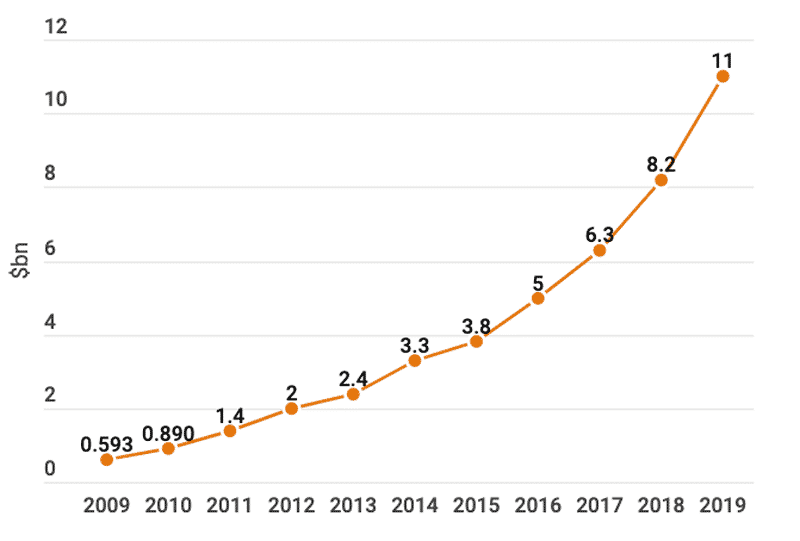

Interesting fact: Amazon, is the biggest advertiser in the world. Amazon has hiked its ad expenditure almost 20-fold in a decade from $593m in 2009 to $3.3bn in 2014 and $11bn in 2019, according to company filings.

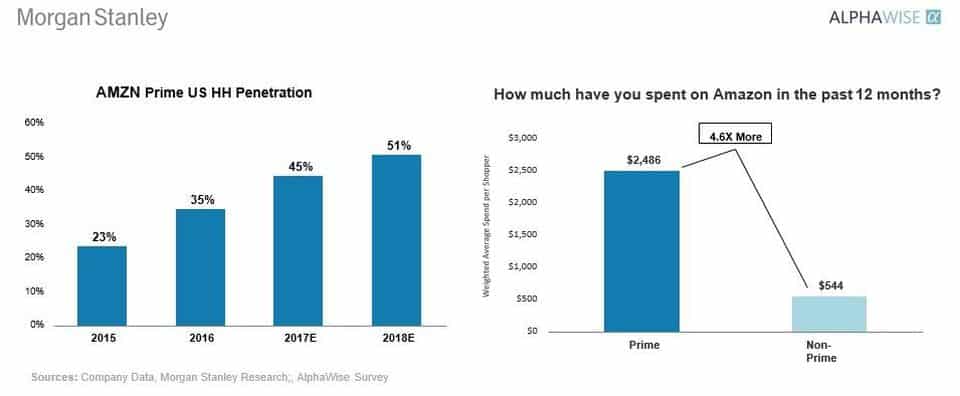

Their record Q4 also saw strong growth in Prime subscriptions, seeing Amazon achieve over 150M paid Prime subscribers globally for their membership program.

