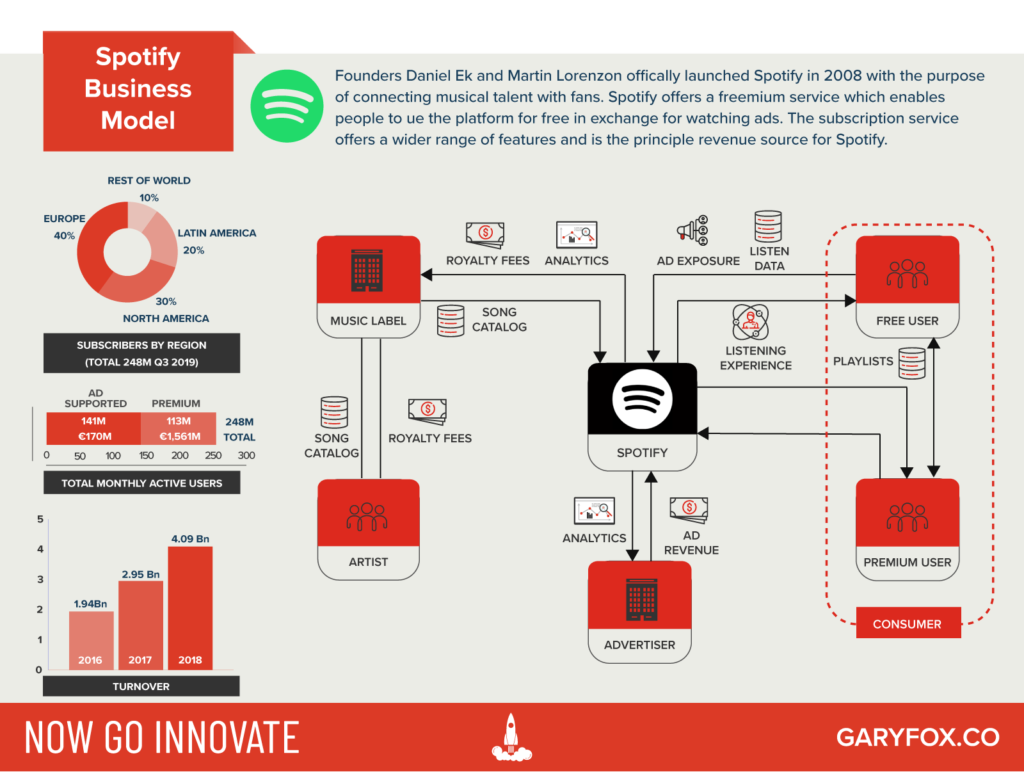

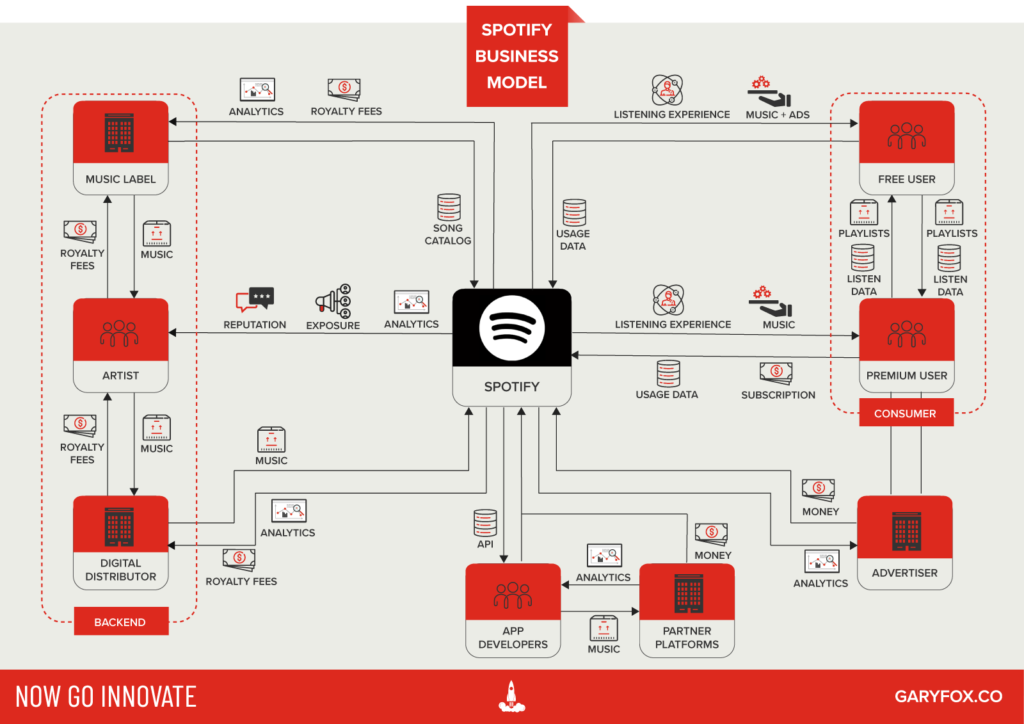

The Spotify business model is based on their digital platform which connects artists with fans to drive music discovery on a scale that has never before existed. Their goal is to enable 1 million artists to live off of their work.

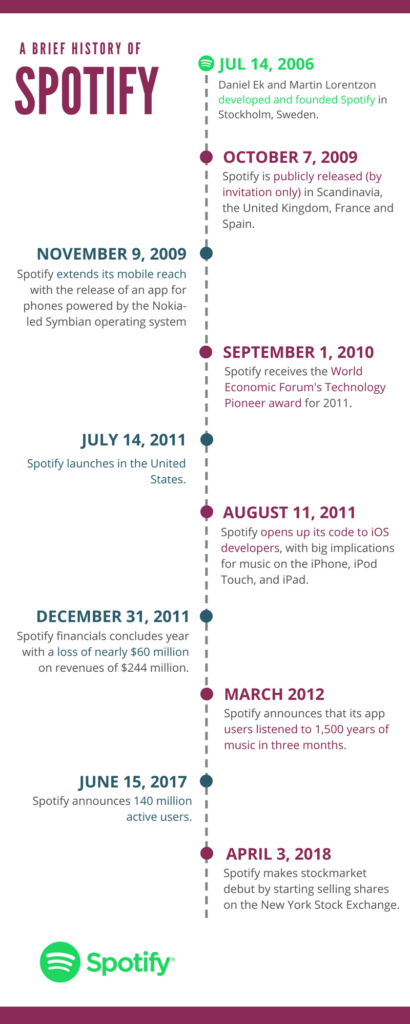

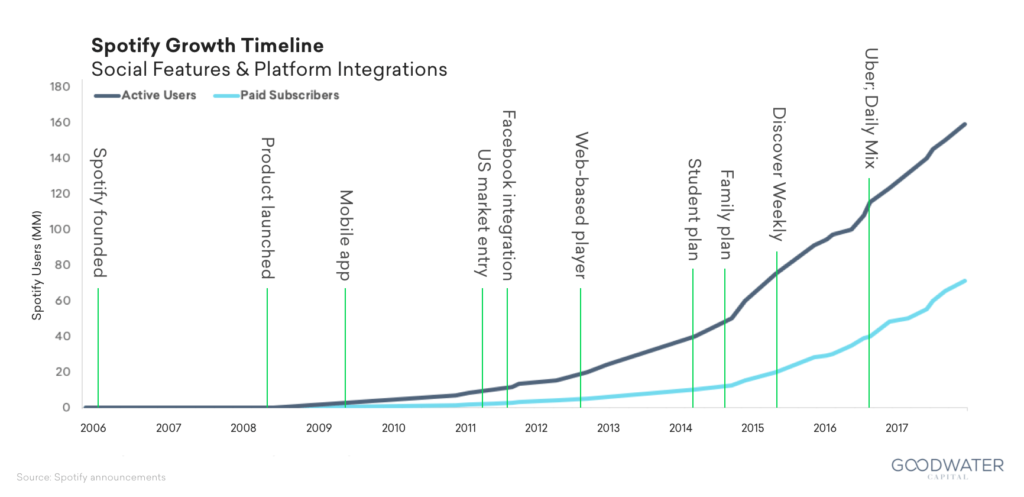

Officially launched in 2009, Spotify is by far the leading global music streaming platform. But if you take a look at Spotify’s acquisitions and recent developments you can see that it has ambitions beyond being a music streaming service.

| Company name: | Spotify |

| Founders: | Daniel Ek and Martin Lorentzon |

| Annual revenue: | 2019: $6.76 Billion |

| Profit | Net Income: | 2019: -$73 Million |

| Market Cap: | (May, 2020): $27.61 Billion |

| Year founded: | 2006 |

| Company CEO: | Daniel Ek |

| Headquarters: | Stockholm, Sweden |

| Link: | Spotify |

| Number of employees: | 4,405 |

| Type of business: | Public |

| Ticker symbol: | SPOT |

| Company Competitors: | Apple Music, Amazon Music, Deezer, Google Play, Pandora, Soundcloud, Tidal |

