The Microsoft business model has created one of the most powerful companies in the world.

In this article, I’ll discover how the Microsoft business model has changed and evolved and what the future of this tech giant looks like.

Did you know Microsoft is worth over $33.7 billion billion dollars! (September 2024)

However, Microsoft went through some remarkable changes and has regained its position as a leading technology company.

We’ll explore how the Microsoft business model fundamentally changed as we go through the article.

Table of Contents

What is Microsoft?

Microsoft is one of the world’s largest technology companies, known for its wide range of products and services that cater to both consumers and businesses. Founded in 1975, Microsoft has grown into a diversified organisation offering everything from software and hardware to cloud services and AI solutions.

Core Value Propositions

These products and services show Microsoft’s vast reach across software, cloud computing, hardware, and enterprise solutions, all aimed at enhancing productivity, connectivity, and innovation across a global customer base.

- Operating Systems:

- Microsoft is best known for its Windows operating system, which powers the majority of personal computers worldwide. Windows 11 is the latest version, aimed at both individual users and enterprises.

- Office Productivity:

- Microsoft 365 (formerly Office 365) includes widely used applications like Word, Excel, PowerPoint, and Outlook, delivered as a subscription service. It is central to Microsoft’s offering for personal productivity and enterprise collaboration.

- Cloud Services:

- Azure is Microsoft’s cloud computing platform, offering a range of services including storage, networking, and AI tools. It competes directly with platforms like AWS and Google Cloud, catering to both developers and enterprises seeking cloud-based solutions.

- Enterprise Solutions:

- Dynamics 365 is a suite of enterprise resource planning (ERP) and customer relationship management (CRM) applications, designed to help businesses manage operations, sales, and customer service.

- Developer Tools:

- GitHub, a platform for software development and version control, is widely used by developers globally. Microsoft also provides Visual Studio, a comprehensive development environment for building applications.

- Hardware:

- Microsoft manufactures hardware products like the Surface range of laptops and tablets, which are popular among professionals for their design and performance.

- It also develops Xbox, a leading gaming console with a vast ecosystem of games and online services through Xbox Game Pass.

- Artificial Intelligence and AI Integration:

- Microsoft is increasingly focusing on AI-powered solutions, with Azure AI offering tools for machine learning, natural language processing, and advanced analytics. It also integrates AI into core products like Microsoft 365, enhancing productivity tools with intelligent features.

- Search and Advertising:

- Through Bing, Microsoft operates a search engine, and its Microsoft Advertising platform allows businesses to advertise online, mainly through search-related ads.

Microsoft: The First Few Years To Success

In 1975, a youthful 20-year-old Bill Gates and his friend Paul Allen formed Microsoft, the company that we all know today.

Back in those early days, computing was in its infancy and the internet was just a small and largely unknown network mostly used by academic institutions (very limited).

Bill Gates and Paul Allen spotted an opportunity to produce basic operation system (interpreter to be exact) for the Altair 8800.

By the early 1980’s MS-DOS, a simple operating system became the go-to operating system for computers. But it was Windows that was the breakthrough, a visual interface that quickly captured the market.

In 1986, Microsoft was launched on the stock market creating billionaires and multiple millionaires.

After that, Microsoft had the money and resources to build its empire and consolidate its position as the main operating system used in PC’s.

However, other entrepreneurs like Steve Jobs also spotted the opportunities associated with personal computing. He stepped into the market, created Apple Mac’s and the Apple business model we all know today.

A Timeline of Microsoft’s History

- 1975: Microsoft is founded by Bill Gates and Paul Allen to develop and sell BASIC interpreters for the Altair 8800.

- 1980: Microsoft partners with IBM to provide the operating system for IBM’s personal computers, which leads to the development of MS-DOS.

- 1985: Microsoft releases the first version of Windows, an operating system with a graphical user interface (GUI), marking the beginning of its dominance in desktop computing.

- 1986: Microsoft goes public, with an initial public offering (IPO) that values the company at $61 million.

- 1990: Microsoft launches Microsoft Office, a suite of productivity applications including Word, Excel, and PowerPoint, establishing itself in business and productivity software.