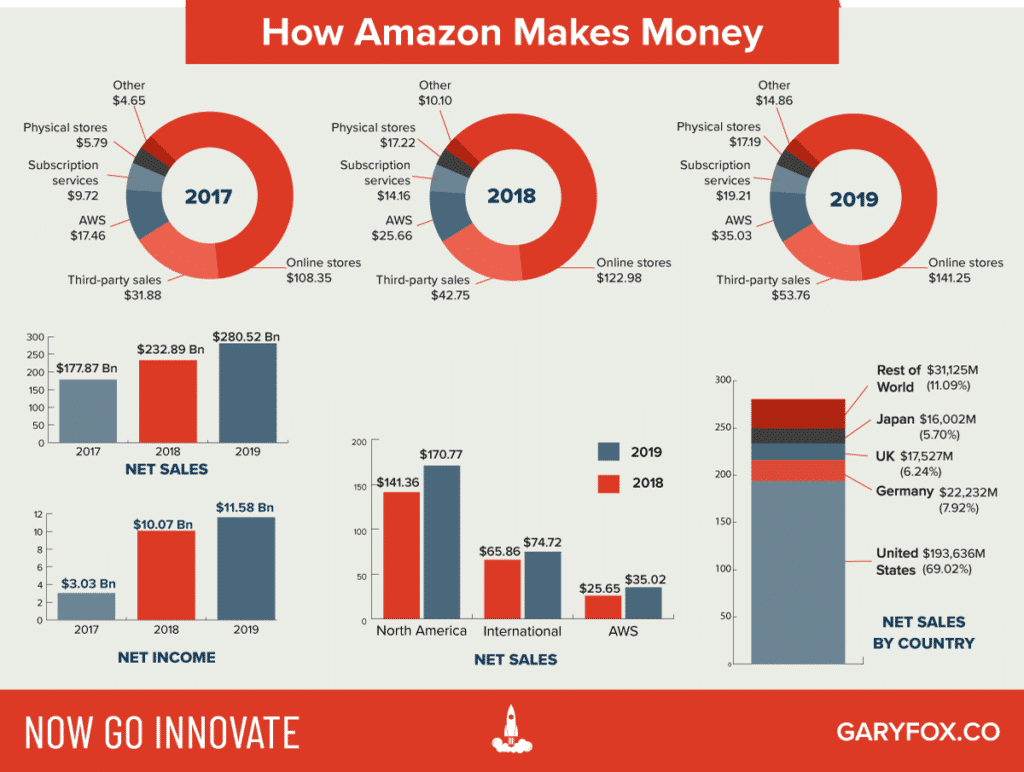

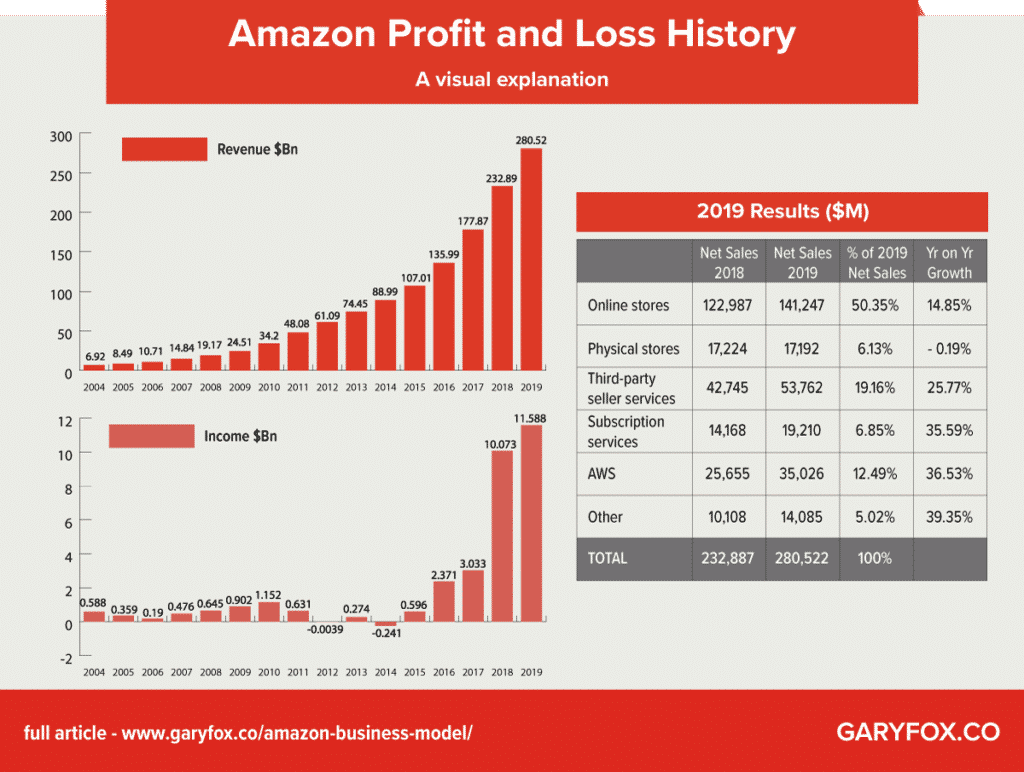

In Amazon’s 2019 annual report, they recorded net sales of over $280 billion and net profit of over $11 billion. The biggest proportion of sales, fifty per cent, came from their online marketplace.

Take a look at the breakdown further below.

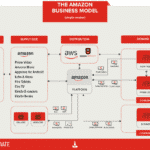

What Is Amazon’s Business Model?

