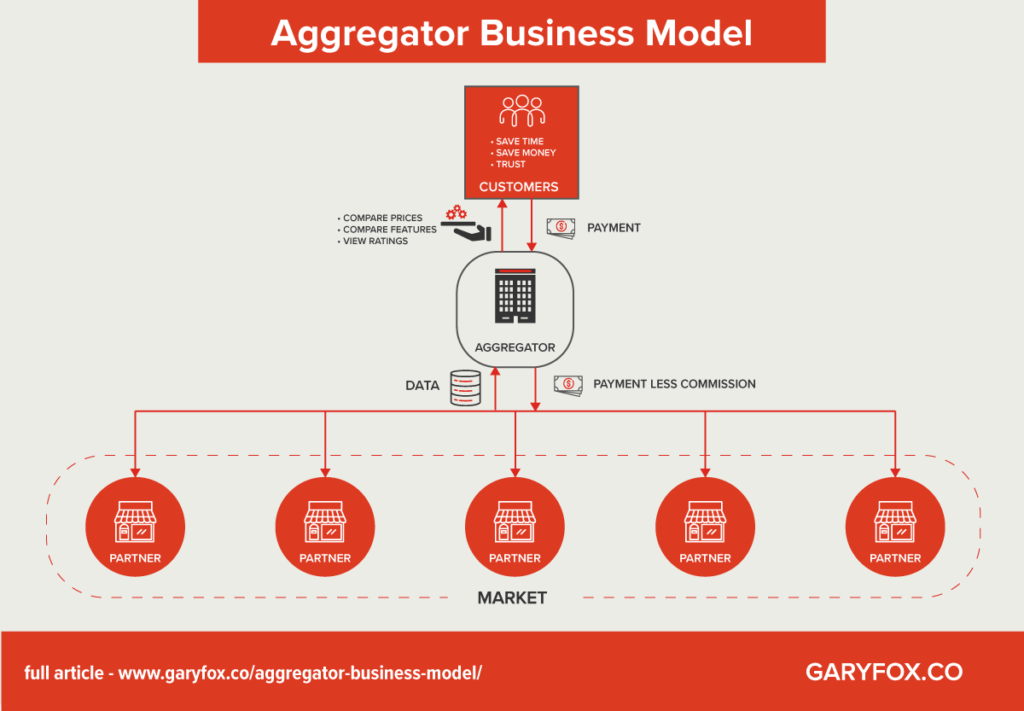

The aggregator business model has transformed industries decimating some firms.

Taxis, hotels, groceries, insurance, travel and many other industries now have a dominant aggregator.

Table of Contents

The Value Proposition of An Aggregator Model

Customer Value Proposition

The value for a customer is based on time, money and trust.

1. TIME: Let’s face it hopping across sites and trying to compare prices would be very time-consuming. Aggregator business models save customers time. This not only reduces the search time but also offers the consumer an instant and often, customizable list of similar products/services to compare.

2. EASE OF USE: It would also be a challenge to then collate and makes sense of all that data. You’d have to create tables with features and prices. By using comparison tables and filters aggregators help customers to make selections based on their needs. In turn, this makes it easier to make decisions.

3. TRUST: Often aggregators also aggregate reviews from a multitude of customers or have their own rating systems. This provides a large pool of reviews and helps the customer to choose a trusted product or service.

4. MONEY. By comparing the prices across the market and balancing that with reviews, customers get the best price vs quality assurance or the best good/supplier for their budget.