- 1995: Windows 95 is released, a major milestone that popularised the start menu and taskbar, becoming one of the most successful operating systems.

- 2001: Microsoft enters the gaming market with the launch of the Xbox, its first video game console, which later becomes a key business unit.

- 2008: Azure, Microsoft’s cloud platform, is announced, eventually transforming the company into a leader in cloud services.

- 2011: Microsoft acquires Skype for $8.5 billion, integrating voice and video communication into its suite of products.

- 2014: Satya Nadella becomes CEO, leading Microsoft’s pivot to cloud computing and AI, a shift that dramatically increases the company’s market valuation.

- 2016: Microsoft acquires LinkedIn for $26 billion, expanding its reach into professional networking and enterprise solutions.

- 2018: GitHub, the world’s largest repository of open-source code, is acquired for $7.5 billion, strengthening Microsoft’s presence in developer tools.

- 2020: Microsoft Teams, part of Microsoft 365, experiences massive growth, becoming one of the leading platforms for remote work and collaboration during the global COVID-19 pandemic.

- 2021: Windows 11 is launched, with a focus on productivity, security, and integration with Microsoft’s cloud services.

- 2023: Microsoft completes its acquisition of Activision Blizzard for $68.7 billion, a major move to expand its gaming division and compete in the growing cloud gaming sector.

- 2024: Microsoft’s market capitalization surpasses $3.2 trillion, cementing its position as one of the world’s most valuable companies.

Who owns Microsoft?

Bill Gate still owns shares in the company, but he has sold or given away the majority of his shres over the years since the company was floated.

Microsoft’s 2023 Annual Report indicates that as of July 24, 2023, there were 83,883 registered holders of record of its common stock. The company boasts 7.43 billion outstanding shares, according to Nasdaq.

Institutional investors predominantly hold Microsoft’s shares, representing 69.14% of the outstanding stock as recorded by Nasdaq on February 9.

If you want to find more interesting facts and to explore the key milestones in Microsofts histroy take a look at their storyline at Microsoft.

I worked with Microsoft on the launch of the Xbox and developing their retail presence. During that time I learned a lot about Microsoft’s business strategy, long-term focus and the great culture that has propelled Microsoft successfully through its different stages.

