In this post, you will learn about the Uber business model. I’ll cover how Uber works, how Uber makes money, Uber’s strategy and how they harness their platform technology to expand into new markets.

Table of Contents

What Is Uber?

Uber is an on-demand ride service that connects passengers with drivers of cars through an app. The Uber platform connects drivers with people that are looking for a ride.

Anyone with a driver’s license, a new car and that has no traffic tickets can become an Uber driver. People simply hail an ‘Uber’ via an app on their phone. Uber finds a driver, ‘hails them’ and takes care of the whole process including payment.

The whole system works on simplicity, convenience and ease of use for both parties – driver and passenger. However, underlying this simplicity is a sophisticated set of technologies. I’ll take you through the technologies, the Uber business model and their strategy.

SECTIONS

First, let’s take a look at how what made Uber successful, its ride-hailing service.

How Does Uber Work?

Uber works as a car-for-hire service, in other words, people use their personal vehicles to offer rides through the Uber service to people who are looking for transport.

First of all, Uber is not a taxi service. Uber drivers cannot simply pick up riders off the street. Uber works as a car-for-hire service, in other words, people use their personal vehicles to offer rides through the Uber service.

Uber benefits from smartphone technology. Both the person who wants and Uber and the driver use the app. Both use the smartphones technologies and this is critical to their business model.

The app (the Uber platform), takes care of everything, from the initial ride-hailing through to the payment process. When a person needs a ride, they use the app to tell Uber their pickup location.

The Uber app hooks into smartphone technologies such as geo-location and integrations with payment gateways to process payments (in other words it’s cashless). The system, called “RideCheck,” also uses the GPS, accelerometer, gyroscope, and other sensors on the driver’s smartphone to check for irregular activity, like an unexpected long stop, or a car crash.

The Uber business model relies on ease of use for the value proposition. But, there is much more under the hood of their platform that makes Uber so much more interesting.

Before moving onto the business model let’s take a look at some of the big numbers and key facts about Uber.

Quick Facts On Uber

Since Uber’s conception, it has grown to be a major force in the transportation industry and has now started to harness the power of its platform to disrupt other markets. Let’s examine Uber’s core business model to understand how it’s able to move easily into other markets.

What Is Uber’s Business Model?