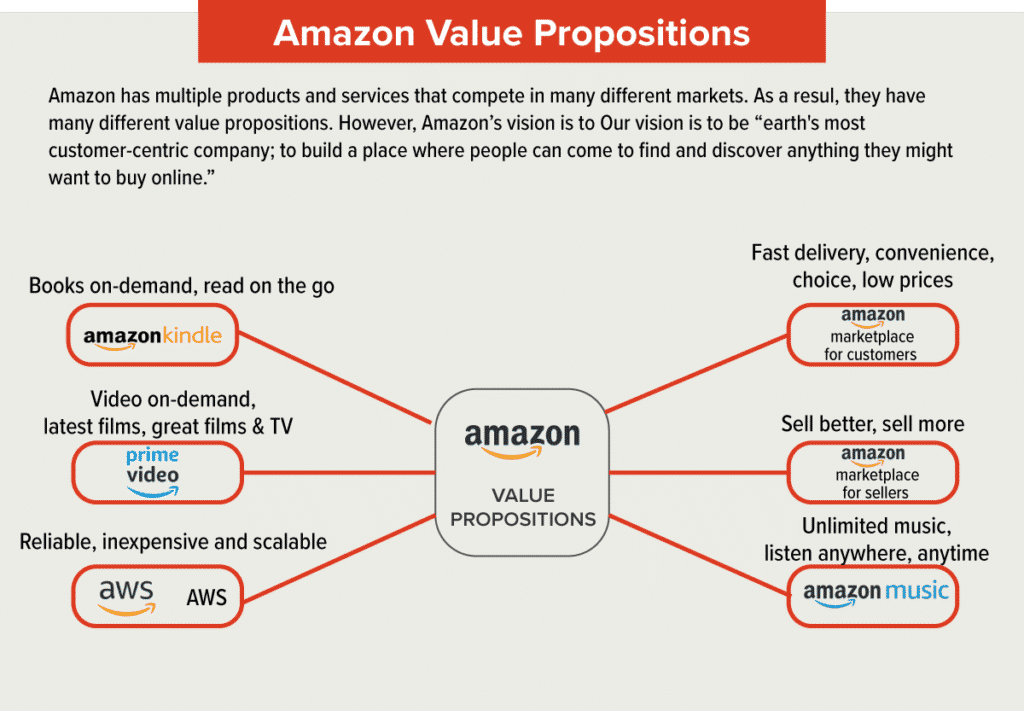

The Amazon business model, which was initially based on eCommerce, has changed and now incorporates entertainment, music, cloud computing, meal deliveries and much more.

On July 5, 1994, Jeff Bezos incorporated the company that went on to become Amazon. He must have seemed crazy at the time, only a small percentage of the population had the internet and it was a far cry from the speed and design we have become accustomed to today.

At the time only 0.447 per cent of the world had access to the internet, however, adoption accelerated and by 1995 it reached 0.777 per cent.

More than 4.5 billion people now use the internet, while social media users have passed the 3.8 billion mark.

From a relatively simple single-sided eCommerce platform, Amazon has grown into a complex digital ecosystem. The Amazon business model is not a single entity, but rather a portfolio of business models.

Amazon has rapidly changed, adapted and established itself as one of the biggest companies in history. Along with AWS, Amazon has a global reach and distribution capability offering both digital and physical products.

As an example, Amazon has harnessed its technology to transform the retail experience with Amazon Go stores. Even traditional retailers like Walmart are no longer safe from the threat of Amazon.

Amazon has set its eye on Payments, Logistics, Pharmacy, Media & Consumer Brands (among other sectors) over the last few years. Underlying this is, of course, its continued investment in technology either through R&D or acquisitions.

Jeff Bezos once famously said, “Your margin is my opportunity.”

Today, Amazon is finding opportunities in industries that would have been unthinkable for the company to attack even a few years ago. Further on this article, we’ll take a look at what the future holds for Amazon. But first, let’s take a look at the sheer scale of the business.

Amazon Quick Facts

Here are some quick facts about Amazon that will help you to understand its scale and to put the core Amazon business model into perspective.

What Does Amazon Sell?

Although Amazon sells a lot more through its subsidiaries, the core Amazon business model is based on an eCommerce market platform. Amazon sells products on the platform but also allows third-party sellers to sell to consumers.

Currently, the platform offers the following products/services:

- Prime Video

- Amazon Music

- Appstore for Android

- Echo & Alexa

- Fire Tablets

- Fire TV

- Kindle E-readers & Books

- Merchant products

- Vendor products

Who Are Amazon’s Customers

Amazon defines what it refers to as three consumer sets: customers, seller customers, and developer customers.

Customers are people that buy products or subscribe to their services. Sellers sell their products on the platforms and developers are focused on harnessing the AWS technologies for infrastructure, digital products or services.

Amazon Business Model: Revenue Streams

Amazon Marketplace

The core Amazon business model is still the heartbeat of its revenue. The majority of Amazon’s revenue (over 50%) comes from the marketplace – sellers and customers.

Amazon Books

At one time the majority of the revenue generated came from the sale of books. Although still significant, the strongest category is now consumer electronics. Amazon marketplace though has a large book depository, audiobooks on Audible and Kindle ebooks.

Amazon Music and Videos

Amazon Business Model includes star websites like IMDB and twitch.tv. Amazon Music and Videos also add to the revenue. These contribute to the subscriptions revenue stream you can see in the financial report below. IMDB supports people being able to profile actors while watching films and hence delivers a more unique experience.

Amazon Gaming

A little less know part of the Amazon business model is Amazon Game Studios. Amazon Digital Game Store also sells third-party games as well.

Amazon Web Services (AWS)

Much of what we build at AWS is based on listening to customers.

Annual report 2018

In 2019, AWS grew by over 36%. AWS is used by many significant sized platforms such as Uber and Netflix. The company has a global IT infrastructure, but can equally be used by freelance developers or big global organizations. As a cloud infrastructure, it is extremely flexible and scalable.