Table of Contents

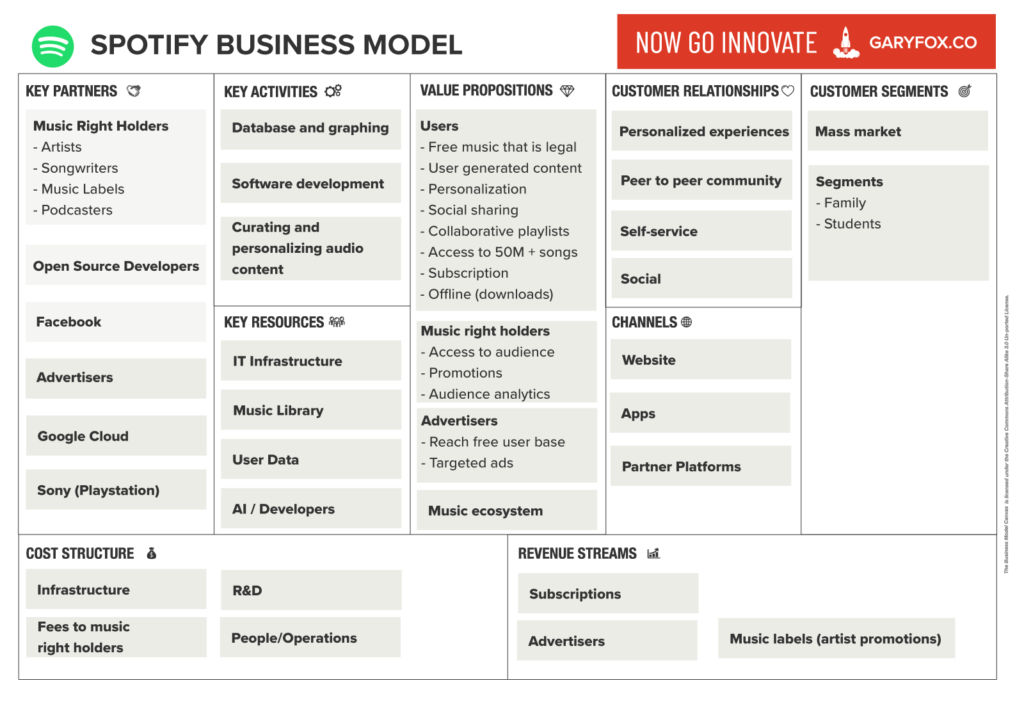

The Spotify Business Model Map

A Short History of Spotify

Spotify initially was on released in 2009 but rapidly grew and has become on the most popular music streaming platforms.

Spotify Mission Statement

Our mission is to unlock the potential of human creativity—by giving a million creative artists the opportunity to live off their art and billions of fans the opportunity to enjoy and be inspired by it.

Spotify

As a two-sided marketplace, the Spotify business model relies on the ability to have both sides of the platform matched. In this case music with music fans.