Value Proposition To Partners

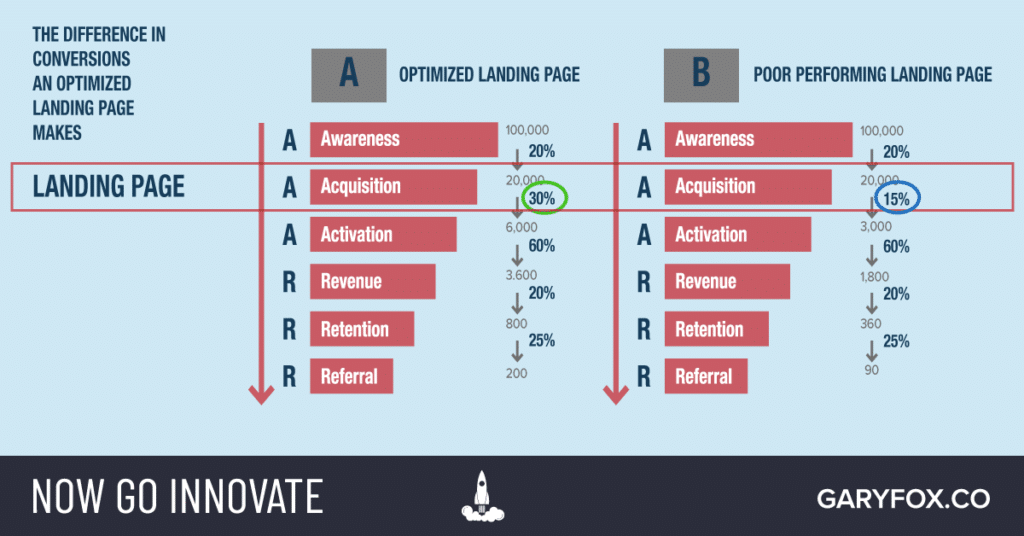

Partners benefit from having to get customers without the cost of marketing. Since most marketing activities work on acquiring a small percentage of customers which then finally purchase there is often a high-cost per acquisition.

There are also costs associated with all the activities related to the systems and staff needed to market a product or service.

The benefit to a partner is that they only pay a commission when a customer buys.

Customers make purchases through the online aggregators and in this way, the providers get more customers without spending an arm and a leg for the marketing. With each order, the aggregator firm gets the commission.

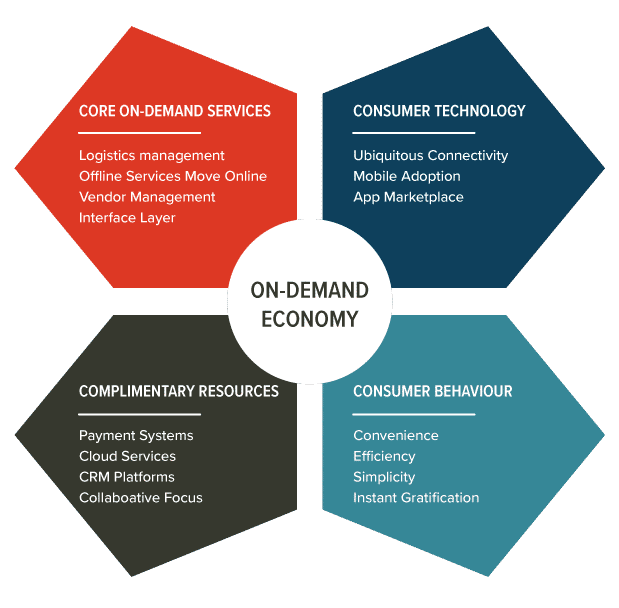

Why Digital Has Fueled The Aggregator Model

A theory is a hypothesis that can be tested and validated scientifically. Some have coined the term aggregator theory, but it is not really a theory just a set of reasons why technology has enabled new forms of business, new digital business models.

Platform economics neatly explain aggregators, and these theories date back 50 years.

The features of digital technology that enable the aggregator business model. Digital enables aggregation models to scale because of the following reasons:

- Direct access to consumers across multiple channels at scale (Marketing). In other words, there are about 7.5Bn people on the internet that you have potential access to. Previously you couldn’t get close to marketing or selling to that many people in the physical world.

- The immediacy and digital distribution effect (Distribution and On-demand). Digital products can be distributed at low costs (near zero costs per unit) but not zero costs. However, compared to physical distribution this has been a game-changer e.g. digitalization and distribution of books, music, news, and video are all examples where previous physical distribution and storage costs were high.

- Transactions Costs. In a digital world the total costs associated with transactions are relatively low but not zero. As an example, platforms that use Stripe or PayPal are subject to their commissions.

- The modularity of digital. Digital apps can be changed in an instant and this will be reflected in the user experience. Modularity provides greater degrees of personalization that cannot easily be attained in the physical world.

- Zero/Low marginal costs of scaling digital services or products. There are zero marginal costs for copying a music file or the details for a room booking. However, the cost of marketing is not a zero marginal cost – important to remember.