AWS continues to show strong growth and fits with the ongoing trend of digitization, growth in platforms and move to digital infrastructures by enterprises as they continue to digitally transform their businesses.

The Amazon business is underpinned by investments in technology. AWS has grown to become an ecosystem of developers that allows Amazon to understand how AI, Internet of Things (IOT) can be used and to invest in potential new ventures.

Amazon Fire Products

Amazon has a strong range of products Fire products which include phones, tablets, Tv and Mobile OS.

Amazon Prime

Amazon Prime is the main subscription part of the Amazon business model. The results for 2019 show a significant jump in Prime memberships. Amazon Prime includes Prime video which competes directly with Netflix, Hulu and HBO NOW.

Amazon Tickets

Amazon Tickets was launched in the UK in 2015 and has since expanded to the US, Asia and the rest of Europe. Its global ticketing business is still a work in progress. However, this fits with their overall entertainment part of the business model. Amazon Tickets vision – “Our vision goes beyond just selling tickets, as we aim to disrupt the entire live entertainment experience, including what happens before, during, and after the show.”

Amazon Patents

Amazon holds more than 1000 patents many of which are licensed by other companies.

Amazon Advertising

The Amazon Ad platform offers sponsored ads, display, and video advertising.

Not many people know about the scale of Amazon’s advertising platform. In 2019, the majority of the ‘other’ revenue consisted of ad revenue which grew by 39% vs 2018 to $14 Bn. As a comparison in 2019, Facebook income from Ad revenue is $69.65 Bn and Google’s Ad revenue was $134.8 billion.

Amazon’s ad platform is powerful because people on the platform have a high-purchase intent. Everyone knows that the jump from ad to a landing page or promotional page, involves risks losing traffic and potential customers.

However, with Amazon, you are on already the place where you will buy plus people know and trust Amazon. No clicking away to find another website, landing page or product. Ads are directly targeted to people already within the platform itself.

You can see from this how the business model of Amazon is changing.

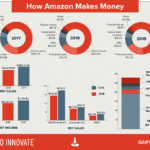

How Does Amazon Make Money?

Amazon makes money in five distinct ways. The majority of Amazon’s revenue comes from sales on the main site, either directly or through third-party commissions. Other sales come from AWS, physical stores and subscription services e.g. Prime.

In this section, we’ll explore how the Amazon business model generates revenue.

| Amazon Service | 2018 ($M) | 2019 ($M) | Yr on Yr | |

| 1. Online stores | 122,987 | 141,247 | 15% | |

| 2. Physical stores | 17,224 | 17,192 | 0% | |

| 3. Third-party seller services | 42,745 | 53,762 | 26% | |

| 4. Subscription services | 14,168 | 19,210 | 36% | |

| 5. AWS | 25,655 | 35,026 | 37% | |

| 6. Other | 10,108 | 14,085 | 39% | |

| Net Sales | 232,887 | 280,522 |

Amazon Business Model: The Financial Results

This is a short break-down of what is included in each of the net sales results.

- Online stores. Includes product sales and digital media content where we record revenue gross. We leverage our retail infrastructure to offer a wide selection of consumable and durable goods that includes media products available in both a physical and digital format, such as books, music, videos, games, and software. These product sales include digital products sold on a transactional basis. Digital product subscriptions that provide unlimited viewing or usage rights are included in “Subscription services.”

- Physical stores. Includes product sales where our customer’s physically select items in a store. Sales from customers who order goods online for delivery or pick up at our physical stores are included in “Online stores.”

- Third-party seller services. Commissions and any related fulfilment and shipping fees, and other third-party seller services.

- Subscriptions: Annual and monthly fees associated with Amazon Prime memberships, as well as audiobook, digital video, digital music, e-book, and other non-AWS subscription services. Amazon’s standard Prime subscription rate is $119/year, which would translate into revenue of more than $17.8 billion, although the company offers discounted memberships for students and others.

- AWS: AWS includes global sales of computing, storage, database, and other services.

- Other: primarily includes sales of advertising services, as well as sales related to our other service offerings.

