Venmo popularity grew on the back of this tidal wave of change to cashless payments. Venmo rose to fame because it targeted Gen Z as well as millennials who are the biggest users of cashless payments. With a spending power of over $140Bn they represent a sizeable market segment.

Who Uses P2P Apps

Generation Z

1Gen Z is the newest generation to be named and were born between 1995 and 2015, in particular, have been the early adopters of alternative payment methods that use smartphone technologies…Google Pay, Apple Pay, Cash app…

Venmo popularity grew on the back of this tidal wave of change to cashless payments. Venmo rose to fame because it targeted Gen Z as well as millennials who are the biggest users of cashless payments. With a spending power of over $140Bn they represent a sizeable market segment.

There were two things that contributed to its early success:

- It developed some unique and powerful ad campaigns targeting Gen Z and millennials.

- It used social sharing and emojis to show others what their friends had been buying.

Venmo wasn’t the only P2P app in the market. Despite stiff competition, Venmo was clever and built its brand using a simple but powerful slogan “Just Venmo Me” which became as sticky as “Just Google it“. i

Making a payment to a friend with Venmo is simply became “Just Venmo Me”.

Let’s not make it awkward, just ___ me,” and “If you ___ the wrong person tonight, you’ll regret it in the morning,Wording taken from a Venmo ad

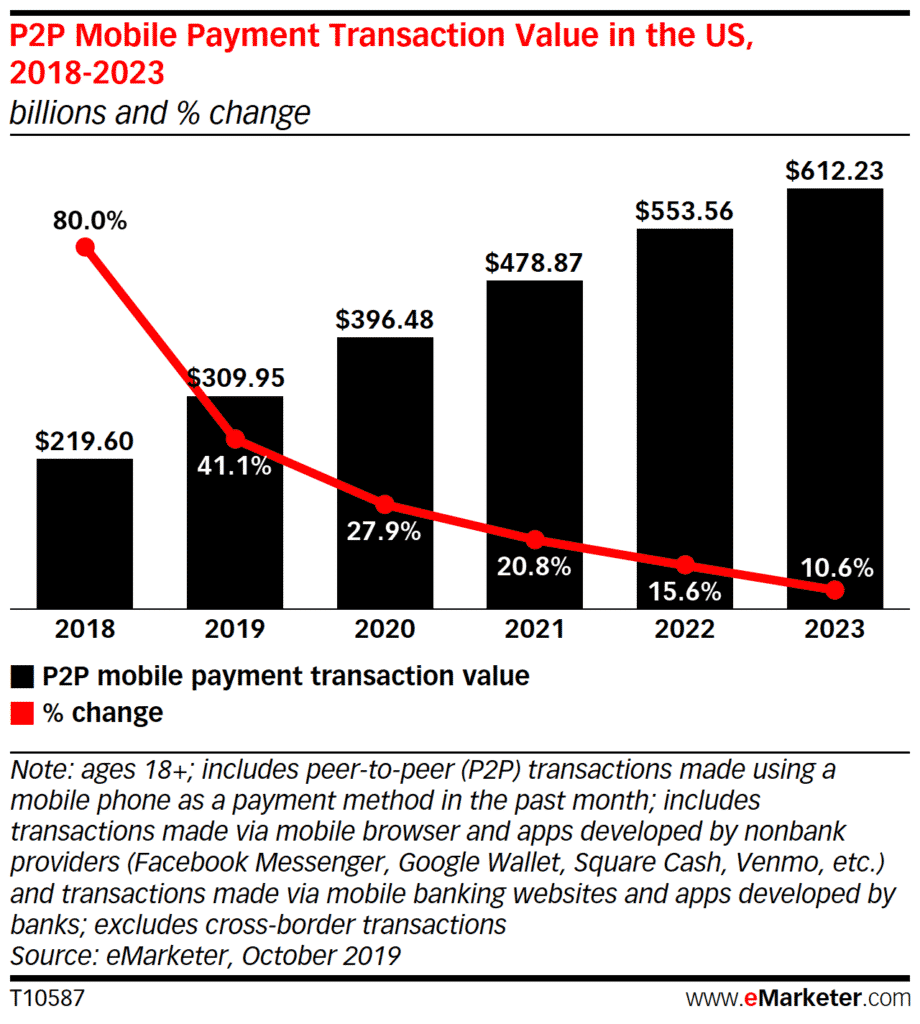

The P2P Transactions Industry

According to eMarketer, P2P mobile transactions will reach $396.48 billion this year, up 27.9% from $309.95 billion in 2019. By the end of 2020, it expects there to be 73.8 million P2P payment users.

At the end of 2019, Venmo achieved over $102 billion in total payment volume and had over 52 million active accounts. That figure is growing rapidly thanks to its parent company PayPal and continued investment into the Venmo app.

However, Venmo is currently available only in the U.S., no transactions may be made outside the country, even by American users.