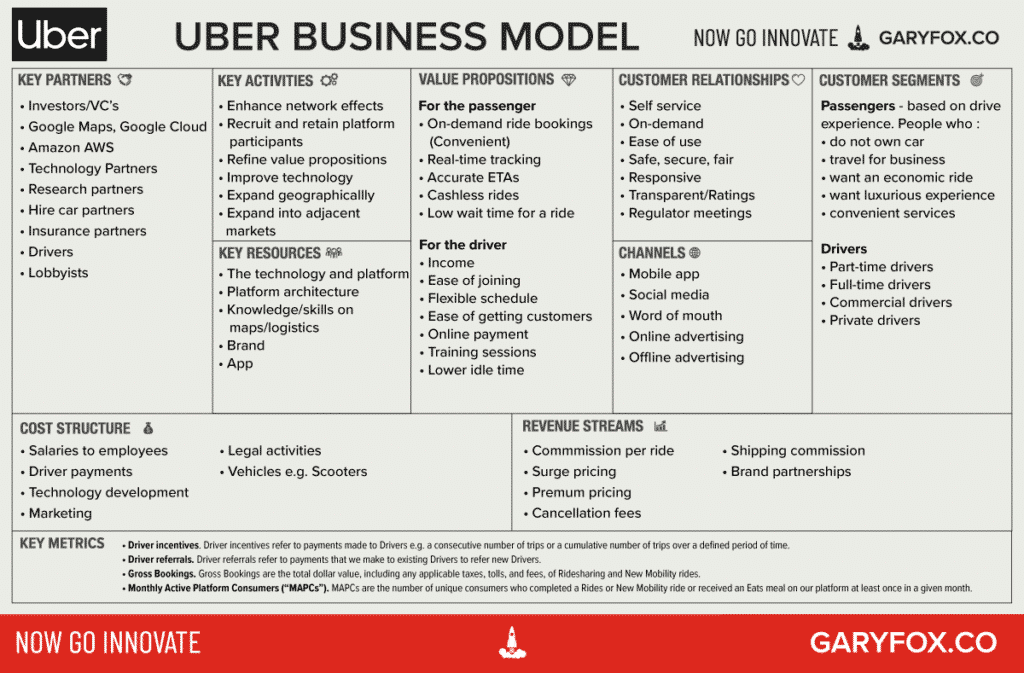

The Uber Business Model is a two-sided platform that connects drivers with customers looking for a ride using their mobile app. The app makes it easy for drivers to find the person who wants the ride.

The Uber Business Model

The Uber Business Model is built upon its digital platform. Like other platform business models e.g. Airbnb, Apple App Store or Amazon they rely on creating demand on both sides of the platform – the supply-side and the buy-side.

There are four main types of platform models:

- Collaboration

- Orchestration

- Creation

- Matching

The Uber platform provides a matching service. As an example, it helps complete match driver with someone wanting a ride. Or in the case of Uber eats, a three-sided market, it matches someone who wants to order food with a restaurant and a delivery method.

What underpins the Uber business model is the technology they employ to identify where people are using Google maps API (on the app) and match this to a driver who is nearby. Additionally, they have a dynamic pricing system that adjusts pricing according to demand in an area.

What is Uber’s Value Proposition

Uber’s value proposition is based on convenience for the rider, and for the drivers and easy way to make money at times that are convenient to them.

One of the most important outcomes of developing a business model is the value proposition. In other words, how you create, deliver and capture value.

The Uber business model for Uber rides offers the following value propositions:

- On-demand cab bookings (Convenient)