- Demand-driven multi-sided networks with decreasing costs. The network effects are based on acquiring more customers who in turn help to create referrals and more marketing momentum, thus lowering the cost of acquisition. Eventually, as firm scales, the costs per customer e.g.fixed costs diminish, costs of acquisition lower and so it becomes more profitable. However, as we can see with Netflix if new competition enters the market, they push up the cost of acquisition and thus counter the network effects.

Physical Value Chain

In most consumer markets there are normally three players: suppliers, distributors, and consumers/users.

Profits prior to the internet and digital went to integrators integrate. As an example, those that integrated supply and distribution or distribution and consumers

Print Industry: Writer and Editors produce the content which was then aggregated into a newspaper (the distribution vehicle for content). Because of the audience, they commanded they were able to sell space in a newspaper to advertisers.

Music Industry: Companies like Sony controlled the artists and the production of the records/DVDs.

Digital Disrupts The Value Chain

Winners in today’s digital economy succeed by providing seamless experiences where they offer value within a supply chain either through disintermediation or bundling or unbundling.

In other words, digital enables a firm to find a gap in the value chain and then fulfill it at a low cost.

Google and content

- Content now is digital and fluid. It can be easily indexed, categorized, combined and distributed.

- Google unbundles the newspaper industry allowing people to quickly find articles and content as they needed it – in the form of single pages. Advertisers thus shifted from newspapers to Google as well to new digital aggregators e.g. Huffington Post.

- Content creation shifted from journalists to bloggers and experts across various fields. The cost of production and distribution dropped as access to technologies to produce and distribute content became accessible to all, it became democratized.

The same is true of video production hence the rise of YouTube and other social networks like TicToc.

How does an Aggregator Business Model Work?

First of all, the aggregator firm creates a network of partnerships that supply the data to the aggregator. The aggregator and partner agree on terms (commission charges) and then set up systems e.g. data exchange.

Terms usually include

- Branding Terms.

- The standardized quality required by the aggregator.

- The Commission, or

- Take-Up rate.

- Other terms depending on the industry and the aggregator involved.

Often, the aggregator model works because all the main players operate on the platform and the aggregator then commands a significant value benefit to the customer.

How do aggregator Sites make money?

The revenue generation in an aggregator business model is similar to that of the marketplace business model. The partners of the company are the source of the revenue. The company generates revenue through commissions which are paid in one of two ways:

- The company makes a mark-up on the partner price. The partner fixes the price and the aggregator firm quotes the final price to the customers after adding their mark-up e.g. 20%.

- The company takes a commission rate per purchase from the partner. This is the same as an affiliate commission but usually has stricter terms and conditions because of the data.

Different types of aggregators

Digital goods can be replicated at zero cost, meaning they are often non-rival. The role of geographic distance changes as the cost of distribution for digital goods and information is approximately zero.

Let’s break this down a bit:

- The goods sold by an aggregator.

- Distribution costs

- Transactions

I’ll use a few different examples.

The overriding premise is that platform companies aggregate demand to disintermediate the distributors (which is now possible because of zero-cost distribution) and win on direct customer experience.

The value platforms offer goes without saying, the ease of use, speed and convenience overrides previous value offered through physically bounded firms.

1. Goods sold and marginal costs

The Cost of Goods Sold (COGS) refers to the direct costs of producing the goods sold by a company.

In the case of Netflix there are two types of Cost of Goods:

- Content purchase which is then amortized (debt in current liabilities and long-term).

- Production of Netflix originals.

If we take the first case for Netflix in 2019 they had $4.4 billion in current content liabilities and $3.3 billion in non-current content liabilities. The Cost of Revenue for streaming in 2019 was 62%.

Replication is near zero, production is not near zero and streaming through a platform can’t happen without infrastructure and therefore are not near zero. A digital product doesn’t distribute itself.

2. Distribution Costs

The internet is an easy way to distribute digital products. That’s true, but it isn’t free by a long shot. If you look a the cost of the infrastructure needed for Netflix to stream in over 160 Countries and the degree of localization needed there are significant costs. Technology and development cost $1.5 billion for Netflix in 2019. Even Uber has a figure of over $1 billion. The difference is the perspective. Operational costs = the platform – the technical staff and infrastructure – these are the cost of goods for a platform business – the platform.