- What Is Venmo?Add ImageVenmo is a peer-to-peer mobile payment app that acts as a digital wallet allowing you to make and share payments with friends. You can easily split the bill and much more.

The Venmo app is available on both iPhones and Android phones. It allows people to quickly and easily exchange money and also see who other friends have been paying.

Prior to Venmo passing money to friends was awkward, to say the least. If you were looking to split a bill at a restaurant, cash was the normal solution. That meant either one person paying and then been loaded with cash and coins or splitting the bill with cards – giving any sane waiter a headache.

Venmo enabling people to quickly transfer money among parties through a safe and protected platform. Plus it was frictionless.

How Does Venmo Work?

Venmo works by linking your credit card or bank account to the app so that it can process payments. Transactions are either through your bank account, credit card or on the app if you have any balance.

After creating an account, you’ll be prompted to add people to your friend’s list to make it easier to transfer money the next time you need to. Each time you make a transaction, the app publishes it in as a memo in an emoji-filled conversational stream. Each user can then see what their friends have been spending their money on and with who.

This social feature though has been controversial and come under scrutiny because of the level of data that can be accessed. Although it doesn’t share the amount, each transaction is by default shared online.

Carelessly leaving privacy settings to public though has led to some unnerving consequences for some people and has also led to some developers showing how revealing Venmo data can be – Publicbydefault and Vicemo.

When you send money, you’ll have the option to make the transaction public, and while you most likely don’t want or need to do this, you’ll have to be careful to not accidentally select the wrong option.

Venmo Features

PayPal is betting long-term on Venmo and with its strong performance in 2019 it clearly is a major part of the PayPal business model.

Here are some of the core features of Venmo:

- Split payments and sharing.

- Web purchases.

- Link bank account and credit cards.

- Pay PayPal merchants using Venmo.

- View what other people are spending their money on.

Who Owns Venmo?

Venmo was founded by Andrew Kortina and Iqram Magdon-Ismail who were roommates at the University of Pennsylvania. In 2009, they launched Venmo as a free service to pass money between friends. In 2010, Magdon-Ismail and Kortina raised $1.2 million of seed money, then two years later, Venmo was acquired by Braintree. In 2013, PayPal acquired Braintree for $800 million.

Is Venmo Safe?

Venmo is safe as long as you take the necessary precautions and follow best practice guidelines. These include setting up multifactor authentication, avoid selling goods using Venmo, don’t click on links that ask for personal information. Also if money mysteriously appears in your account do not send it back.

Like all payment methods, there are vulnerable ways to scam people. Most of these scams involve people revealing information to them or persuading people to make payments and then not complete the deal. Be aware of common Venmo scams. Also, including be wary of people who fraudulently dispute a payment after you’ve sent them money.

The advice from Venmo:

Venmo is designed for payments between friends and people who trust each other. Avoid payments to people you don’t know, especially if it involves a sale for goods and services (like event tickets and Craigslist items).Venmo advice about security

Venmo Business Model

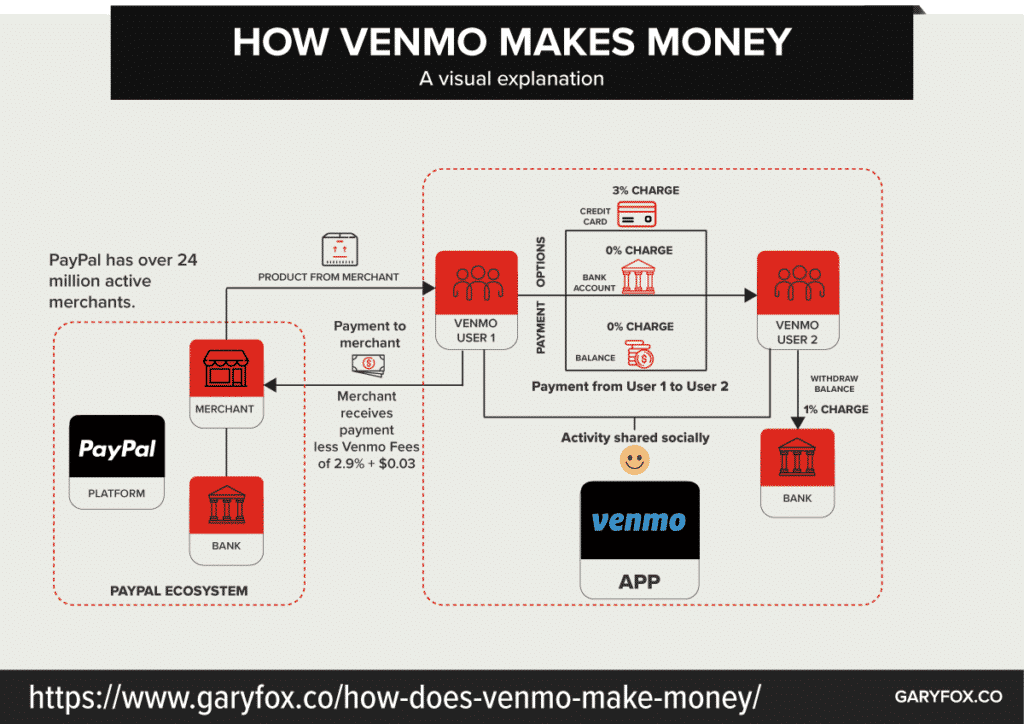

Venmo makes money from the fees it charges people for certain types of transactions and from merchant fees. Thanks to PayPal’s infrastructure, Venmo is compatible with at least 24 million merchants, consequently enabling Venmo to have two discrete types of revenue streams.