The Microsoft Business Model

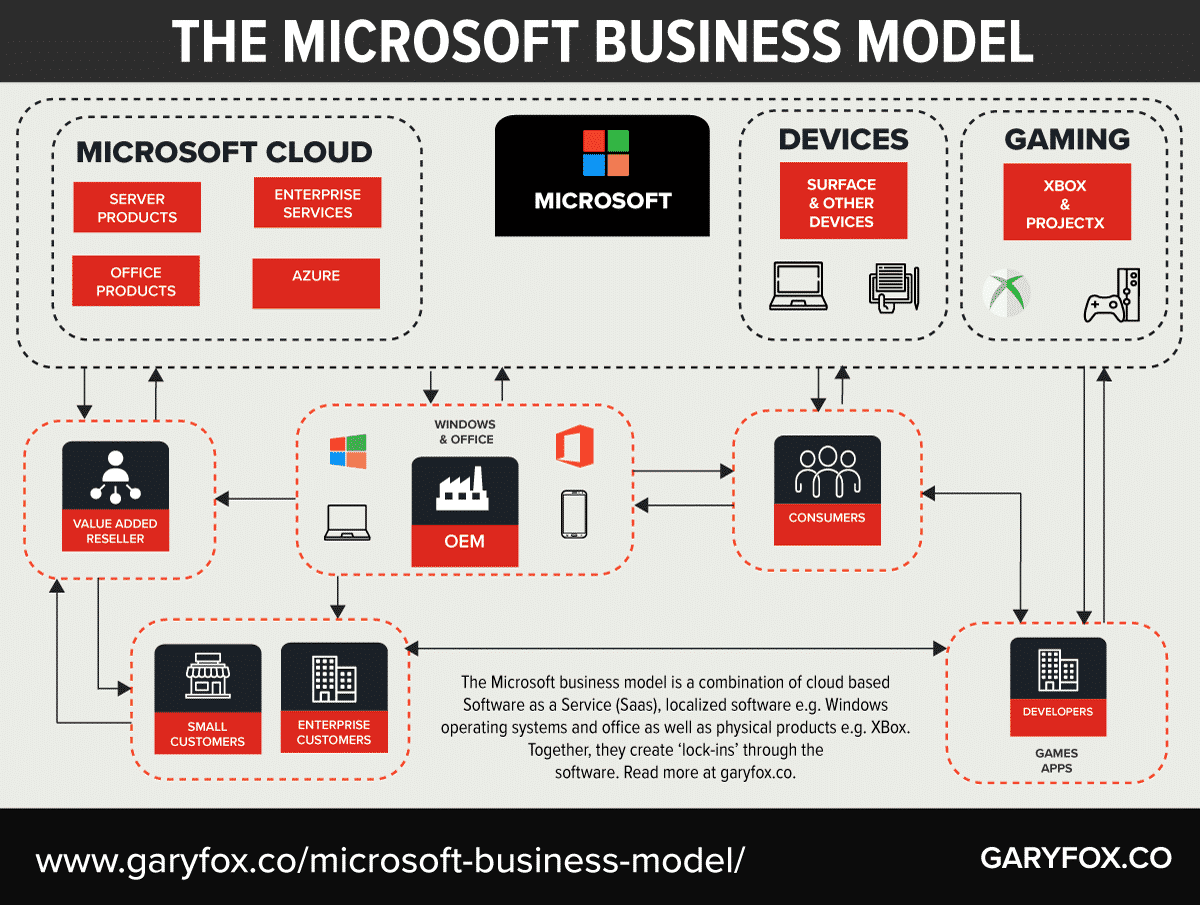

The core business involves the sale, distribution and support of software solutions. Although Microsoft sells hardware this is a relatively small part of the business.

The Microsoft Business Model Patterns

- Solution Provider: Microsoft provides a full range of solutions for a business to operate e.g. ERP, CRM as well as development platforms for bespoke and customized requirements.

- Razor and Blade: apps and other software won’t work unless specifically developed for the different operating systems. Another example is the Xbox games only working on the Xbox.

- Lock-in: Customers get lock-in to using Microsoft software because of large switching costs.

- Freemium: Linkedin is free to use as a business social network. However, to get the full value from the platform e.g. Linkedin Learning you need to be a premium member.

- Subscription model: Linkedin premium membership is a subscription model. Moreover, Office 365 and most of the cloud services provided by Microsoft are in fact, subscription models.

- Hidden Revenue Model: Bing is the search engine that you can use from Microsoft. While it is free advertisers are using the platform to push ads to you based on the keywords you use. A further example is Linkedin, although there is a free version of Linkedin, both free and premium users are shown Ads in their newsfeed. These ads are a significant source of revenue for Linkedin.

- Layer Player: Microsoft provides the core operating system as well as applications that then work with it such as Microsoft Office. Although Microsoft does sell some hardware, e.g. Surface laptops, it is a limited range compared to its software.

- Ingredient Branding: Microsoft branding is built into the use of laptops and PC’s. Although an ingredient, e.g. you buy the PC, Microsoft has already ensured that its brand is prominently shown.

The Evolution Of The Microsoft business model

Operating systems like Mac OS and Windows are unique and apps that work with one operating system will not work the other. That creates a form of lock-in effect making it hard for customers to switch.

This form of lock-in works for developers and customers. Both have to invest time and effort into getting used to the operating system and understand how it works.

A developer does this so he can make money from selling apps that work with Microsoft operating systems. Users need to be able to get work done and use it in their day-to-day life.

Switching costs are a form of competitive advantage because they create barriers to change for customers – in other words, people do not want to invest time to learn something new.

However, the Apple business model lowered the switching costs by making its operating systems easy to use through attention to design.

Despite heavy competition, Microsoft has evolved beyond operating systems and has made some critical changes over its time, not to mention a staggering amount of strategic acquisitions.

