Early stage startup tools vary enormously and depend on the market and type of product/service. Most startups evolve and grow in their use of data. For some that could be in as little time as a few months, while for others that might be spread over a few years as the business gains maturity. Either way, the tools tend to change, different platforms serve different purposes.

Typically there are three different phases of customer analytics:

- The Quick and Easy Phase: Early on, startups might not have enough customer data to make decisions based on analytics. There may or may not be someone actively looking at the data analytics platform, and because implementing analytics often competes with other core activities – like producing a product or seeing to customer support – analytics are often set and forgot. For this phase, analytics platforms need to be really quick to implement.

- The What’s Really Happening phase: Once the startup has got traction with customers and has established a sales funnel, investing in analytics (and/or an analytics team) makes a lot of sense. Analytics can help better define and understand the business model. Because the business challenges are clearer at this point, it becomes easier to find the right analytics tool for the job. During this phase, it’s often more important for the data to point in the right direction than to be entirely accurate.

- The Customer Finance phase: Because of pressures from investors or the need to scale customer acquisition with reliable data points, deeper analytics tools come into play. Startups need to invest in robust backend analytics and/or their own data warehouse. The analytics platforms may remain the same, but often business intelligence platforms like Tableau, Domo and Looker are introduced.

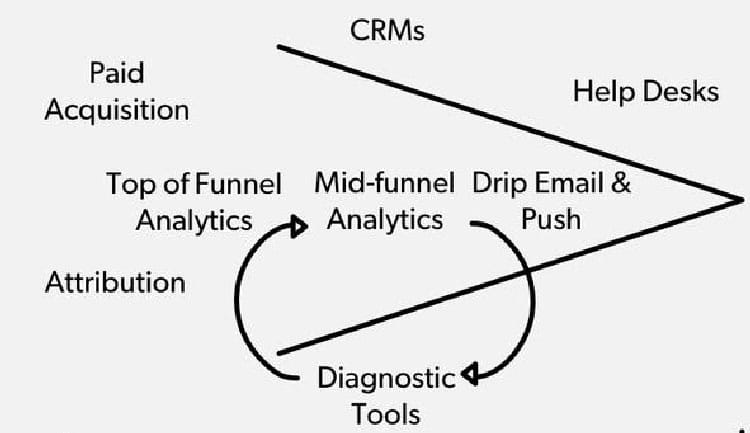

A Funnel View of Early Stage Startup Tools

When you think about customer data most people jump straight to their analytics tools. But there are many different and valuable tools that help provide insights into your customers. Examples are advertising tools, help desks, CRM, chatbots, attribution and a dozen other tools that generate customer data and measure interactions.

First of all, you want to diagnose where you have a problem. You need to separate out the hard data from the soft data. Of course, you want the analytics, the behavioural data to improve the customer’s journey. However, you also want the why question answered – sometimes it’s obvious and other times you need to get the qualitative data.

Use quantitative tools to discover symptoms or opportunities and qualitative tools to diagnose them.

Knowing when a user has viewed a page, purchased a product or invited a friend. It’s defining and refining who a user — or customer — is by the many actions they take.

Compile a checklist of tool categories.

Basic top of the funnel analytics: Google Analytics.

Mid- to deep-funnel analytics: Mixpanel or Amplitude are especially good event tracking tools.

Business-wide analytics: Looker, Mode and Periscope for SQL business intelligence.

Diagnosis tools: Olark, Livechat and Intercom. For the video recording segment of diagnosis tools, Fullstory and Inspectlet are the best choices. They provide the ability to watch what customers are doing, maybe even while talking to them on a live chat tool.

Drip email: Customer.io and Autopilot. Infusionsoft works well for e-mail management and funnels.

Sales and support tools: Zendesk and Salesforce.

Paid acquisition: Facebook and Twitter.

Attribution: Convertro (web) and Kochava or Hasoffers (mobile).

Set out Clearly What You Want To Achieve

When you are looking for early stage startup tools for your business, be aware that while research is good, there’s no replacement for just trying a tool out. Most platforms are freemium or provide monthly payment plans.

It is often difficult to assess whether a tool is a good fit before using it. However, most people rely on research because it’s time-consuming to fully integrate and run data through a system to assess its value.

After you set up your website tracking once, you can just flip switches to pipe it through several tools. People who are responsible for vendor selection want to show that they are running a thorough process internally.

The most simple and impactful way to choose a tool is simply to write down your objectives. What do you need from a tool, what other tools need to integrate with it, what data sets do you need to align and how easy is it to use.