- Real-time tracking

- Accurate ETAs

- Cashless rides

- Low wait time for a ride

- Upfront pricing

- Multiple ride options

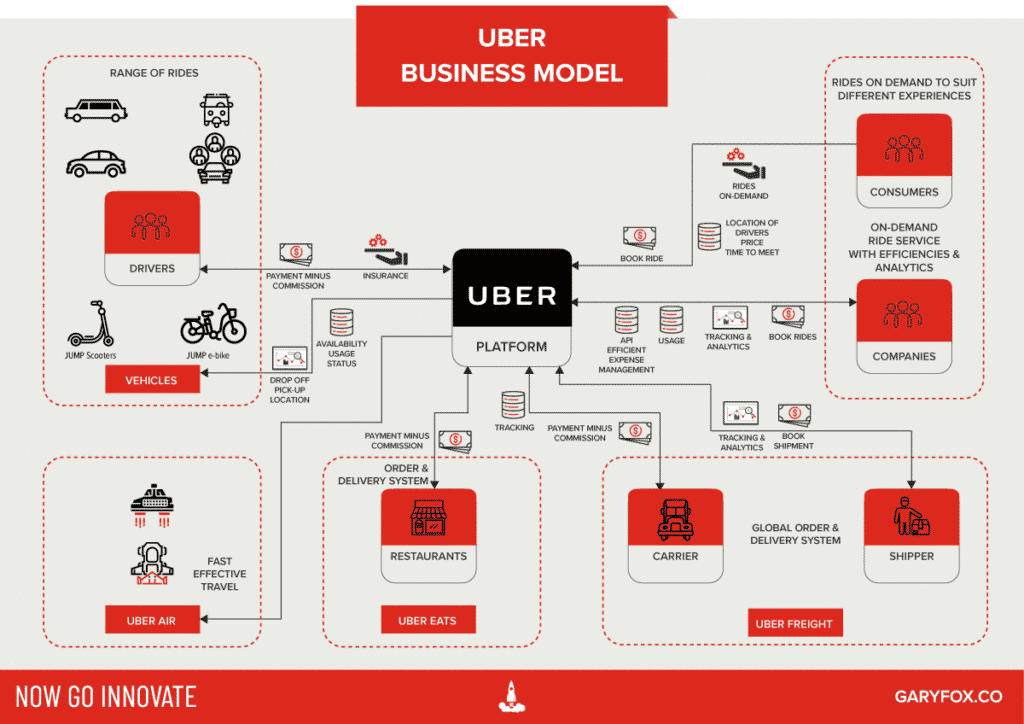

The Uber Business Model Map

Uber BusinessModel Anlaysis

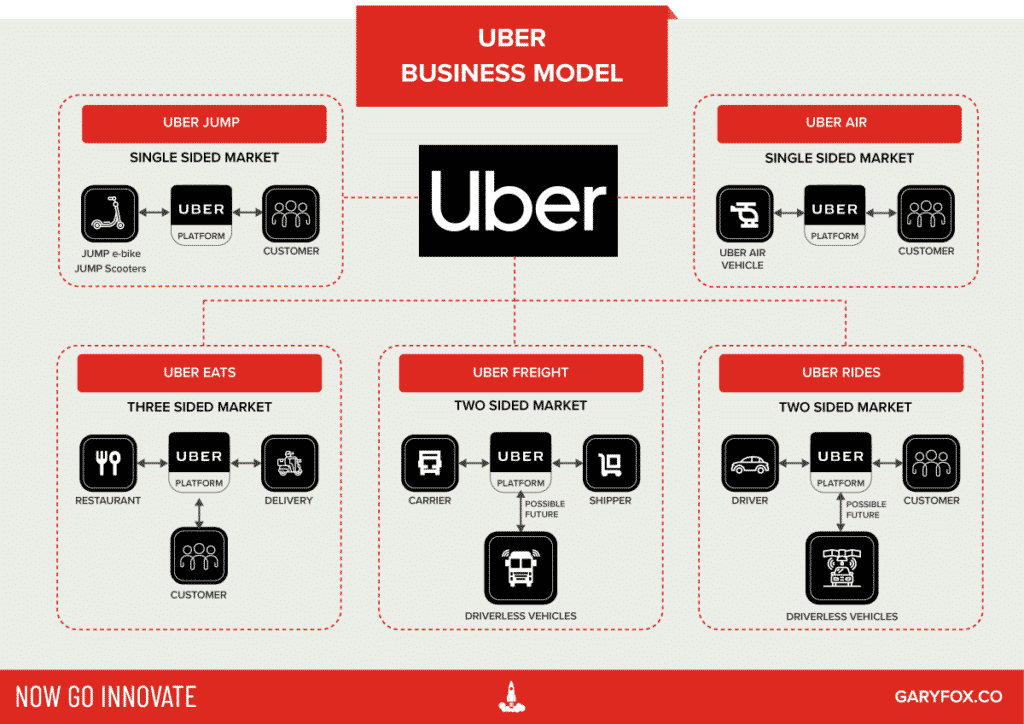

Although most people associate Uber with rides, they have since expanded into other transportation and are expected to enter into the driverless vehicle market.

The core of their capabilities is the ability to match and track objects – a vehicle for most cases. But more recently shipments.

uber business model analysis

The Uber Business Model is shifting as they harness the power of the platform, AI and new driverless technologies towards a future where hailing a ride might not involve a driver (a human) at all. Uber business model and the platform:

- Single-sided market – Uber is the supplier to the market.

- Two-sided market – matching suppliers to buyers.

- Three-sided market – matching suppliers, buyers and deliverers.

Uber technologies

Uber mentions the term artificial intelligence six times in its IPO filing, highlights machine learning 11 times and the word algorithm 16 times. Those mentions aren’t by accident. Uber makes it clear that its data science and algorithms are critical to its marketplace technologies.