Next, I’ll break down how the Microsoft business model and reveal some of the underlying business model principles used.

What is Microsoft’s business strategy?

Our Future Opportunity

We are focused on helping customers use the breadth and depth of the Microsoft Cloud to get the most value out of their digital spend while leading the new AI wave across our solution areas. We continue to develop complete, intelligent solutions for our customers that empower people to be productive and collaborate, while safeguarding businesses and simplifying IT management. Our goal is to lead the industry in several distinct areas of technology over the long term, which we expect will translate to sustained growth. We are investing significant resources in:

- Transforming the workplace to deliver new modern, modular business applications, drive deeper insights, and improve how people communicate, collaborate, learn, work, and interact with one another.

- Building and running cloud-based services in ways that utilize ubiquitous computing to unleash new experiences and opportunities for businesses and individuals.

- Applying AI and ambient intelligence to drive insights, revolutionize many types of work, and provide substantive productivity gains using natural methods of communication.

- Tackling security from all angles with our integrated, end-to-end solutions spanning security, compliance, identity, and management, across all clouds and platforms.

- Inventing new gaming experiences that bring people together around their shared love for games on any devices and pushing the boundaries of innovation with console and PC gaming.

- Using Windows to fuel our cloud business, grow our share of the PC market, and drive increased engagement with our services like Microsoft 365 Consumer, Microsoft Teams, Microsoft Edge, Bing, Xbox Game Pass, and more.

Our future growth depends on our ability to transcend current product category definitions, business models, and sales motions.

Source: Microsoft 2023 Annual Report

The Ambitions That Drive Microsoft

To achieve our vision, our research and development efforts focus on three interconnected ambitions:

- Reinvent productivity and business processes.

- Build the intelligent cloud and intelligent edge platform.

- Create more personal computing.

Microsoft produces software solutions for businesses and consumers.

Microsoft’s strategy is heavily focused on integrating platforms and apps and using Artificial Intelligence to drive the next evolution of computing, productivity and business innovation.

The AI capabilities are also echoed in ‘Create more personal computing‘. AI will drive new ways to personalize experiences in real-time as the interface with customers becomes more liquid enabling personalized content and customer journeys.

From distributing software on CD’s, customers now simply download the software or in the case of many enterprise software use it as a SaaS platform.

Customers have moved from buying the software as a single cost transaction to now now ‘renting’ the software through subscription business model.

This shift in the revenue model has resulted in a significant jump in profits (see below) as Microsoft now shifting towards a global platform business.

The Move To Cloud Services

What Is Azure?

Azure is a cloud computing platform that provides Infrastructure as a Service (IaaS), Platform as a Service (PaaS), and Software as a Service (SaaS). Azure offers services such as computing, storage, networking, and Artificial Intelligence (AI).