When selecting an early stage startup tool you need to move quickly and experiment. It may seem obvious, but I’m shocked by how many companies take too long in selecting and testing a tool

If you want to have a complete picture of your customers – write down what that means in terms of data. Then consider what that might look like at various stages of going through your marketing funnel. map out your data your points.

When testing a tool gauge the level of support that you get when you ask questions or need help with any integrations. Don’t forget that the first set of support experiences can say a lot about how the long-term support you will or won’t get.

The tool’s support team should be there early to ensure your trial is successful. With tools, there can be pain points when switching platforms. If they aren’t attentive to your needs at this stage it won’t bode well for the future.

Understand the Cost and Cost Benefits of Early Stage Startup Tools

The price you pay is only the top-line price. A tool should provide a clear business benefit such as time saved.

A good way to analyse a tool is to evaluate the dollar value of your time. Tools then not only save you money on hourly cost but also accelerate your work. Say you are assessing your time at $50 per hour and buying MailChimp at $100 per month will save you building an e-mail distribution tool. That’s clearly worth it.

Most early stage startup tools are a pay monthly set up. As companies get bigger you can move to annual contracts, but at that point, it’s not a big deal, usually because the revenues and profits are established.

One frequent problem I come across though is that when companies after six months of sending to a tool, it can very difficult to untangle yourself because you’ve installed tracking code all over the place. One way to prevent this, or at least make it easier, is to make sure that you are separating data collection from the tools that receive the data.

Switching cost is a variable to factor into the total expense of a tool. Most early stage startup tools fall into eight or so different categories. For example, your data must graduate from different analytics tools as your startup grows. As you grow you will start to expand the use of these categories.

Early Stage Startup Tools – Quantitative and Qualitative Data

For early stage companies, capturing customer feedback and perspectives is essential. Your primary goal at the early stages is to iterate on the product itself or product positioning. You have to develop the product-market fit and demonstrate this with sales. The most important thing you can do is customer development. You might not have the volume for statistical significance at this point, so the focus has to be on qualitative analysis. you need to observe, talk to, survey and generally double down on getting to understand what customers want and how they feel about your product. Often ethnographic research, observing your customers is the best way.

The failure mode of may early stage startups is to rely too heavily on quantitative data. The qualitative understanding though is critical at the early stages. So, you can’t get too distracted by quantitative metrics that don’t really matter — there’s a cost, and it’s usually at the expense of the qualitative data that’s most essential early on.

Understanding what tools are good for as well as their limitations are useful. For each tool, you should have a clear focus and have a clear objective for it.

Google Analytics, it is about knowing how much traffic you’re getting. You know which of your product landing pages are working, who is talking about you and sending you traffic.

For the mid to deep funnel analytics such as Mixpanel, Amplitude and Kissmetrics, you’re optimised when you have a full funnel analysis for each major product workflow. From this, you will then know how likely a user will be to complete a major set of actions before buying your product. In addition, you should be able to extract the next steps on how to improve that process.

For your Business-wide analytics such as Looker, Mode and Periscope, you should be able to build high-quality dashboards for every team, including the executive team and the board of directors.

Diagnosis tools: For chat tools, your product manager should feel as they’re actually learning a lot. It’s a more qualitative tool.

For Drip email tools, success is being able to capture a list in a funnel. You want to be able to see which campaigns work and be able to optimise them. Clear visibility then of different parts of the funnel and conversion rates is vital.

Sales and support tools such as Zendesk and Salesforce, success is your sales and support teams having a complete understanding of different customer types and providing them with an exceptional level of service.

Paid acquisition and attribution tools are about ROI and understanding if you are targeting the segments that match your users, Also you need to explore new segments and audiences and test ads. Finally, integrating this data with your analytics tool to see how much revenue that customer generated, their lifetime value gives you an understanding of cash flow and metrics for scaling.

Your expectation for each tool is instrumental with how you use it and what data you focus on. Using the right combinations of data will deliver insights that change how you make decisions. That could result in making choices faster, in a more informed way, or more collaboratively with your team or customers.

Success comes from implementing a tool, using it and making decisions with the data it’s serving up to you.

Structuring your data and having a clear strategy will help you make the right decisions about the tools you use and how they integrate. As you make decisions, make them quickly and learn. In most cases, default to experimenting with and buying your tools, which is a more holistic, cost-effective approach. Seek a balance between quantitative and qualitative tools, and ensure they meet a predetermined, baseline mark of success for each type of tool.

One last piece of advice is to create a data repository that allows each tool to share one complete version of the data, which, when routed to each team’s tools, seems to have been collected especially for their purpose.