Uber has built its own proprietary marketing, routing and payment technologies. The bridge between Uber’s various ventures is its marketplace technologies.

Uber’s technologies comprise the real-time algorithmic decision engine that matches supply and demand for our Personal Mobility, Uber Eats, and Uber Freight offerings.

- A demand prediction engine to predict volume, supply and demand and location dynamics with current and historical trends. Data visualizations are available for zones with unique pricing characteristics.

- Matching and dispatching algorithms that review and consider variables such as distance, time, traffic, weather and even meal preparation times for Uber Eats.

- Pricing tools that set real-time prices at the local level based on demand.

The Uber business model relies on Uber continually investing in their new technologies and harnessing new AI to reshape the future of transportation.

Ubers Key Metrics

The Uber business model is based on some core metrics which guide how well it is performing. First of all, per customer averaged over a month indicates loyalty plus the number of services a customer uses.

Driver incentives. Driver incentives refer to payments made to Drivers e.g. a consecutive number of trips or a cumulative number of trips over a defined period of time.

Driver referrals. Driver referrals refer to payments that we make to existing Drivers to refer new Drivers.

Excess Driver incentives. Excess Driver incentives refer to cumulative payments, including incentives.

Gross Bookings. Gross Bookings are the total dollar value, including any applicable taxes, tolls, and fees, of Ridesharing and New Mobility rides.

Monthly Active Platform Consumers (“MAPCs”). MAPCs are the number of unique consumers who completed a Rides or New Mobility ride or received an Eats meal on their platform at least once in a given month.

Uber Acquisitions

The Uber business model has transformed Uber’s capabilities and presented further opportunities for expansion. Moreover, with the focus on AI it points to smarter segmentation of customers based on use and other data.

| Company | Description | Purchase Value | Date |

|---|---|---|---|

| Cornershop | Online grocery delivery in Chile and Mexico, and more recently in Peru and Toronto | Undisclosed | 2020 |

| Careem | Careem is the internet platform for the greater Middle East region. A pioneer of the region’s ride-hailing economy, Careem is expanding services across its platform to include mass transportation, delivery and payments to become the region’s everyday super app. | $3.1Bn | 2019 |

| Swipe Labs | Swipe Labs built a social app that was a competitor to Snapchat. They have been doubts about the benefits of this acquisition. | Undisclosed | 2017 |

| Geometric Intelligence | Geometric Intelligence, a startup co-founded by academic researchers with AI experience, and its team provide the core for Uber’s central AI lab at Uber’s SF HQ. | Undisclosed | 2016 |

| Otto | The company focused on retrofitting semi-trucks with radars, cameras and laser sensors to make them capable of driving themselves. However, since the acquisition Uber has focused on autonomous cars. | $680M | 2016 |

| deCarta | DeCarta was a company that provided a range of location and map services, including in-map search, location APIs, turn-by-turn navigation and more. | Undisclosed | 2015 |

The Uber business model is changing and adapting and these acquisitions point the direction for how Uber will expand and address problems that its technology can solve in different markets.

Uber Business Strategy

What’s Uber business strategy

The ride-hailing market has become more competitive as others have entered the market, received funding and taken on Uber head to head. The largest of these is Lyft.

Any company that has invested heavily in its resources and built unique capabilities needs to exploit them whilst maintaining a focus on its core market. The long-term play is in autonomous vehicles but it is many years before they will be a day to day reality.

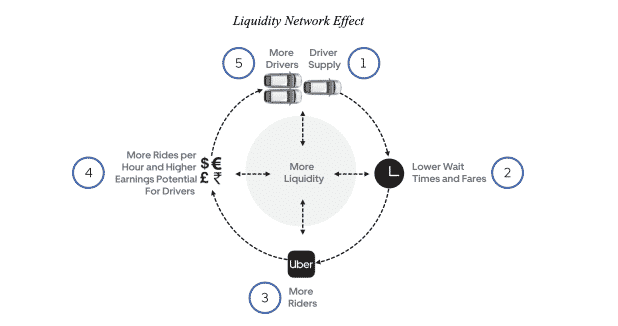

The core focus is to use an existing core base of users who want convenience and a variety of ride experiences and scaling the network effect which results in more liquidity. As I have mentioned before in my talks, it is the customer experience that will underpin how they achieve this.