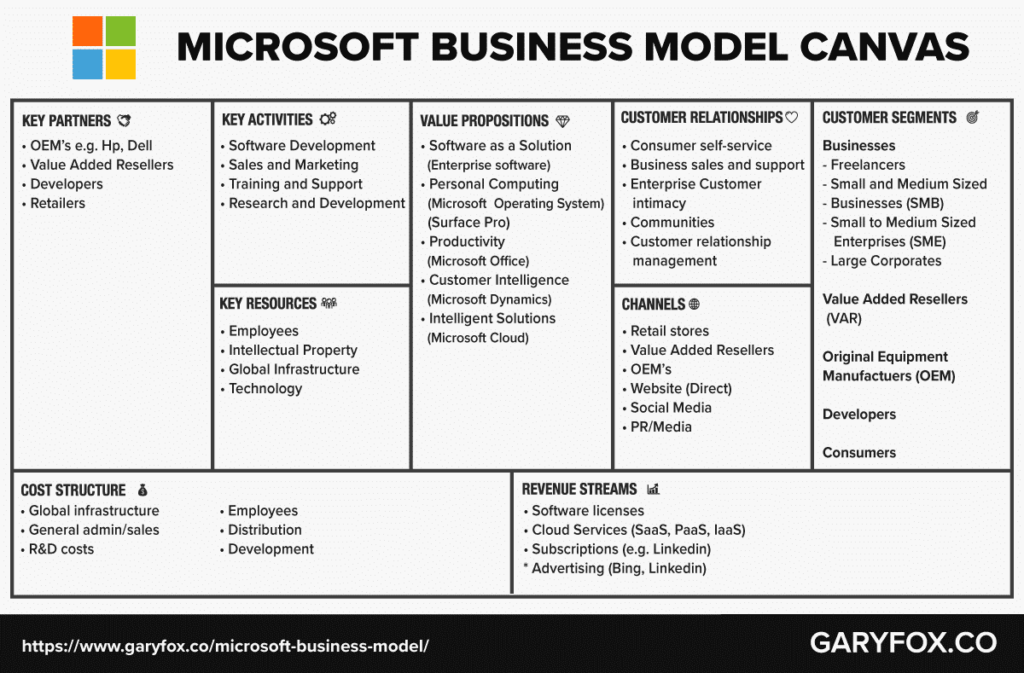

The Microsoft Business Model Canvas

You could produce a business model canvas for each of the market offers. To make it simple I’ve just focused on the core business.

What are Microsoft Customer Segments?

The core customer segments of the Microsoft Business Model are:

- Businesses: Microsoft caters to many different types and sizes of companies, but it is the SME and large corporate market where a large number of its solutions are focused. Smaller businesses are managed through Value Added Resellers, who themselves are a key segment.

- Corporates: These are the companies that have account managers and support teams.

- SMB’s and SME’s: Small to medium-sized businesses will usually deal with VAR’s for support and services.

- Value-Added Resellers: VAR’s distribute and support SMB’s and SME’s in the use of Microsoft products. Many VAR’s have teams of highly trained IT professionals who advise and work with companies. Microsoft supports VAR’s with training and accreditation schemes to ensure that they are able to keep up to date with the latest software releases and technical know-how.

- Original Equipment Manufacturers: OEM’s produce the hardware and install Microsoft Windows and Microsoft Office on the PC/Laptop. Hp, Samsung and Dell are examples of some of the larger OEM clients.

- Developers: Microsoft Azure is a platform that provides developers with the capabilities to design and develop applications. Other developers produce apps for operating systems such as Microsoft Windows phones and Xbox games. The increasing focus on developers is one of the reasons that Microsoft purchased GitHub.

- Consumers: Home users of PC’s, laptops and cloud services such as Microsoft 365 and Microsoft Office and Xbox gaming.

The Bing Advertising Business Model

Bing is a web search engine owned and operated by Microsoft. The service has originally was Microsoft’s search engine MSN Search. Bing is the third largest search engine globally, with a query volume of 4.58%.

The Bing business model is based on the hidden revenue model. Users can search on Bing for free while advertisers can use Bing to promote products or services.

The Linkedin Business Model

LinkedIn is the number one social network for business professionals with more than 645 million members and growing.

The platform has three main propositions:

- Talent Solutions

- Marketing Solutions

- Premium Subscriptions

Talent Solutions is comprised of two elements: Hiring, and Learning and Development. Hiring is a service for recruiters to help them attract, recruit, and hire talent. Learning and Development provide subscriptions to enterprises and individuals to access online learning content (Linkedin Learning).

Marketing Solutions enables companies to advertise to Linkedin’s user base.

Premium Subscriptions enables professionals to manage their professional identity, grow their network, and connect with talent through additional services like premium search. Premium Subscriptions also includes Sales Solutions, which helps sales professionals find, qualify, and create sales opportunities and accelerate social selling capabilities.

How Microsoft Makes Money?

Microsoft employs several different revenue models in its operations. In this section, I’ll show you where the Microsoft business model makes money and how it generates profits.

Microsoft Financial Performance

| Metric | 2022 | 2023 | Year-on-Year Growth (%) |

|---|---|---|---|

| Revenue | $198 billion | $211 billion | +7% |

| Operating Income | $83 billion | $88 billion | +6% |

This table highlights Microsoft’s steady growth in both revenue and operating income from 2022 to 2023, driven by its continued focus on cloud services, AI, and strategic acquisitions.