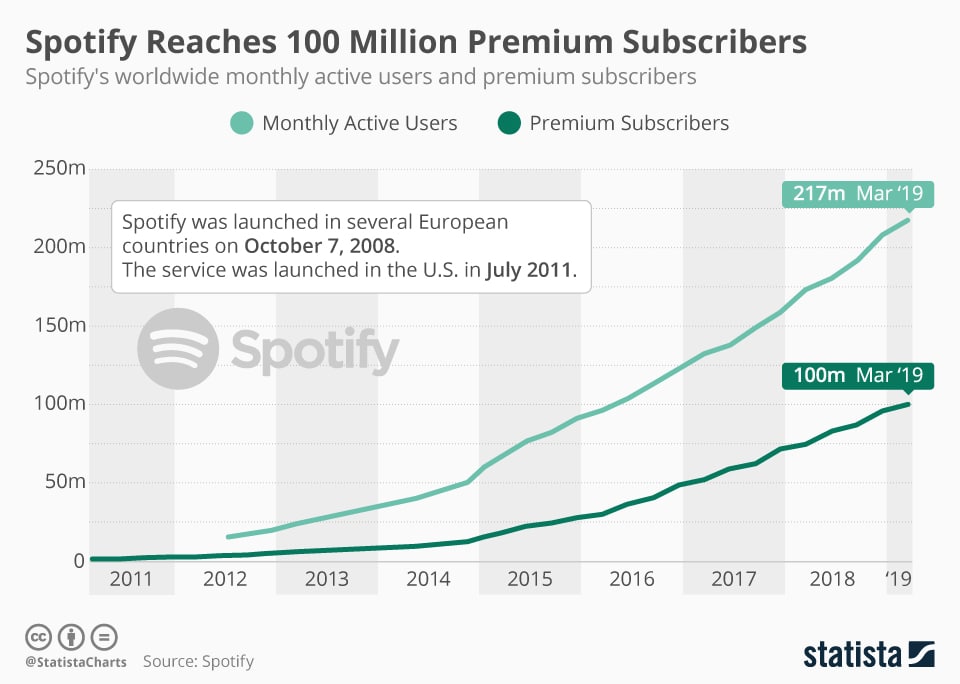

Spotify Key Metrics

Spotify uses a number of metrics, its key performance indicators, to track how customers engage with the content and how well Spotify retains them.

The following are the ones that indicate how well the platform is being adopted and used.

- MAUs (monthly active users)

- Number of premium subscribers

- Number of ad-supported users

- Premium churn

- Hours of content consumed

Spotify Acquisitions

Spotify’s push into podcasting is mostly driven by a need for diversification. Its adventures in the music business have been defined by rivalries with big music labels and an array of well-armed competitors like Pandora and Apple Music.

Daniel Ek, CEO made the following statement to encapsulate the Spotify rationale for their recent acquisitions.

To really understand [our motivation for spending on podcasts], take the current value of the video industry. Consumers spend roughly the same amount of time on video as they do on audio. Video is about a trillion dollar market. And the music and radio industry is worth around a hundred billion dollars. I always come back to the same question: Are our eyes really worth 10 times more than our ears? I firmly believe this is not the case.

Daneil Ek

The Spotify business model is evolving beyond its traditional boundaries and moving into directly compete with Apple in the podcast market.

Spotify Acquires podcasting companies

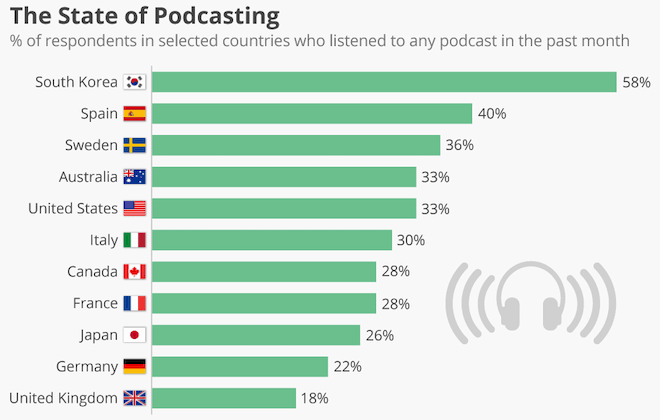

The Spotify business model is changing. Spotify estimates that in the future 20% of all listening will be non-music content. This neatly mirrors the huge growth in podcasting and an opportunity for both listener and ad revenue growth. Spotify aims to bring the Netflix experience to audio with new content offerings and potentially attract new subscribers who are essentially not music lovers.

The Growth of Podcasting

Podcasting Fast Facts

- It’s estimated that there are approx. 750,000 podcasts in existence. Source: Apple WWDC.

- 30 million episodes as of December 2019.

- 70% of people in the US are familiar with the concept of Podcasting. Source: Infinite Dial.

- 51% of people in the US have listened to a Podcast, at least once. Source: Infinite Dial.

- 50% of all US homes are podcast fans. Source: Nielsen, Aug 2017

- 16 million people in the US are “avid podcast fans” (Nielsen Q1 2018)

- 56% of podcast listeners are Male

- 45% of monthly podcast listeners have a household income of over $75K – vs 35% for the total population.

- A report from the Interactive Advertising Bureau (IAB) and PwC in June estimated that the podcasting industry generated $479.1 million in advertising revenue last year.

Spotify’s Parcast Acquisition

Spotify confirms paid $56 million for Parcast. Parcast has two production studios, through which it has created more than a dozen popular podcast shows.

- Max Cutler founded Parcast in 2016. Since then, the company has launched eighteen premium series.

- Parcast’s home base is Los Angeles, California, where the company has two studios and over twenty employees.