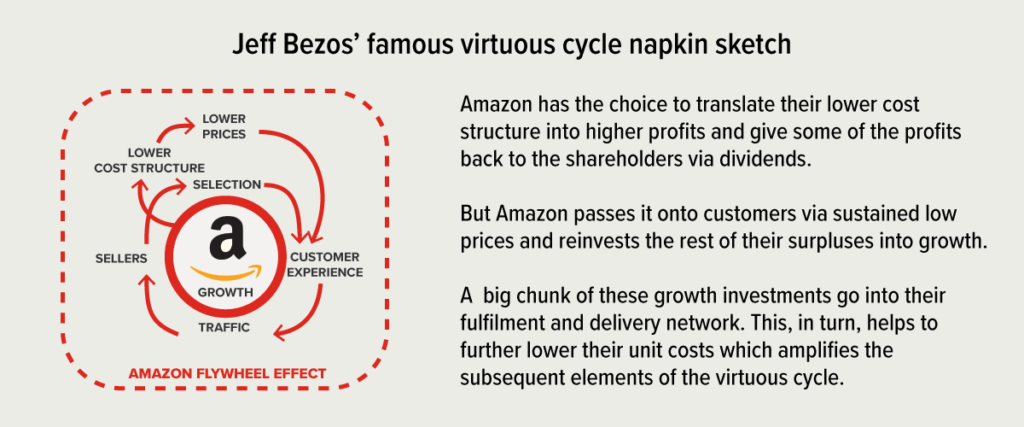

Amazon Business Model: Jeff Bezos’s Flywheel

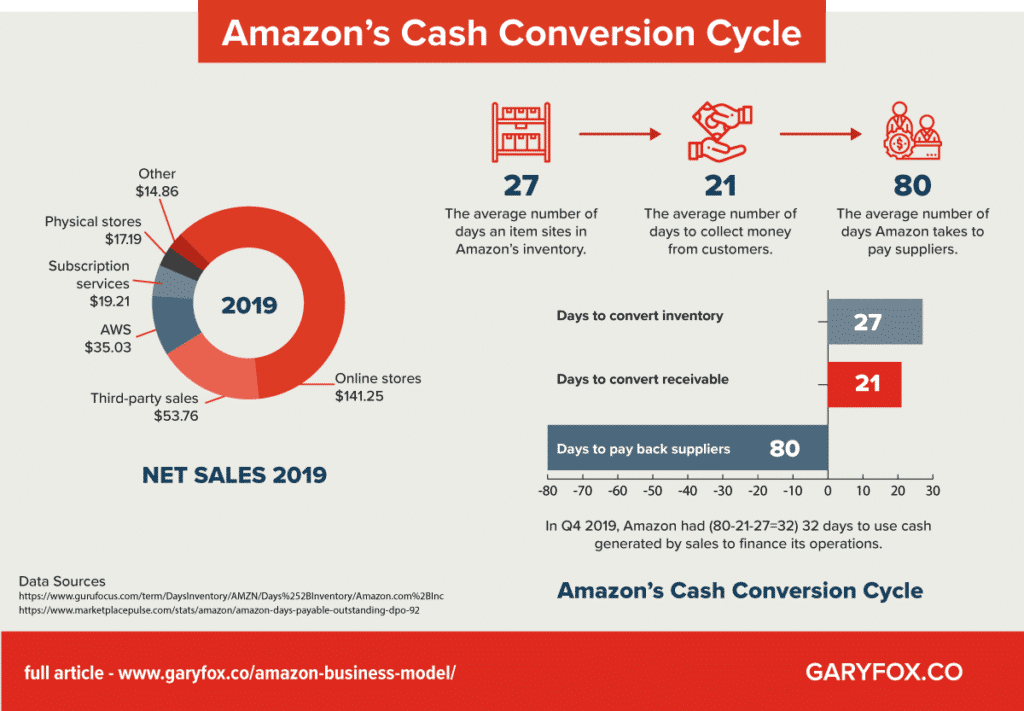

Because of our model we are able to turn our inventory quickly and have a cash-generating operating cycle. On average, our high inventory velocity means we generally collect from consumers before our payments to suppliers come due.

Amazon report January 2020

Amazon’s Cash Machine

Amazon benefits from its cash conversion cycle. In simple terms, Amazon receives payments from its customers before paying for the product.

Because of our model we are able to turn our inventory quickly and have a cash-generating operating cycle.

Amazon annual report 2018

By using days payable for suppliers, Amazon is able to fund their growth using suppliers’ balance. Why is this important? It allows Amazon to have the cash to invest in other things and make use of the money rather than being tied up in inventory.

There are three aspects to take into account the cash conversion cycle:

- Days payable outstanding (DPO)

- Days inventory outstanding (DIO)

- Days sales outstanding (DSO)

Amazon’s DPO

Days payable outstanding (DPO) is a standard accounting metric, showing the company’s average payable period. Days payable outstanding tells how long it takes a company to pay its invoices. The formula to calculate DPO is written as: ending accounts payable / (cost of sales/number of days).

- Amazon’s DPO: Last reported quarter 2019 Q4 it was 79.76, up by 3% year-over-year from 77.81.

Amazon’s DIO

- For the three months ended in Dec. 2019 was $19,632 Million.

- Amazon.com’s Cost of Goods Sold for the three months ended in Dec. 2019 was $66,169 Million.

- Amazon’s DIO: Hence, Amazon.com’s days inventory for the three months ended in Dec. 2019 was 27.07.

Amazon’s DSO

Days Sales Outstanding (DSO) is a standard accounting metric, defined as a measure of the average number of days that a company takes to collect revenue after a sale has been made. A low DSO value means that it takes a company fewer days to collect its accounts receivable.