This table shows Microsoft’s Revenue and Operating Income performance by category for 2022 and 2023, along with year-on-year percentage change:

| Category | 2022 ($ millions) | 2023 ($ millions) | Year-on-Year Change (%) |

|---|---|---|---|

| Revenue | |||

| Productivity and Business Processes | 63,364 | 69,274 | +9% |

| Intelligent Cloud | 74,965 | 87,907 | +17% |

| More Personal Computing | 59,941 | 54,734 | -9% |

| Total Revenue | 198,270 | 211,915 | +7% |

| Operating Income | |||

| Productivity and Business Processes | 29,690 | 34,189 | +15% |

| Intelligent Cloud | 33,203 | 37,884 | +14% |

| More Personal Computing | 20,490 | 16,450 | -20% |

| Total Operating Income | 83,383 | 88,523 | +6% |

This table highlights Microsoft’s growth in key areas such as Intelligent Cloud and Productivity and Business Processes, while noting a decline in More Personal Computing.

Microsoft’s More Personal Computing division, which includes Windows and Xbox, has seen a decline in performance in recent years.

In 2023, Xbox hardware sales fell by 30% due to weaker console demand and a lack of new blockbuster first-party games, contributing to an overall decline in gaming revenue by 4%. Despite some growth in services like Game Pass, which increased by 3%, the hardware segment continues to struggle. The decrease in first-party content and lower third-party engagement also negatively impacted the Xbox platform (Microsoft); TechSpot).

Similarly, the Windows segment saw a sharp 10% decline in sales in early 2023. This drop is attributed to a contraction in the global PC market, which shrank by 30% year-on-year due to lower demand post-pandemic and global economic conditions. Microsoft’s device sales, including Surface laptops, also contributed to the weakened performance in the personal computing segment. Sources: (Observer; TechBlogUp).

The decline in both Xbox and Windows sales reflects broader market trends of saturation in console gaming and a cooling PC market, while Microsoft pivots its growth strategy more towards cloud services and AI.

How is Microsoft growing?

Key growth areas in FY 2023 as reported by Microsoft:

Financial Performance Summary

- Productivity and Business Processes: This segment saw a revenue increase of 10%, driven by a 13% growth in Office 365 Commercial products and cloud services.

- Intelligent Cloud: Revenue in this segment grew by 19%, highlighted by a substantial 29% increase in Azure and other cloud services.

- More Personal Computing: Revenue in this sector increased by 8%. Specific areas such as Windows and Surface saw a decrease, with Windows OEM revenue down by 25% and Devices revenue down by 24%. However, the decrease was offset by gains in other areas.

Key Financial Figures

- Annual Revenue: Microsoft reported an annual revenue of $211.915 billion for 2023, representing a 7% increase from the previous year.

- Net Income: The net income 2023 was approximately $72.361 billion, showing a slight decrease of 1% from the previous year.

- Market Highlights: Key drivers for growth included significant contributions from cloud services and a strategic focus on integrating artificial intelligence into their offerings.

How much money does Bing make?

In the fiscal year 2023, Microsoft reported approximately $12.2 billion in revenue from search and news advertising, including Bing’s revenue. This figure represents a 5.26% increase over the previous year’s revenue in this category .

How much money does LinkedIn make?

In 2023, LinkedIn, owned by Microsoft, generated approximately $16 billion in revenue. This represents a 10% increase from the previous year, driven by growth across all major lines of LinkedIn’s business, including Marketing Solutions, Talent Solutions, and Premium Subscriptions.

How much revenue does Microsoft make a year?

Microsoft business model relies heavily on the core revenues from operating systems, servers products and Microsoft Office.

In 2023, Microsoft reported an annual revenue of approximately $211.915 billion. This represents a 7% increase from the previous year, highlighting the company’s continued growth across its various business segments, particularly in cloud services and productivity applications.

How Profitable Is Microsoft?