- You can count the highly popular Unsolved Murders, Cult, Serial Killers and Conspiracy podcasts among Parcast’s high-end, scripted crime and mystery shows.

- These genres are particularly appealing to women over seventy-five per cent of the Parcast audience is female.

- Parcast will continue to develop its unique stories. In fact, there are more than twenty new scripted shows focused on topics like crimes of passion, the justice system, and the world’s most resilient survivors slated to launch later this year.

Spotify’s Gimlet Media Acquisition

Gimlet Media was founded by Alex Blumberg and Matthew Lieber in 2014 . Gimlet Media is counted as one of the best content creators in the audio space with celebrated shows such as Homecoming and Reply All part of its stable.

Gimlet set out to build “the HBO of audio,” Matt Lieber co-founder told Variety in 2017. The company has established itself in the podcast market with its popular scripted and unscripted shows, including Homecoming, StartUp and Reply All.

The Gimlet acquisition by Spotify is estimated to be worth somewhere around $230 million.

Spotify’s Anchor T. Acquisition

Anchor is a leading company that is used for podcast creation, publishing, and monetization services. Anchor reimagined the path to audio creation, enabling creation for the next generation of podcasters worldwide.

Originally founded in 2015, Anchor initially started life as a social audio app. However, the social-audio concept didn’t go anywhere and the company eventually pivoted towards an end-to-end podcasting platform. The final version of the platform is an end to end solution for podcasters. Later it launched something called Anchor Sponsorships, an in-platform advertising marketplace for shows hosted on the platform.

Spotify Acquires SoundBetter

Perhaps the biggest signal as to how Spotify business model will change is in their acquisition of SoundBetter. SoundBetter is a music production marketplace that was founded in 201. It has more than 180,000 artists registered on its network in 14,000 cities spanning 176 countries.

SoundBetter makes it easy for labels and artists to source a wide array of music services. Spotify will combine SoundBetter into the Spotify for Artists group, which caters to more than 400,000 artists and their teams. According to Spotify, the SoundBetter acquisition will give artists a new avenue to connect with collaborators or generate additional income.

Spotify Business Model Canvas

Spotify Customer Segments

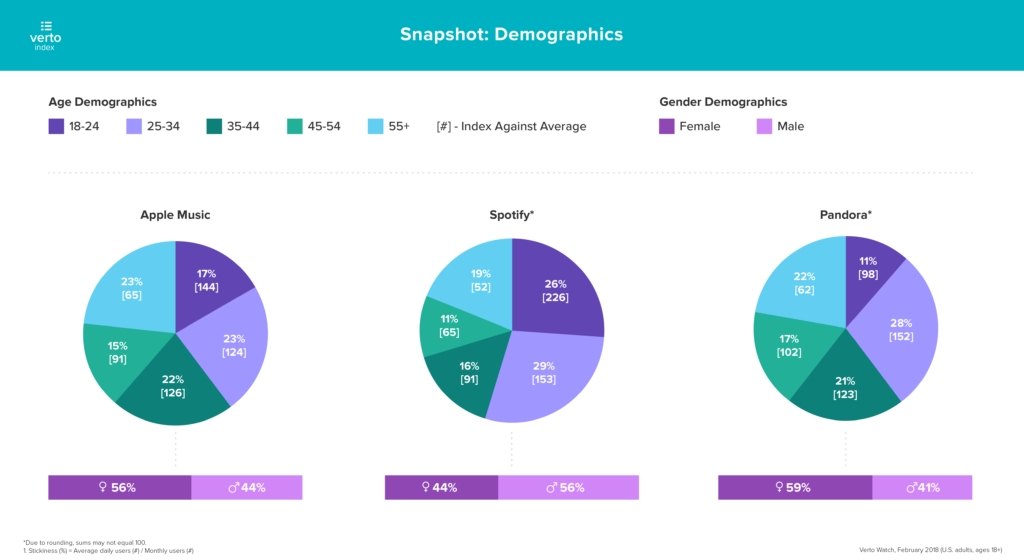

Although Spotify appeals to all ages, the largest number of users are millennials, with 29 per cent of its users aged 25 to 34 and 26 per cent aged between 18 and 24 years old.

As a strategy, Spotify has increasingly made it more accessible in terms of pricing by offering ‘packages’ to fit to different audience segments. They offer a family package and most notably a discount for students.

The strategy is that the early adoption of Spotify will then lead to ongoing use of the platform.