In many developing countries that do not have a strong logistics infrastructure, there is a need to connect suppliers with customers. As an example, most retailers are still supplied from a host of different suppliers rather than a wholesaler. The Uber business model provides new opportunities for trade and efficiencies.

We can see from Uber’s acquisitions that they have identified opportunities to improve the transparency and access between supplier and buyers.

The Uber business model is rapidly evolving as they expand into new geographies and new markets.

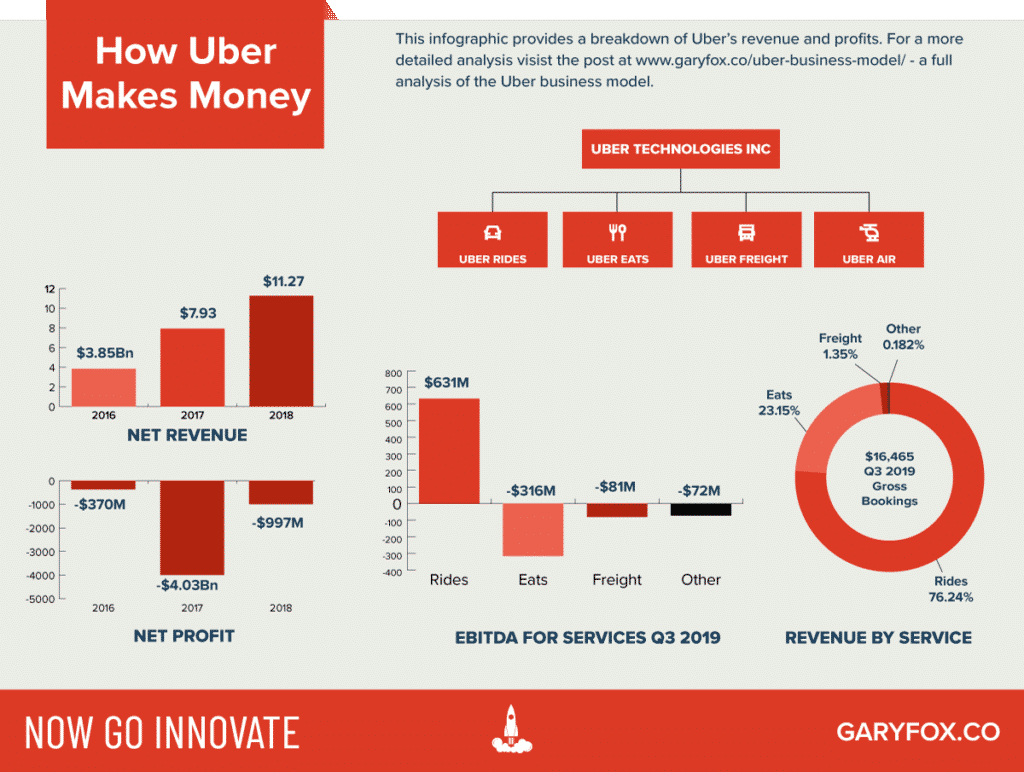

How does Uber make money

Uber History

Uber’s story began in Paris in 2008. Two friends, Travis Kalanick and Garrett Camp, were attending the LeWeb, an annual tech conference the Economist describes as “where revolutionaries gather to plot the future”.

In 2007, both men had sold startups they co-founded for large sums. Kalanick sold Red Swoosh to Akamai Technologies for $19 million while Camp sold StumbleUpon to eBay (EBAY) for $75 million.