Microsoft’s profitability can be assessed by looking at its net income and the performance across its main business segments. In the fiscal year 2023, Microsoft reported a net income of approximately $72.361 billion, which indicates a slight decrease of 1% from the previous year.

Breakdown by Product/Service

- Productivity and Business Processes

- Revenue: $18.291 billion for the quarter ending June 30, 2023 (an annual increase of 10%)

- Key Contributors: Office 365 Commercial products and cloud services growth of 13%.

- Intelligent Cloud

- Revenue: $23.993 billion for the quarter ending June 30, 2023 (an annual increase of 19%)

- Key Contributors: Azure and other cloud services, with a growth of 29%.

- More Personal Computing

- Revenue: $13.905 billion for the quarter ending June 30, 2023 (an annual decrease of 4%)

- Key Areas: Despite the decrease, there are significant areas of activity, such as Xbox content and services and Windows Commercial products. However, Windows OEM and Devices saw a substantial decline.

Overview of Profitability

- Microsoft Cloud: This area, which includes Azure, is a significant driver of profitability, with robust growth reflecting the increasing reliance on cloud infrastructure and services.

- Office Products: Both consumer and commercial sectors of Office products continue to show strong performance, contributing positively to Microsoft’s overall profitability.

- Windows OEM and Devices: These sectors faced challenges, affecting their profitability due to a decrease in revenue.

Microsoft Acquisitions In the Last 10 Years

To understand more about the future of strategy of Microsoft and its plans, it is worth looking at its recent acquisitions.

- 2014 – Mojang:

- Microsoft acquires Mojang, the developer behind Minecraft, for $2.5 billion. This move strengthens its presence in gaming and expands its portfolio to include one of the most popular video games globally.

- 2016 – LinkedIn:

- Microsoft acquires LinkedIn, the professional networking platform, for $26.2 billion. This acquisition enhances Microsoft’s footprint in the enterprise space, integrating LinkedIn with its cloud and Office products.

- 2018 – GitHub:

- Microsoft buys GitHub for $7.5 billion, reinforcing its focus on developers and the open-source community. GitHub becomes integral to Microsoft’s developer ecosystem, along with Azure’s cloud services.

- 2018 – Flipgrid:

- Microsoft acquires Flipgrid, a video-based social learning platform used widely in education, to strengthen its offerings in the education sector and integrate it with Microsoft 365 tools like Teams.

- 2018 – Bonsai:

- Acquisition of Bonsai, an AI startup focused on machine learning for automation, signals Microsoft’s investment in AI and machine learning to enhance its Azure AI services.

- 2019 – PromoteIQ:

- Microsoft acquires PromoteIQ, a marketing technology company, to bolster its Microsoft Advertising business and expand its digital marketing offerings.

- 2020 – Metaswitch Networks:

- Acquisition of Metaswitch Networks, a telecommunications software company, helps Microsoft enhance Azure for Operators, offering more services to telecom operators.

- 2020 – ZeniMax Media:

- Microsoft buys ZeniMax Media, the parent company of Bethesda (developer of popular games like Fallout and The Elder Scrolls), for $7.5 billion, expanding its Xbox Game Studios and gaming IP portfolio.

- 2021 – Nuance Communications:

- Microsoft acquires Nuance Communications, an AI and speech recognition company, for $19.7 billion, significantly boosting its healthcare sector offerings, particularly in AI-driven solutions like speech-to-text for medical professionals.

- 2022 – Xandr:

- Microsoft acquires Xandr, an advertising company from AT&T, to enhance its digital advertising capabilities, particularly in targeted and programmatic ads integrated with its existing services.

- 2023 – Activision Blizzard:

- Microsoft completes its acquisition of Activision Blizzard for $68.7 billion, the largest acquisition in Microsoft’s history. This move expands its gaming division and strengthens its position in the rapidly growing cloud gaming sector.

Strategic Summary of Microsoft’s Acquisitions

These acquisitions indicate a few clear, long-term strategies for Microsoft:

- Cloud and AI Leadership:

- The acquisitions of GitHub, Nuance, and Bonsai reflect Microsoft’s heavy focus on expanding its AI capabilities and reinforcing its leadership in cloud computing through Azure. Microsoft aims to be the platform of choice for both developers and enterprises, leveraging AI across industries, from healthcare to telecommunications.