- Last reported quarter 2019 Q4 it was 21.72, up by 3% year-over-year from 21.02.

Amazon Business Model: Value Propositions

Amazon Business Model – Channels

Amazon spends a good deal of money on ads. Advertising and other promotional costs to market products and services cost Amazon $6.3 billion, $8.2 billion, and $11.0 billion in 2017, 2018, and 2019.

In their SEC filings Amazon state that the aims of their communications strategy are (unsurprisingly) to:

- Increase customer traffic to our websites

- Create awareness of our products and services

- Promote repeat purchases

- Develop incremental product and service revenue opportunities

- Strengthen and broaden the Amazon.com brand name.

Amazon Partnership strategy

As Amazon has grown, its developed partnerships and has strategically acquired businesses that fit either its core business model or to a future strategic goal. See the infographic below to see how Amazon’s acquisitions fit its strategy.

Amazon’s partnership strategy can be viewed as ‘try before you buy’ (invest then buy), pure partnership and an ecosystem approach.

Amazon Business Model: Invest then Buy

Amazon has invested heavily in its future strategy through targeted acquisitions. Often it has moved from initial investment through to full acquisition and integration into Amazon. The acquisitions give a good indication into the future of Amazon as its strengthens its capabilities and enters new markets.

Examples include Drugstore.com (pharmacy), Living.com (furniture), Wineshopper.com (wines), HomeGrocer.com (groceries), Sothebys.com (auctions) and Kozmo.com (urban home delivery) and more recently Wholefoods.com.

Ecosystem of Sellers

Amazon has an estimated 8 million third-party sellers, Amazon is one of the largest online marketplaces in the world. In 2019, sellers on the Amazon marketplace sold $200 billion worth of products.

Affiliate networks and programs

Another critical element of Amazon business model has been built upon a network of publishers. Often blogs that earn a commission for any referrals that lead to a sale. This is the basis of affiliate marketing and helps to build the overall Amazon ecosystem and drive traffic to its website.

Amazon’s Growth

How does Amazon Business work?

The Amazon business model has been built up over two decades and for years was not considered profitable. During that time it made huge investments in its infrastructure.

As a strategy, it has created an economic moat (competitive advantage) and made it hard for any competitor to match its logistics and fulfilment capabilities. The Amazon business model has several economic moats including patents, technology and partnerships.

Amazon’s Supply Side

Given such a staggering amount of categories, let alone individual items, the question arises where do all these products come from? It’s not just the storage and logistics but also inventory costs, especially for low-frequency items. Here are the most common sourcing models:

Amazon uses three approaches for the fulfilment of books but also a number of other categories. The following three approaches are typical of Amazon’s (though it is more complex than illustrated):

- Standard inventory: hold only the most popular stock in their own fulfilment centres.

- Just-in-time inventory: arrangements with the producers (rather than wholesaler) to ship the stock to either Amazon or (depending on a number of factors) directly to the customer when an order comes in.

- Third-party sellers: this is another case of inventory not owned by Amazon and sold through Amazon Marketplace. These can be other professional sellers or other users who want to sell their used items. In most cases, the inventory would be held and shipped by the 3rd party unless they use Fulfilment by Amazon and/or Shipping with Amazon services.

Marketplace strategies

Like many other platforms (e.g. Uber) the Amazon business model increasingly relies on Artificial Intelligence.

It is used to maximize profits through dynamic pricing, bundling products and offer personalized promotions and recommendations.

These are some of the classical marketing levers to drive volume and growth.

The Amazon business model depends on not just offering the lowest pricing but offering pricing that rapidly reflects market changes and pricing changes. Amazon tracks pricing across the web to identify its price point and that of its competition.

In practice, as is the practice for many online retailers, the lowest prices are for the most popular products, with less popular products commanding higher prices and a greater margin for Amazon.

- Price dynamism: Amazon makes millions of price changes every day. Some estimate, they change the pricing of 15-20% of their products per day. Dynamic pricing also called surge pricing, demand pricing, real-time pricing or algorithmic pricing is where the price is flexible based on demand, supply, competition price, subsidiary product prices.

- Price perception strategy: One e-commerce service company points out that Amazon’s “[…] consistently low prices on the highest-viewed and best-selling items drive a perception among consumers that Amazon has the best prices overall”.

- Demand/supply pricing: It is presumed that inventory levels (supply) and demand influence the dynamic pricing. For example, when demand for a product spikes within a short period, say, due to a promotional campaign, this may lead to surging prices. Some accounts state that Amazon keeps surplus profits on a Marketplace product for themselves rather than passing it onto the merchant.

- Competition monitoring: Here is an example of how prices change for popular items change within one day as each retailer constantly checks their competitor’s prices and reacts algorithmically.

- Seasonal prices: up to 30% of annual sales are concentrated in the period between Black Friday and Christmas, with some categories being particularly popular in this time frame.