3. Transaction Costs

Two types of costs are incurred with digital transactions. Usually, third-party commissions e.g. Stripe or PayPal. The second is fluctuations in exchange rates which often hit companies.

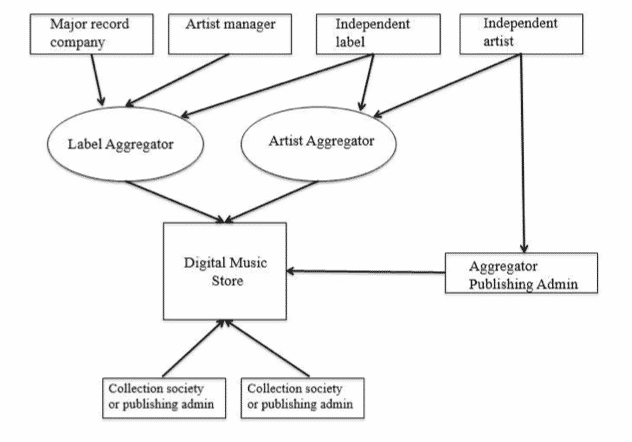

The emergence of music aggregators is a market response to the high level of transaction costs and bargaining asymmetry associated with selling digital music online.

The Types of Aggregators

The aggregators can be classified based on the value chain – customers, partners and costs.

- Single value chain offer or value chain integration.

- No or low COGS vs high COGS.

- Primary distribution or secondary.

What Are Some Examples of The Aggregator Business Model?

There are hundreds of aggregators, but here are some examples that illustrate how the aggregation model is playing out in different markets.

Digital music aggregation industry

Search Aggregators

Google is a search aggregator. Google indexes data across multiple industries and then use to present search, consumers, data that they are looking for. From hotel bookings to queries on weather to content…Google indexes the web and then monetizes this by giving opportunities for companies to be on page 1 in exchange for payment.

Travel Industry Aggregator Business Model

A travel aggregator is a website that searches for deals across multiple websites and shows you the results in one place. For example, if you wanted to find a cheap flight from New York City to London, you could sit down and check multiple airlines which would take ages. Alternatively, you could use a website like Skyscanner, which will check hundreds of airlines at once.

Taxi Aggregator Business Model

The Uber business model is an example of an aggregator business model within the taxi industry. Uber takes the services from the drivers and provides customers to them in exchange for a commission.

Uber has been the most influential taxi booking app. Uber provides personal as well as shared taxis. The company hires drivers who bring their own taxis. Uber does not have employees, it hires these drivers as service providers and provides them a platform where they could get more customers. Uber works on a commission basis. It charges up to 20-25% commission rate from the drivers and also earns revenue through promotional partnerships. There is also a price surge on holidays and during a certain period of the day.

How Blockchain will Be The Game Changer

Why do blockchains allow new startups to compete with the likes of Google and Facebook? Blockchains will change the aggregator business model to a distributed business model.

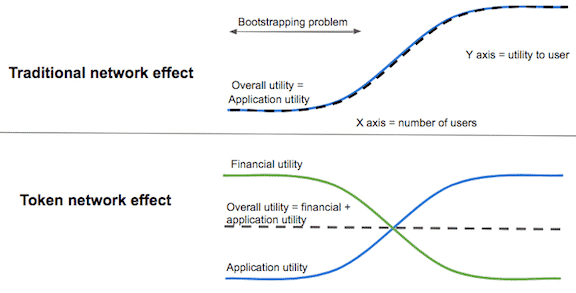

- Network Effects—Blockchains offer tokens (monetary incentive) which give early adopters greater upside the earlier they join the network.

- ML Data Advantage: Blockchains use a DLT (distributed ledger technology) architecture where data is shared and open, rather than a client-server architecture where data is closed and siloed.

Network Effects: Token-Based Incentivizes for Early Adopters

Before blockchains and the digital scarcity of tokens, it was difficult to attract early users to a new network. But now, a company can “pay” early adopters in a native token and those early adopters will be incentivized to increase the value of their tokens.