Rumor has it that the concept for Uber was born one winter night during the conference when the pair was unable to get a cab. Initially, the idea was for a timeshare limo service that could be ordered via an app. After the conference, the entrepreneurs went their separate ways, but when Camp returned to San Francisco, he continued to be fixated on the idea and bought the domain name UberCab.com.

Ryan Graves, who was Uber’s General Manager and an important figure in the early stages of the company, became CEO of Uber in August 2010. In December 2010, Kalanick took over again as CEO, while Graves assumed the role of COO and board member.

The Cease-and-Desist Order

In October 2010, the company received a cease-and-desist order from the San Francisco Municipal Transportation Agency. One of the main issues cited was the use of the word “cab” in UberCab’s name. The startup promptly responded by changing the name UberCab to Uber and bought the Uber.com domain name from Universal Music Group.

Uber Timeline

Uber has taken an interesting path in its 10 years in business. Here’s a brief timeline underscoring its biggest and most noteworthy moments.

March, 2009. Kalanick and Camp, along with college buddies Oscar Salazar and Conrad Whelan, create the “black car” ride service model that would ultimately become UberCab.

June, 2010. UberCab is launched in San Francisco, and the ride service immediately connects with the city’s tech-heavy, and car-ownership averse, urban professionals.

October, 2010. UberCab is renamed Uber, and the company snares $1.25 million in capital funding to expand. Former Napster co-founder Shawn Fanning is an early investor. Two months later, CEO Graves steps down and is replaced by Kalanick.

May, 2011. Uber rolls out in New York City, and is met with heavy resistance from the city’s massive taxicab industry. Six months later, Uber launches in Paris.

December, 2013. Uber drivers join up to file a lawsuit against Uber, looking to be designated as employees, and not contract workers. It’s the first of multiple showdowns between drivers and Uber.

August, 2014. Uber introduces UberPool, a ride-sharing model that enables riders to “pool” their rides and split the fare between multiple parties.

April, 2015. UberEats is launched in Los Angeles, Chicago and New York, giving consumers the Uber experience with food delivery. The service immediately catches on with young millennials too busy on the job to cook dinners – giving Uber another profit line in the process.

February, 2017. Uber is hit with its first of several charges of sexual harassment in the workplace. A blog post from a former company engineer lights the fuse with charges of a sexist workplace culture at Uber. Management responds to the resulting outcry by hiring former U.S. Attorney General Eric Holder to investigate the matter, and to look into the company’s workplace culture. Five months later, Kalanick resigns as CEO after strong pressure from the company’s board of directors. He is replaced by Dara Khosrowshahi, the former CEO at Expedia.

May, 2019. Uber goes public on the New York Stock Exchange, with an initial share price of $45, and a market capitalization of $75.5 billion.

Who has funded Uber

In the 10 years since its inception, Uber has found support among some of the world’s biggest backers, with outsized pockets to match. Its largest shareholder is SoftBank (SB Cayman 2), which invested $9.3 billion of its Vision Fund in the company last year.

| Stockholders | Shares (in thousands) |

|---|---|

| SB Cayman 2 Ltd. | 222,228 |

| Entities affiliated with Benchmark Capital Partners | 150,079 |

| Entities affiliated with Expa-1, LLC | 81,575 |

| The Public Investment Fund | 72,841 |

| Entities affiliated with Alphabet Inc. | 71,097 |

Other shareholders include Google’s Alphabet and Garrett Camp’s startup studio Expa-1. Saudi Arabia’s Public Investment Fund, the country’s sovereign wealth fund, has also invested in Uber, sending $3.5 billion by wire transfer—then the largest payment ever sent in one lump sum—in June 2016. It remains the largest investment made by a foreign government in a venture-backed startup.

MORE Resources

Uber Business Model

Uber Business Model

If you have any comments on the Uber business model please leave them below or jump onto the chat.