- Enterprise Dominance:

- LinkedIn and Nuance play significant roles in Microsoft’s push to become indispensable to business users. The integration of LinkedIn with its Office 365 and Dynamics 365 suites boosts its enterprise offerings, providing tools for professionals, business networking, and customer relationship management.

- Gaming Expansion:

- Microsoft’s acquisitions of Mojang, ZeniMax, and Activision Blizzard highlight its ambition to dominate the gaming market. These moves not only bolster the Xbox ecosystem but also strategically position Microsoft as a leader in cloud gaming, where it can leverage Azure’s infrastructure to deliver gaming services globally.

- Digital Advertising and Marketing:

- The acquisitions of PromoteIQ and Xandr show Microsoft’s intent to build its advertising business, particularly within its ecosystem of services such as LinkedIn, Bing, and Xbox. This indicates a broader move to challenge established advertising players like Google.

- Education and Collaboration:

- The acquisition of Flipgrid aligns with Microsoft’s long-term strategy to dominate the education and collaboration space, especially through Microsoft Teams and Office 365. By incorporating tools that cater to students and educators, Microsoft ensures future growth in these sectors.

5 Powerful Takeaways To Learn

Key Takeouts from Microsofts Strategy

- Strategic Clarity and Leadership Direction: Microsoft’s focus on cloud computing and AI, driven by strong leadership, has redefined its priorities and enabled dominance in key technology areas like Azure and AI-driven applications.

- Building an Integrated Ecosystem: Microsoft’s success lies in creating a deeply interconnected ecosystem, where Azure, Windows, and Xbox work seamlessly together. Azure powers Xbox Cloud Gaming, allowing cross-platform functionality between Windows PCs and Xbox consoles, enhancing user dependency on the Microsoft platform.

- Developer Engagement and Open Collaboration: Through acquisitions like GitHub and investments in developer tools, Microsoft fosters collaboration and innovation. The open ecosystem encourages developers to build on Azure, expanding Microsoft’s reach.

- Strategic Acquisitions to Drive Future Growth: Acquisitions such as LinkedIn, Nuance, and Activision Blizzard are focused on expanding into high-growth markets like cloud gaming and AI, providing long-term growth opportunities.

- Synergistic Innovation Across Business Units: Microsoft’s ability to combine cloud, AI, and gaming capabilities, such as integrating Azure with Xbox for cloud gaming, creates synergies across its ecosystem. This drives innovation and value across all sectors.

5 Points You Can Learn from Microsoft’s Strategy

- Invest in an Integrated Ecosystem: Microsoft’s success stems from its ability to create a cohesive ecosystem where products like Azure, Windows, and Xbox work together. Businesses can benefit by building interconnected product or service ecosystems that lock in users and create value across multiple touchpoints, ensuring long-term customer engagement.

- Leverage Synergies Across Units: By using advancements in one area, like AI in Azure, to improve gaming or enterprise tools, Microsoft maximizes the impact of its innovation. Businesses can apply this by identifying ways to cross-leverage resources, skills, or technologies across different units, which increases efficiency and amplifies overall impact.

- Targeted Acquisitions for Future Growth: Microsoft’s acquisitions of LinkedIn, Nuance, and Activision Blizzard show a focus on future growth markets. For businesses, acquiring or partnering with companies that fill gaps or add strategic value can position them better for long-term success in emerging areas.

- Open Innovation and Developer Engagement: Through platforms like GitHub, Microsoft fosters innovation and builds external partnerships. Businesses can benefit from adopting open innovation practices, collaborating with external partners to expand their capabilities and co-create value.

- Adapt to Market Shifts with Clear Leadership: Microsoft’s pivot to cloud and AI under Nadella’s leadership shows the importance of strategic clarity and the willingness to adapt to market changes. Businesses should remain agile, constantly reassessing their strategies and aligning them with emerging trends to stay competitive.