Spotify Value Proposition

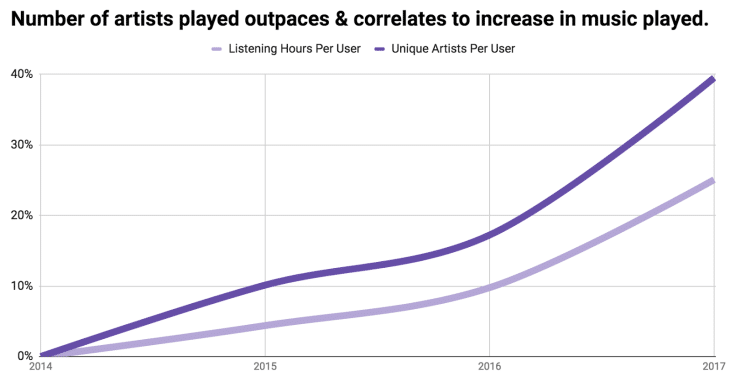

- Newness and discovery of music.

- Easy access to a massive catalogue of 50M plus songs.

- The convenience of streaming online music for a short set of time.

- For Premium users the ease of downloading songs and playing them offline.

- The ability for users to stream music for free, but having to listen to ads (similar business model to online radio).

- Social sharing of playlists and integration with Facebook to see what friends are playing.

Spotify Channels

Spotify Distribution Channels

Spotify distributes the music online via browsers, as well as apps, that work on Windows, MacOS, Linux computers, Playstation, Xbox and mobile devices- iOS, Windows, and Android smartphones.

Spotify Marketing Channels

Spotify uses a mix of platforms for customer acquisition including Snapchat, Facebook and more traditional advertising through TV, PR and even billboards.

Spotify Customer Relationships

- On-demand music and podcast streaming.

- Customized Spotify playlists.

- Social sharing and music discovery.

- HD sound quality of the music.

- Discovery of concerts and the ability to follow favourite musical talent.

- Download available music for offline playing.

- The Spotify community.

- The fanbase of the service makes the network.

- Self-service customer service.

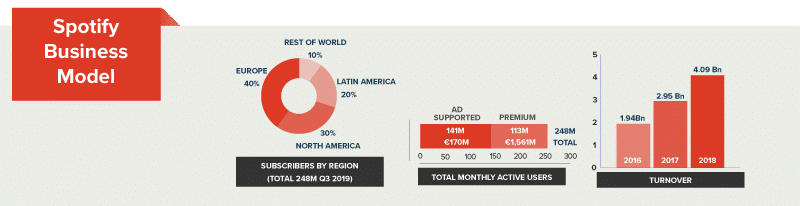

Spotify Revenue Streams

Spotify has also introduced a new revenue opportunity based on music labels promoting artists on their platform.

Spotify Key Resources

Spotify Business model relies on the key resources associated with a digital platform. It also has several resources in terms of

- Over 4600 employees.

- The new innovative updates on the platform and through its partnerships e.g. Starbucks.

- The huge music catalogue – over 50M songs.

- The growing podcast catalogue – through acquisitions.

- The million monthly active users.

- The customized content it gives its users.

Spotify Key Activities

- Maintaining the site.

- Developing the app on various platforms.

- The roadmap for the product.

- Managing the huge library they have.

- Marketing their product and what it offers.

- Expanding their user base.

- Negotiating for new contracts.

- Content acquisitions.

Spotify Key Partnerships

- Record labels

- Rightsholders

- Independent artists

- Third-party integrations

- Digital Infrastructure – Google Cloud.

Examples of Spotify Partnerships

Spotify Cost Structure

The company pays roughly 70 per cent of its revenue for royalties to artists and companies that hold the rights to the music. Spotify pays artists and labels per streamed track, with the Spotify artists page explaining that there is an average “per stream” payout to rights holders of between $0.006 and $0.0084.

- Offices (Locations in Major Regions/Countries)

- Salaries (Staff and Executive Team)

- Licensing fees

- Copyrights

- IT operations

- Research and Development e.g. AI

- Legal

Summary of Spotify Business Model

Spotify business model relies on growth through new users. The future growth potential will come from new business model innovations and it looks like that already poses a threat to record labels.

Spotify is now signing direct licensing deals with some artists and testing the ability to allow others to upload directly to its platform. YouTube and Apple Music are creating content and putting marketing budget behind artists. And Apple Music has also acquired Platoon, the British startup which helped a number of emerging artists to develop, including Billie Eilish.