How Does Venmo Make Money?

Venmo makes money by using an innovative peer-to-peer transfer system: it charges fees when money is sent using a credit card 3%, withdrawals 1% and by charging merchants 2.9% of the transaction plus $0.30.

We generate revenue from consumers on fees charged for foreign currency exchange, optional instant transfers from their PayPal or Venmo account to their debit card or bank account.PayPal end of year financial report – released 2020.

There are a number of fees associated with the Venmo business. Altogether, these fee-based services generate over $200 million for PayPal, with 29% of Venmo transactions now “monetizable,” up from 24% last quarter, and 17% in the quarter before that.

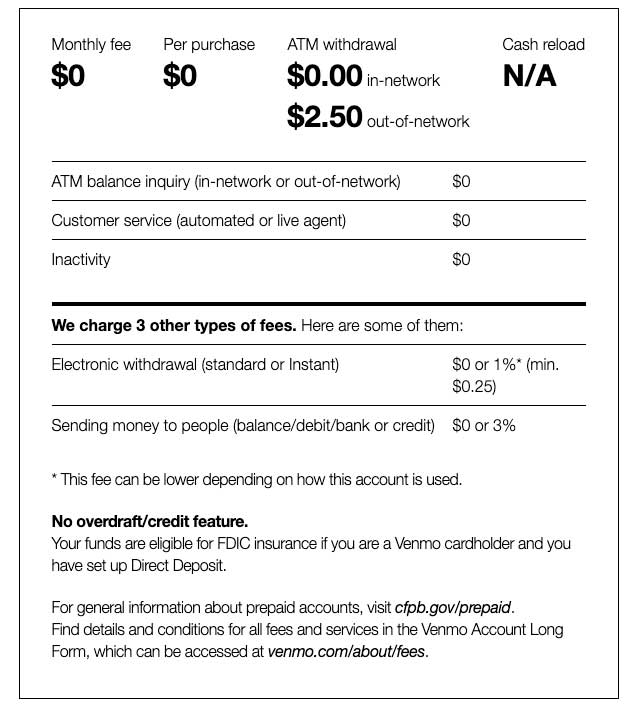

Venmo Fees

- Sending money to people (using a credit card) – 3%.

- Sending money to people with the Venmo Purchase Program (using a balance/debit card/bank) – 3%.

- Transfer money from your Venmo account to your eligible linked debit card or bank account with the Instant Transfer option – 1%.

Merchant Fees

PayPal has over 305 million active accounts consisting of 281 million consumer active accounts and 24 million merchant active accounts across more than 200 markets.

In 2018, as part of its merchant services, PayPal opened up the merchants to receive payments from custoemrs using “Pay with Venmo”. There’s no doubt that many merchants focused on millennials seized the opportunity and subsequently boosted the financial results for Venmo.

Many of those merchants are huge players such as Uber, GrubHub, Abercrombie, or Hollister.

Merchants, businesses that accept payment using Venmo, are charged 2.9% of the transaction plus $0.30.

Venmo Mastercard

In 2018, Venmo released a new physical debit card and made it available to users. The card runs on the MasterCard network and offers ATM access and overdraft protection. It enables up to $400 in daily ATM withdrawals, though transactions at non-MoneyPass ATMs come with at least $2.50 in withdrawal fees.

Is Venmo Profitable?

Venmo payment volumes hit over $102 billion in 2019 and it ended the year with over 52 million active accounts. But, as of 2019, it has yet to be profitable.

Who Are Venmo’s Competitors?

Add ImageVenmo Competitors has lot of competitors. Not all of them are Peer-to-Peer payments though.

Square Cash: Built by Twitter Inc. co-founder Jack Dorsey, is probably the biggest competitor. The Cash app offers free debit card-based transactions through email or a mobile app but charges businesses a fee of 2.75%.

Google Wallet: Google Wallet is another close competitor to Venmo, and is also the most similar. Both are free, and both link to debit cards or bank accounts, but Google Wallet is also available in the U.K.

Apple Pay/Android Pay: Apple Inc.’s Apple Pay is a payment system used for making purchases in stores on iPhones. Apple pay only work on iOS products.

Popmoney: Popmoney is similar to Venmo, but charges $0.95 to send money from a debit card or bank account. It’s powered by veteran bank technology provider Fiserv.