- Bundling/recommendations: Another tactic is bundling (sometimes with discounts) whereby Amazon suggest similar products for you to buy, e.g. under “customers who bought this item also bought”.

Demand Side

The Amazon business is built on delivering exceptional customer experience. Despite its size, any complaints are dealt with quickly and its response times but many other industries e.g. banks to shame.

How Amazon Optimizes The Customer Experience

There are many ways to center a business. You can be competitor focused, you can be product focused, you can be technology focused, you can be business model focused, and there are more. But in my view, obsessive customer focus is by far the most important. Even when they don’t yet know it, customers want something better, and your desire to delight customers will drive you to invent on their behalf.

Jeff Bezos

The Amazon business model puts the customer experience at the centre of everything it does. Some key points:

- Amazon’s services are so tailored and streamlined that it’s difficult to consider shopping elsewhere! From 1-click checkout to prompt delivery, everything about Amazon’s services is designed to make shopping completely streamlined, efficient and convenient.

An insight into Amazon’s UX strategy can be viewed below:

Amazon’s Acquisitions

Amazon has traditionally been a conservative buyer. Despite the historic Whole Foods acquisition ($13.7Bn), as well as a few other purchases like Zappos ($1.2Bn, 2009) and smart doorbell system Ring ($1.2Bn, 2018).

Overall, Amazon has historically been far less focused on acquisitions than its tech giant rivals. However, that seems to have changed. There are now multiple business models besides the core Amazon business model that started and remains within the marketplace.

How The Acquisitions Point To Amazons Goals

Over nearly two decades, the retailer has gobbled up or invested in at least 128 companies from Paris to Dubai. This infographic below shows some of the largest.

Amazon’s Business Strategy

Jeff Bezos The Vision

The latest report includes a great vision for Digital Agility.

We will continue to focus relentlessly on our customers.

We will continue to make investment decisions in light of long-term market leadership considerations rather than short-term profitability considerations or short-term Wall Street reactions.

“Relentlessly focus on customer experience by offering our customers low prices, convenience, and a wide selection of merchandise.”

“We work to earn repeat purchases by providing easy-to-use functionality, fast and reliable fulfillment, timely customer service, feature-rich content, and a trusted transaction environment.

Who Amazon Sees As Competition

In the 2019 sec filing Amazon

Competition continues to intensify, including with the development of new business models and the entry of new and well-funded competitors, and as our competitors enter into business combinations or alliances and established companies in other market segments expand to become competitive with our business.

Amazon sec filing January 2020

Amazon describes the competitive environment for its products and services as intense. It views its main competitors as:

- Physical, e-commerce, and omnichannel retailers, publishers, vendors, distributors, manufacturers, and producers of the products we offer and sell to consumers and businesses.

- Publishers, producers, and distributors of physical, digital, and interactive media of all types and all distribution channels.

- Web search engines, comparison shopping websites, social networks, web portals, and other online and app-based means of discovering, using, or acquiring goods and services, either directly or in collaboration with other retailers.

- Companies that provide e-commerce services, including website development and hosting, omnichannel sales, inventory, and supply chain management, advertising, fulfilment, customer service, and payment processing.

- Companies that provide fulfilment and logistics services for themselves or for third parties, whether online or offline.

- Companies that provide information technology services or products, including on-premises or cloud-based infrastructure and other services.

- Companies that design, manufacture, market, or sell consumer electronics, telecommunication, and electronic devices.

- Companies that sell grocery products online and in physical stores.

Based on this we can pull out the main themes:

- Amazon has its sights on Grocery – household purchases.

- Amazon is focused on expanding AWS and its offer e.g. AI as a service.

- Amazon will expand its range of consumer electronics for the home and smart devices to compliment Amazon Echo.

- Amazon will continue to invest in entertainment and media e.g. Amazon Music and Prime Video.

Amazon’s Strategy

Amazon’s generic corporate strategy can be described as concentric diversification.

This strategy is based on harnessing technological capabilities and following a cost leadership strategy aimed at offering the maximum value for its customers at the lowest price. The strategy involves a customer-centric focus where Amazon becomes the go-to portal for their online shopping needs.

Apart from this, Amazon’s strategy is driven by its sources of competitive advantage:

- technology.

- economies of scale.

- leveraging efficiencies between external drivers and internal resources.

- use AI to drive supply-side efficiencies and demand-side insights and growth.

Experimentation and testing at Amazon

Amazon writes in the blog that it’s a safe space to fail. It’s about more than the typical test, fail, repeat cycle that many companies can claim. It’s understood at Amazon that it’s OK to unwind a decision that was the wrong one, and to try again with a different decision.

One area where I think we are especially distinctive is failure. I believe we are the best place in the world to fail (we have plenty of practice!), and failure and invention are inseparable twins. To invent you have to experiment, and if you know in advance that it’s going to work, it’s not an experiment. Most large organizations embrace the idea of invention, but are not willing to suffer the string of failed experiments necessary to get there.

Amazon annual report 2018

Business models are all about experimentation. The Amazon business model approach is no different. The brand isn’t afraid to experiment with potential flops, like the Fire Phone, Amazon Auctions and WebPay. It is only through failure that Amazon ultimately succeeded with the super-successful Amazon Kindle, Amazon Prime and Echo.

Amazon Advertising Grows Up

Amazon’s advertising division is already the third-largest digital advertising platform in the U.S. (behind Google and Facebook).

Amazon last year confirmed its intended purchase of the Sizmek ad server and Dynamic Creative Optimization (DCO) suite. Some believe that this move could disrupt the very top of the digital advertising market.

omnichannel retailing

What is omnichannel retailing? The goal for Amazon, in fact, most retailers/etailers is to be able to sell to customers at the time of need through any device and through any channel.

Omnichannel retailing is a fully-integrated approach to commerce, providing shoppers with a unified experience across all channels or touchpoints.

You can see from the CBInsights diagram how the Amazon business model is providing a raft of services that would otherwise be performed by a bank.

Expansion Into New Markets

Healthcare

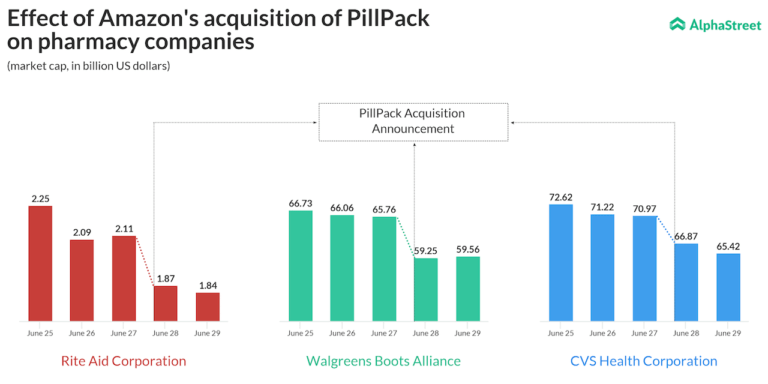

Prescription drug spending is $500 billion in the US alone. The business model is horribly antiquated and ripe for disruption. Who needs nine thousand Walgreen’s locations when you can just ask Alexa to refill your prescriptions and have them delivered the next day?

Amazon popped up on the health-care sector’s radar in 2017 for its rumored interest in pharmacy and drug distribution. Health-care executives were forced to address the Amazon factor so often that mentions of “Amazon” eclipsed mentions of “emergency room” in both the third and fourth quarters of that year. ”Amazon could be both a competitor in some areas and a collaborator in others,”

As an example, Amazon is moving into the $3 Trillion health care market. Amazon announced that it is partnering with Warren Buffett’s Berkshire Hathaway and JPMorgan Chase JPM to get into the health care business. Before the collaboration, the company acquired online pharmacy PillPack for nearly $1B.

Its investment into cancer detection company GRAIL was a vote of confidence in genomics, which with its massive data and processing needs, will be a major area for computing.

Country Expansion

Amazon expanded geographically with its acquisition of Souq.com, a Middle Eastern e-commerce site. Expect more acquisitions which consolidate its presence in developing economies.

AWS GROWTH CONTINUES

Seattle-based Amazon is doubling down on AI for AWS and the ecosystem around its AI assistant, Alexa. It’s seeking to become the central provider for AI-as-a-service. But it’s not leaving retail behind either, running grocery, book, and convenience stores across the US.

AI Everywhere

Amazon is funnelling huge amounts of money into the AI tech and talent. The Amazon business model already has seen acquisitions across a wide range of AI companies:

- 2017 – Harvest.ai

- 2016 – Embodied

- 2016 – Trackr

- 2016 – Definedcrowd

- 2016 – Kitt.ai

- 2015 – Mara.ai

- 2015 – Orbeus

- 2015 – Safaba

- 2015 – 2Lemetry

- 2013 – Ivona Software

- 2013 – Evi Technologies

The Amazon business model of the future will be underpinned by AI everywhere – from backend supply logistics through to optimising product suggestions and the overall customer experience.

More Retail – Groceries and Household Supplies

Notably, Amazon’s $13.7B purchase of grocery chain Whole Foods last year shook up the grocery industry, highlighting Amazon’s increasingly deep push into brick-and-mortar retail.

Amazon began a program called AmazonFresh to stock and ship groceries — including vegetables and refrigerated and freezer products — that it used as a way to stay competitive with traditional big-box retailers like Walmart and Target and Uber-like logistics newcomers like Instacart. The company now sells its own line of meal kits through Fresh to rival ready-to-cook options from companies like Blue Apron and Plated.

Amazon Business Model The Future

The trends highlighted earlier will make it interesting to watch as the pace of change and technology rapidly evolves. In turn, this will create exciting opportunities for Amazon to break into new markets with new business models and disrupt incumbent players.